Indian energy consortium increases shares in Russian oil fields

Russia and India strengthened their ties over the weekend with several agreements which will increase Russia’s share in India’s energy markets and give India a greater share in a number of upstream projects in Russia.

Russia’s state-owned oil giant Rosneft (ticker: RNFTF), Oil India, Indian Oil and Bharat Petroresources signed a Heads of Agreement for the possible acquisition of a 23.9% share in Vankorneft, a Rosneft subsidiary, by a group of Indian investors, the company said in a press release.

Recoverable resources in the Vankor field, where the Russian company operates, was 361 million tons of oil and condensate, and 138 Bcm of gas, at the first of the year. In 2015, Vankor produced 22 million tons of oil and 8.71 Bcm of gas, making it one of Russia’s most productive fields.

Rosneft also signed a Memorandum of Understanding with ONCG Videsh Limited for cooperation in the Vankor project, envisaging the Indian company increasing its share in the project to 26%. The MoU includes an analysis of joint trading developments between the two, including the possibility of entering into long-term crude-oil supply contracts.

The deal will bring the Indian consortium’s total interest in Vankor to nearly 50%.

Turning of a New Leaf: Sechin

Source: Rosneft. Rosneft CEO Igor Sechin and Indian Oil Minister Dharmendra Pradhan.

“The signed documents literally mark the turning of a new leaf in the cooperation between Russia and India in the energy sector,” said Rosneft Chairman and CEO Igor Sechin. “The cooperating formula … is aimed at the creation of vertically integrated model, allowing India partners to participate in the upstream sector, whilst opening the growing India market to Rosneft. The reached agreements represent a shift from energy dependency to energy partnership of both countries.”

In a separate deal signed during Sechin’s visit to India, the Indian consortium also entered into a share sale agreement for a 29.9% participatory share in Taas-Yuryahk Neftegasodobycha. BP (ticker: BP, BP.com) and Rosneft formed a joint venture to develop the project at the St. Petersburg Economic Forum in June 2015. Rosneft will retain a majority stake in the JV.

“Joined efforts of Rosneft, BP, Oil India, Indian Oil and Bharat Petroresources allow a significant acceleration of the Upstream projects’ implementation by virtue of increasing JV financial potential as well as open new prospects for marketing the East Siberian hydrocarbons,” said Sechin.

Rosneft also entered into an agreement with Essar Oil, allowing the Indian company to acquire a 49% stake in the 400 MBOPD Vadinar refinery in western India. The companies expect the deal to close by the end of June 2016, according to a Rosneft press release. Essar plans to implement a modernization program expanding the refinery’s capacity 25%.

The infusion of capital from Indian partners will allow Rosneft to pay off debts from its $55 billion acquisition of TNK-BP in 2013 in addition to giving the Russian company greater access to one of the world’s fastest-growing energy demand centers.

India the next China

Source: Raymond James

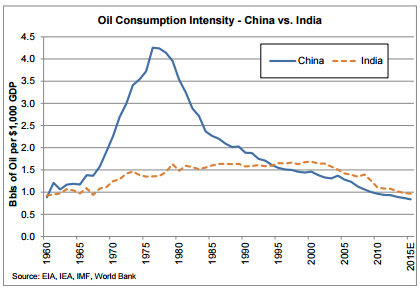

As demand for energy in China begins to cool, India continues to look for new sources of energy to fuel its growth. India looks to be the main driver behind Asia’s future growth, replacing China, based on research from Raymond James.

Raymond James also believes that India’s oil consumption intensity – defined as oil consumption per unit of GDP – is currently 16% higher than China’s, meaning growth in India’s GDP has 16% more effect on oil consumption than an equivalent change in China, all things being equal.

Demand for other types of energy in India are also expected to balloon, with natural gas demand in the country expected to grow to 523 MMcm/d in 2018-2019 alone, a 30% increase from its current level of 405 MMcm/d, according to the country’s oil ministry.

This tremendous demand growth will offer a substantial outlet for Russian oil and gas production, particularly as the country struggles under the burden of economic sanctions from the West, its traditional market.

Russia has begun a pivot east as tensions with the U.S. and Western Europe continue to worsen. The country has focused primarily on increasing cooperation with China up to this point, but with limited success.