Operators reducing operating expenses to match price downswing

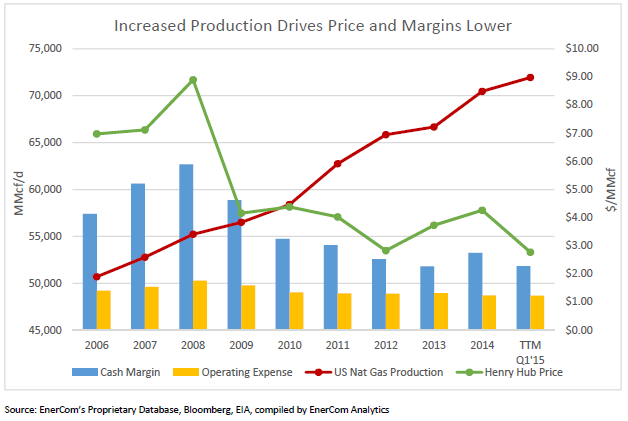

Natural gas production has continued to rise over the last nine years, steadily pushing down the price of natural gas at Henry Hub, and putting increasing pressure on companies’ cash margins. The above chart looks at five companies in the Marcellus, illustrating the downward trend in Henry Hub prices and cash margins as production increases. The five companies tracked in EnerCom’s analysis are Cabot Oil & Gas (ticker: COG), Encana (ticker: ECA), EQT Corporation (ticker: EQT), Range Resources (ticker: RRC) and Southwestern Energy (ticker: SWN).

Increased efficiencies have allowed for higher production with lower operating costs, allowing companies to continue profiting despite lower prices. ”Increased efficiencies not only affects the bottom line, but longer laterals, increased frac stages, and lower well completion costs can all help drive the production higher with less capital outlay,” according to EnerCom Analytics.

Greater efficiencies are likely to remain an important part of gas production, too. Prices are expected to stay relatively low in the long-run. If companies hope to remain competitive, they’ll need to continue lowering their operating expenses in order to maintain healthy cash flow.