Miller Energy Resources, Inc. (ticker: MILL) is an oil and natural gas exploration, production and drilling company operating in multiple exploration and production basins in North America. Miller’s focus is in Cook Inlet, Alaska and in the heart of Tennessee’s Appalachian Basin.

Steady Production Increases from New Wells

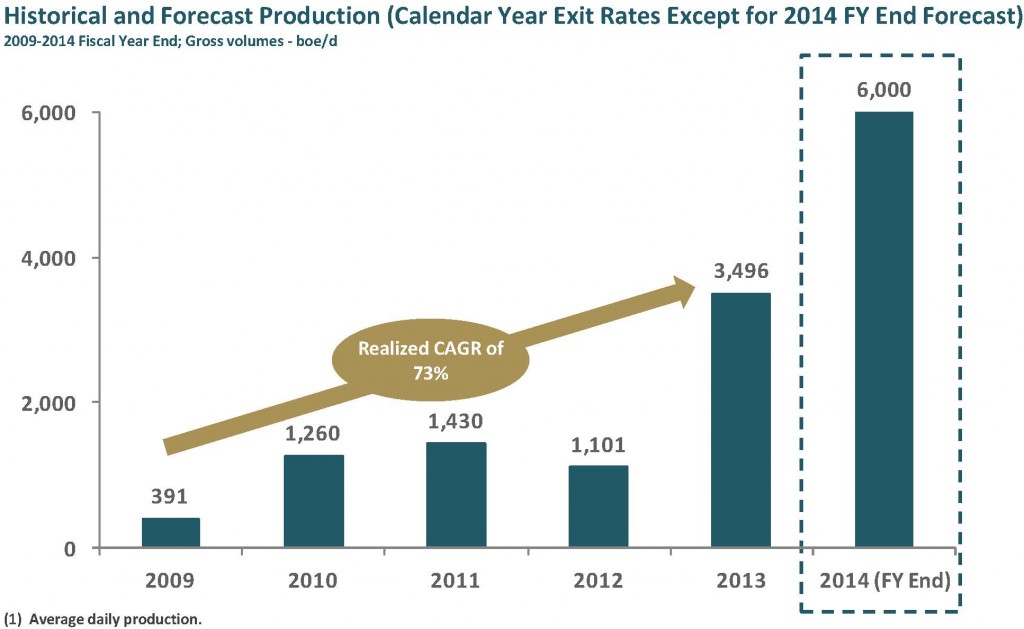

Miller Energy’s production for the fiscal third quarter of 2014, which ended January 31, 2014, was 225,000 barrels of oil equivalent (2,450 BOEPD), an increase of 174% compared to the same period last year. Analysts were pleased with the operational achievements but production came in below many analysts’ expectations. We’ll discuss in more detail upcoming catalysts that are expected to drive production to 6,000 BOEPD by fiscal year-end 2014. OAG360 notes that revenues during the quarter more than doubled from the same quarter last year totaling $16.6 million.

What’s driving the production and revenue growth? And is it sustainable? Miller’s inventory of recompletions and workovers, complemented by its exploration and development projects provides the company an inventory of future growth potential. For example, Miller placed five new wells online in the Cook Inlet and reported two additional wells coming online in the Appalachia region.

Adding to this inventory, Miller acquired the North Fork Unit where an additional Cook Inlet well is currently being completed. This acquisition added an additional 1,280 BOEPD from six producing wells. Pro forma for the North Forks acreage, February 2014 production in Alaska was 4,295 BOEPD compared to 3,239 BOEPD.

Infrastructure Constraints

Source: MILL March 2014 Presentation

Management said revenues would have likely been higher if the company was not restricted by the limited infrastructure in the Cook Inlet. In a conference call following the release, management said it has reached a definitive agreement with Tesoro (ticker: TSO) to construct the Trans-Foreland Pipeline. The proposed 29-mile pipeline would transport hydrocarbons across the Cook Inlet to TSO’s refinery. An Alaska Journal of Commerce article said the pipeline’s capacity would be 62.6 MBOPD and discussions for construction are expected to start within the year.

Catalysts

Increased liquidity. MILL refinanced its credit facility and entered into a new credit agreement with Apollo Investment Corporation and Highbridge Principal Strategies. The new facility provides for a $175 million term credit facility at an interest rate of LIBOR plus 9.75%, subject to a 2% LIBOR floor. It also allows MILL to insert a senior facility of up to $100 million, and allows the company to implement a discretionary share repurchase plan. This influx of liquidity allowed Miller to close its North Fork acquisition, and provided the company additional capital to achieve its operational goals.

Low-Hanging Fruit. Miller expects to add an additional rig to its newly acquired North Fork properties. Just as the company has done at Olson Creek and Otter, Miller plans to revitalize/workover its existing well inventory which would include opening the chokes on some of the wells in the area. In last quarter’s release, MILL reported 11 of its 12 Alaska wells had successfully been reworked. MILL believes the North Fork holds 24 additional well locations, according to a conference call on December 12, 2013. The company forecasts production to surpass 6,000 BOEPD by year-end 2014.

Expansion. Miller Energy is interested in expanding its footprint in Alaska by means of acquisitions. The company said acquisitions look more attractive than in times past. With new financing and an inventory of wells coming online that will drive revenues, Miller is positioned to grow through acquisitions as well as add to its land base for future development. Lastly, keep an eye out for operations update on the Sword #1 well where Miller is evaluating an perforating additional zones.

Source: MILL March 2014 Presentation

Recent Miller Energy Interview

Miller Energy’s CFO John Brawley was recently interviewed at EnerCom’s The Oil & Services Conference discussing MILL’s near-term financial goals, as well as its production outlook from its Cook Inlet assets

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication.