New regulations target three main sources of emissions

The Environmental Protection Agency (EPA) announced earlier this week that it will set new regulations to lower methane emissions by 45% compared to 2012 levels. The move comes as part of an overall policy from the Obama administration to reduce greenhouse-gas (GHG) emissions. The EPA’s methane regulations come on the tail of the final version of the Clean Power Plan, which hopes to lower CO2 emissions by 32% from 2005 levels, as part of the agency’s overall program of reducing emissions.

Even though methane only makes up 9% of U.S. GHG emissions, it is far more potent than other gases at capturing and storing the heat from the sun. Compared to CO2, the main contributor to U.S. GHG emissions, methane captures 30 times more atmospheric heat.

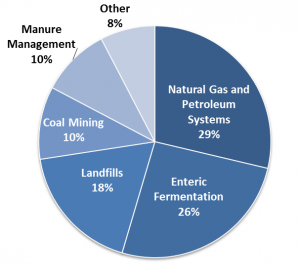

The EPA’s regulations target three main sources of methane emissions: agriculture, waste from homes and business, and the natural gas and petroleum industry, which the EPA says is responsible for the majority of methane emissions.

The new regulations are expected to cost the oil and gas industry between $320 million and $420 million a year by 2025 and provide climate-change benefits of $460 million to $550 million. “Today, through our cost-effective proposed standards, we are underscoring our commitment to reducing the pollution fueling climate change and protecting public health while supporting responsible energy development, transparency and accountability,” said EPA Administrator Gina McCarthy.

According to the EPA’s release, the new regulations will target methane reduction in the oil and gas industry by requiring equipment that captures methane on new projects that produce, store and transport oil and gas. The new regulations will require a significant reduction in natural gas flaring in order to meet the EPA’s targets.

Mixed reactions from the industry

The oil and gas industry’s reaction to the new regulations was mixed following the announcement of the methane regulations. Jack Gerard, president and chief executive of the American Petroleum Institute, said the rule duplicated a 2012 measure that requires cuts of volatile organic compounds from new natural gas wells, reports The Wall Street Journal. “The oil and gas industry is leading the charge in reducing methane,” said Gerard. “The last thing we need is more duplicative and costly regulation that could increase the cost of energy for Americans.”

Mark Boling, an executive vice president at Southwestern Energy (ticker: SWN), thought the proposal had more positives. “We think that the combination of approaches really allows a company a lot of flexibility to assess their own emissions profile and determine for that particular company what is the most cost-effective way to reduce methane emissions,” he said.