Combined Companies will Create Fourth Largest MLP

MPLX LP (ticker: MPLX), the master limited partnership (MLP) vehicle of Marathon Petroleum (ticker: MPC), has announced the oil and gas industry’s third-largest acquisition to date in 2015.

According to news releases from the three companies involved, MPC and MPLX have signed a definitive agreement to acquire MarkWest Energy Partners LP (ticker: MWE) for total consideration of $20 billion, including approximately $4.2 billion in debt. The acquisition will be completed as a unit-for-unit transaction, with MWE shareholders exchanging each unit for 1.09 MPLX common units and a one-time cash payment of $3.37 per share. The exchange represents a premium of 32% per MWE’s closing price on July 10.

MPC will contribute $675 million in cash to MPLX to fund the transaction and will continue to be its primary shareholder, possessing 19% of its common units. The deal is expected to close in Q4’15.

The only larger energy deals this year include a $30.4 billion asset dropdown by Enbridge (ticker: ENB) in July along with Royal Dutch Shell’s (ticker: RDS.B) $70 billion takeover of BG Group (ticker: BG) in April.

What MPLX Gains

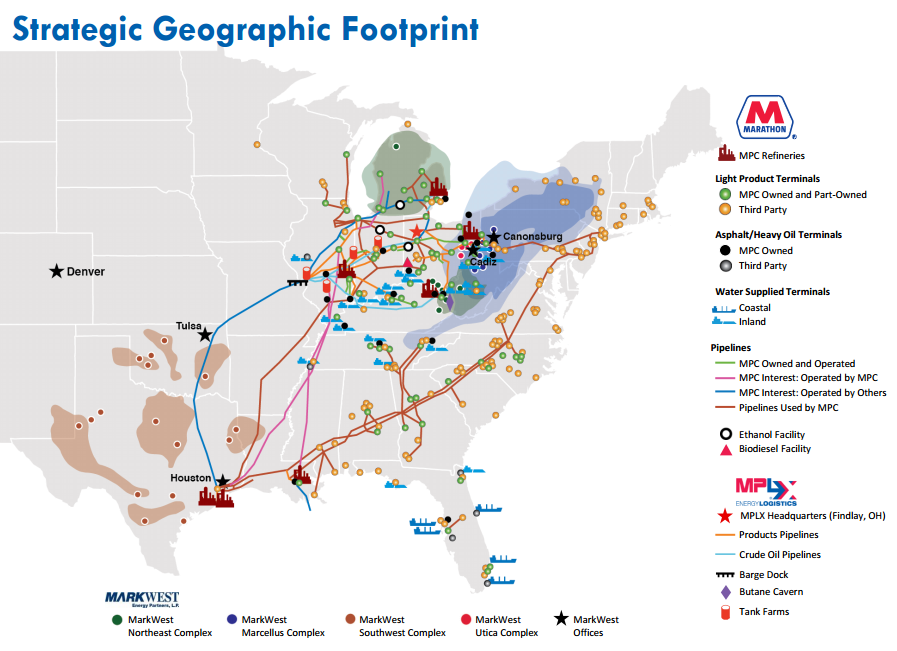

MarkWest Energy Partners has a very significant stake in the midstream market; its processing system is the largest in the Appalachia region and is the second largest in the United States, while its fractionation business is the fourth-largest in the nation. A total of 34 facilities are scattered throughout the Marcellus/Utica region and another 18 are currently under construction. Gary Heminger, President and Chief Executive Officer of Marathon Petroleum, said the alignment of MWE along the east coast was the primary driver for the acquisition, rather than cost synergies that could arise from an integrated business.

MPLX on its own is a smaller midstream MLP, ranking 28th out of 61 companies in terms of market capitalization in EnerCom’s MLP Weekly Benchmarking Report. Marathon Petroleum, however, is a sizable player in the downstream market and is involved primarily in retail and refining. The Fortune 25 company reported a MPC-best $891 million in earnings in its Q1’15 release and closed on the $2.8 billion acquisition of Hess Corporation’s (ticker: HES) retail business in October 2014. The location of HES stores are spread along the east coast and include several hundred locations in the Appalachia region, where MarkWest is focused.

The acquisition is a two-fold approach to benefit the consortium, explains Heminger. “This combination is a significant step in executing MPC’s strategy to grow its higher-valued, stable cash flow midstream business, by transforming MPLX into a large-cap, diversified master limited partnership,” he said in a conference call with analysts and investors. “This combination creates a unique new competitor in the midstream sector.” A note from Wunderlich Securities said MPLX will be: “broadly diversified between G&P and crude and products transportation and storage, and would be an even more formidable presence in the Marcellus and Utica shales. It would provide some vertical integration to MPC, which is a large consumer of natural gas liquids.”

Marathon Oil (ticker: MRO), the exploration and production arm of the Marathon family, was not involved in the merger.

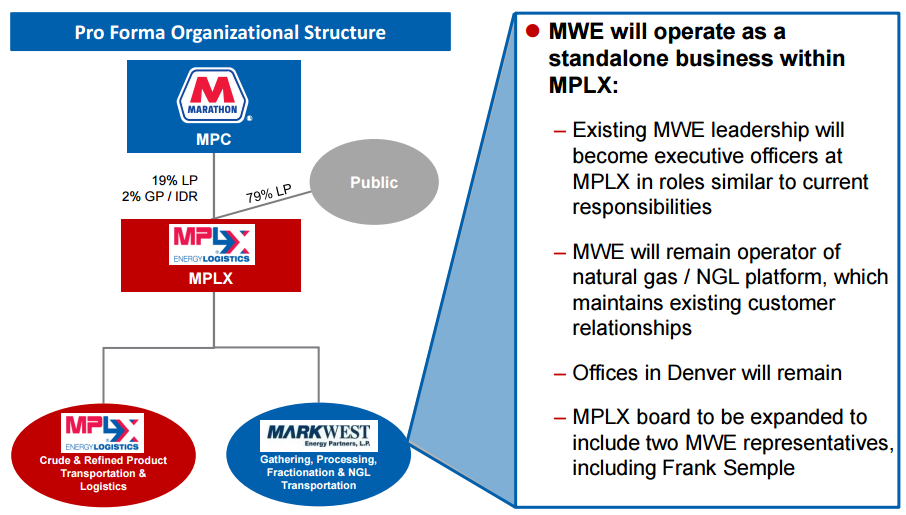

MPLX, Pro Forma

MarkWest will become a wholly owned subsidiary of MPLX, and its management team will remain intact. The company’s Denver offices, a region where MPLX said it wants to “maintain a significant presence,” will remain unchanged. MWE management is in line to gain two seats on MPLX’s board as well as a position among the MPC directors.

MPLX announced no changes to its distribution plan, reiterating a 29% increase this year and a 25% compound annual growth rate through 2017. MPC management said MarkWest’s $7.5 billion, five year capital investment program, combined with MPC’s MLP-qualifying earnings, “provides a clear path to the growth in distributable cash flows of the combined partnership.”

A previous MPLX sale proposal to acquire MPC’s marine transportation business has been deferred indefinitely. Heminger said about $1.6 billion in drop down opportunities remain in place, but “we always wanted to be able to replace anything we drop down with new assets, organic or acquisitions.”

Growth Stage Strengthened

Approximately 90% of MPLX’s cash flows are fee-based, and its drastically improved midstream network includes 7,600 miles of pipeline, 6.8 Bcf/d of processing capacity and 379 MBOPD of fractionation capacity. MarkWest has invested $11.3 billion in its growth plan since 2010, increasing its adjusted EBITDA by 160% in the time frame.

“MPC’s strong balance sheet and liquidity position will enable MarkWest to accelerate organic growth in some of the nation’s most economic and prolific natural gas resource plays that it may have been limited in pursuing otherwise,” Heminger said.

MPLX, meanwhile, has increased its distribution by 56% since its initial public offering in 2012. Management said it aims to maintain an investment grade profile and will target a debt-to-EBITDA leverage of 4x and distribution coverage of 1.05x to 1.10x.

In MarkWest’s 2015 Analyst Day, the company projected to hold 60% of all Appalachia fractionalization and processing capacity by 2017. MarkWest believes gas volumes from the region can more than double by 2025, and the financial strength of MPC and MPLX will provide strength to make an impact in the growing market.

Click here for company releases from:

Marathon Petroleum – MPLX – MPLX Presentation