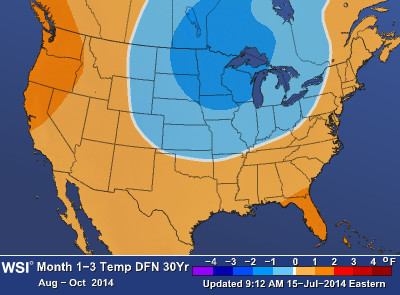

Weather Services International (WSI), a division of Weather Central, expects natural gas inventory numbers to largely recover in the coming months due to below-average temperatures in the “northern and central Rockies eastward across the Great Lakes and Ohio Valley regions,” according to its seasonality report on July 21, 2014. Above-average temperatures are expected in the Southeast and Pacific Northwest, with the latter pushing the colder air to the east.

The Marcellus Shale, the source of 38% of U.S. natural gas and the producer of 15.2 Bcf/d in July 2014, will see lower gas prices in the upcoming cooling season, says Chris Kostas, Senior Power & Gas Analyst at ESAI Power LLC. “Northeast natural-gas prices (i.e. Marcellus shale gas region) should continue to run very soft compared to Henry Hub due to below-normal regional temperatures and increased production,” he said.

ESAI expects the price differential to persist through the month of October. “Increased production and pipeline constraints are causing wide spreads to Henry Hub this year,” said Kostas. The production, in line with lower temperatures, is expected to have a direct impact on natural gas inventory levels. Inventory has been below the five-year average for all of 2014 after a cold winter season slowed production rates and froze pipelines. The most recent inventory report on July 11, 2014, revealed 2,129 Bcf – 25% below the five-year average and 22% below 2013 levels.

The report says average 2014 injection rates are roughly 2.3 Bcf/d above last year’s rates. Current year inventory fell by 71% in the withdrawal period between the beginning of January through the end of March. By comparison, average withdrawal for the same time period over the last five years is 42%, and 2013 represented a drop of 49%. However, the higher than normal injection rates, combined with seasonal demand, “Should also allow natural-gas inventories to refill rapidly in August and decrease the deficit to last year’s level,” said Kostas.

ESAI believes inventory levels will finish the injection season above 3,700 Bcf/d, which would place levels roughly 4% below the five year average. If achieved, the injection would represent a 74% increase in storage levels from now through mid-November. According to ESAI, “soft energy demand in the Northeast and Marcellus shale gas regions should continue to pressure delivered natural-gas prices lower and help natural-gas inventories finish the injection season very strong.”

WSI also said another cold winter may be favored this year, but warned its confidence in its long-term forecast is low due to “known unknowns.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.