Using the downcycle to your advantage

The last two years have been a difficult period for the oil and gas industry. The drop in oil prices following OPEC’s November 2014 decision to defend market share over oil prices left the industry in a world of hurt as the value of a barrel of oil tumbled from over $100 to less than to just over $26 in less than 20 months.

Many companies were unfortunately unable to make it through the downturn, and many more were forced to sell assets and cut back spending in order to survive, but in that environment some were able to prosper.

Calgary-based Blackbird Energy (ticker: BBI) was one such company, growing more than 8x over the course of 2016 from a company with a $41 million enterprise value to one with a $357 million enterprise value. Throughout the downturn, the company remained focused on growing profitably, and that will continue to be the case moving forward, Blackbird Chairman, President and CEO Garth Braun told Oil & Gas 360®.

“Our mindset hasn’t changed since last year. We were not in contraction mode then, and we will continue to grow this year,” Braun said. “We saw the last two years as an opportunity to increase our acreage in the liquids-rich corridor of the Montney, build out our infrastructure, roll out our Stage Completions system, and build value for investors. This is a company that has taken the downturn as a competitive opportunity.”

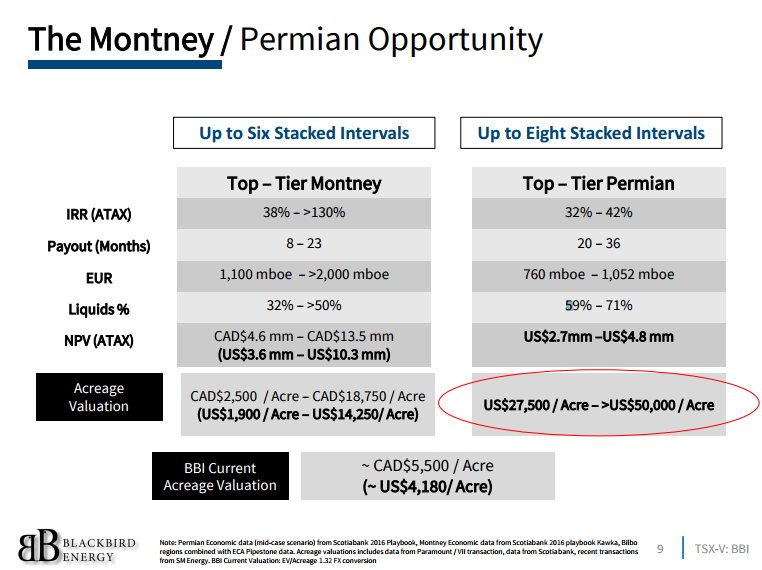

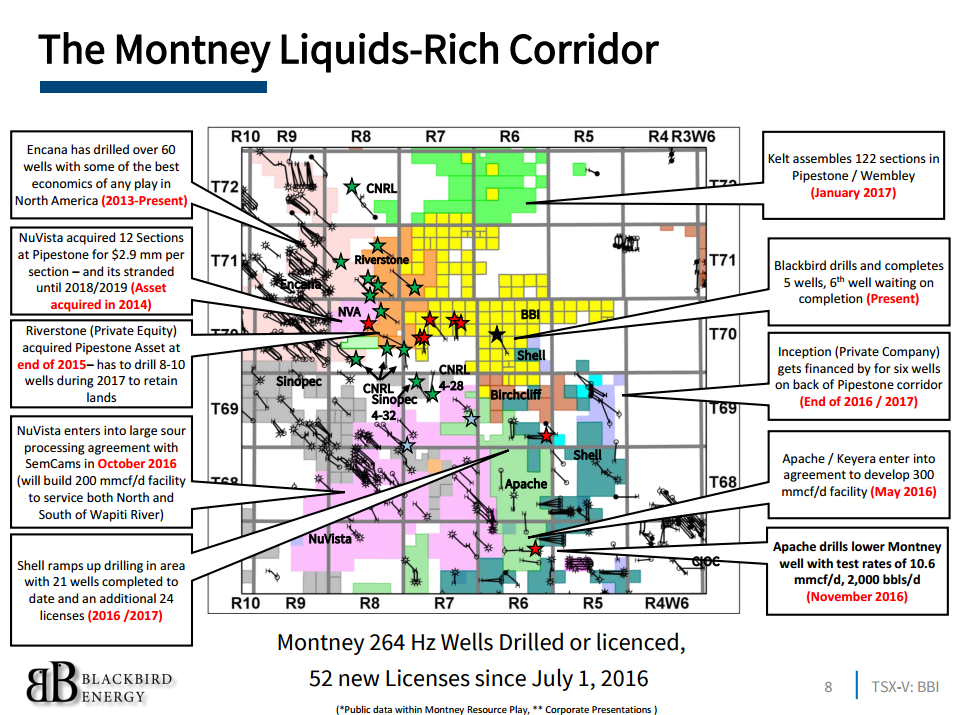

Since 2014, Blackbird has assembled roughly 97 net sections in the Elmworth / Pipestone region of northwest Alberta in the liquids-rich corridor of the Montney. Many companies are seeing impressive results in the area, with 660 feet of stacked pay in the Montney often compared to the Permian.

When the downturn came, it was an opportunity for Blackbird to improve, said Braun. The company has lowered its drilling and completion costs, begun using the Stage Completion system to improve well results, and built out infrastructure in the Montney over the course of the last year.

“We were the first to do a monobore [well] in our corridor, which reduced our drilling times and cost. This has allowed us to get our drilling costs down to $5.5 to $6.0 million, and our completion times are down substantially using the Stage Completions system.”

Stage Completions reported a record completion time and frac intensity in the Blackbird 3-28-70-7W6 Upper Montney well February 15. According to a press release from Stage, Blackbird was able to complete a 56 stage frac job using approximately 1.9 tons per linear meter in just 3.3 days.

“We’re doing pinpoint completions with greater tonnage,” said Braun, explaining some of the advantages associated with the Stage Completion system. “Our completion times are down substantially, and our pumping costs are down 20%. The reduction in costs and higher EURs should lead to a higher NPV (net present value) as well.”

Blackbird plans to continue moving forward with its drilling program as well, with the company planning to license 10 to 12 wells before the end of April, Braun told Oil & Gas 360.

“The industry is beginning to drill substantially more wells right on the border of Blackbird’s acreage. We know guys are coming to drill next to us because we’ve got the rock,” said Braun. “In Canada, it is beginning to be recognized that the Pipestone/Elmsworth corridor is one of the most liquids-rich and highly economic plays. And we’re in the middle of it.”

Building infrastructure at less than half the cost of two years ago

In addition to the rollout of Stage Completions technology in Blackbird’s wells last year, the company also constructed a gathering system for approximately $16.1 million.

“Two years ago, this infrastructure would have cost $40 million,” said Braun. “We just transitioned from a non-cash flow company to a company that will have cash flow this year,” he continued, but the cash flow is not the most exciting advantage Blackbird will realize from the new infrastructure, according to the company’s CEO.

“Yes, the infrastructure is to get us to production, but it also allows me to get a good look at how wells are performing,” explained Braun. “In the very near term, companies like Blackbird are going to be making some large, sour processing and take away commitments for 2018-2021, and scale up. The benefit is, we now have a facility that we can produce our wells into, look at the production, and look at what we might be able to do better, so we can roll out our big commitments.

“[This infrastructure] was so I could put my foot in the swimming pool. I’m getting ready to dive in. There is large sour processing coming through our corridor, and we’re about to lock up long-term processing and takeaway commitments.”

Blackbird Energy presenting at EnerCom Dallas

Blackbird Energy will be presenting its story at the Tower Club Downtown Dallas on Thursday, March 2, as part of EnerCom Dallas, an investor conference which is modeled after EnerCom’s The Oil & Gas Conference® in Denver.

The Dallas conference is designed to offer investment professionals a unique opportunity to listen to a wide variety of oil and gas company senior management teams update investors on their operational and financial strategies and learn how the leading independent energy companies are building value in 2017.

The forum offers healthy dialogue and informal networking opportunities for attendees.

To sign up for EnerCom Dallas and hear Blackbird Energy, or to find out more information about presenting companies at EnerCom Dallas, click here to visit the conference website.

Buyside institutions wishing to have one-on-one meetings with Blackbird Energy and other presenting company executives may login at the conference website and request meetings.