Noble Energy and Delek Group announce the commercial viability of their Cyprus project

Israel’s Delek Group (ticker: DLEKG) and Texas based Noble Energy (ticker: NBL) announced the commercial viability of their natural gas project offshore Cyprus, according to a release from Delek. The joint venture’s plan calls for 8 billion cubic meters (Bcm) of natural gas production per year and construction of a pipeline to carry the gas to Egypt, reports Reuters.

The plan calls for a floating storage and offloading vessel (FPSO) to process the gas produced from Cyprus’s offshore Block 12 and ship it through a yet to be constructed pipeline to Egypt. The arrangement with Egypt was made possible through an agreement the country signed with Cyprus in February, said Delek. Block 12 is estimated to hold 128 Bcm of gas and 9 million barrels of condensate.

The deal is good news for Cyprus, which required an international bailout in 2013 to keep its economy afloat. The country is looking to diversify its economy from its traditional sources of income, namely tourism, in order to avoid a similar problem in the future.

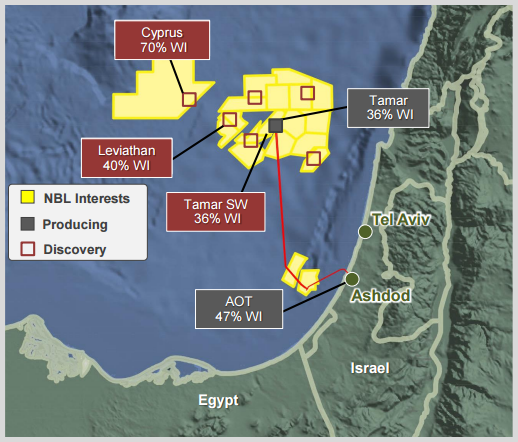

Noble currently holds a 70% interest in the joint venture, with Delek Group’s subsidiaries Avner Oil Exploration and Delek Drilling, each holding 15%. Delek group has announced that it is in talks with Noble to purchase an additional 19.9% stake in the project for about $155 million.

Noble has been operating in the region since 1998 and said the supply/demand imbalance makes the area attractive for investment, pending the cooperation of local governments. A project in the nearby Tamar Field has averaged a gross rate of 750 MMcf/d, roughly in line with estimates from the Cyprus gas play.