OPEC member Nigeria looking to fund power, transport and road infrastructure projects with cheap money

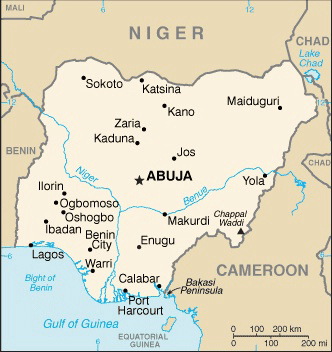

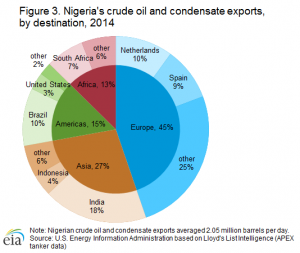

Nigeria, an OPEC member and Africa’s largest economy, is looking to international institutions in order to fund its record-setting 2016 budget. With approximately 35% of GDP, 75% of government revenue and 90% of export earnings coming from oil, the continued low price of crude oil has led Nigeria to seek out $3.5 billion in loans from the World Bank and African Development Bank.

Low oil prices have already take a project budget shortfall of $11 billion, or 2.2% of GDP, to $15 billion, or 3% of GDP, reports Financial Times. The country’s foreign reserves, which stood at $43 billion two years ago, are also being quickly spent, with $28 billion remaining at the end of January, according to CNN.

The $2.5 billion from the World Bank and a parallel $1 billion loan from the ADB would be tied to infrastructure projects, Nigerian Finance Minister Kemi Adeosun said. The recently elected government of President Muhammadu Buhari is hoping to increase budget spending to record levels to improve the country’s infrastructure and decrease its dependency on oil. Nigeria’s parliament is currently considering a $30.7 billion spending plan for 2016, reports the Australian Financial Review.

Not an emergency loan – Adeosun

While Nigeria is looking to international loans to help fund its budget, Adeosun said the loans were not an “emergency” measure but rather the “cheapest way possible” to fund a “deficit budget.”

“I’m getting sub-3% blended costs from the multilaterals and export credit banks. It’s my strategy for borrowing for capital projects. If the World Bank [will] offer me sub-3% to do the power, transport, road projects we need, why would I go to the Eurobond market to find that?” she said.

The World Bank loan would be subject to an International Monetary Fund endorsement of the government’s economic policies and bank officials say they would have to be confident the Nigerian government was undertaking significant structural reforms, but a loan from the World Bank would carry far fewer stipulations than one from the IMF.

“I think we all agree that Nigeria is facing significant external and fiscal accounts challenges from the sharp fall in … oil prices, as of course are all oil exporters,” Gene Leon, the IMF’s representative in Nigeria said. But he added that Nigeria was not in immediate need of an IMF program. “We are not in that space at all.”

Chief Africa economist for Standard Chartered bank Razia Khan said going to the World Bank could be attractive as it may offer Nigeria better terms for a loan than it would get from the international money markets, reports BBC. Nigeria is deliberately boosting spending on infrastructure development to try to boost the economy as it tries to deal with oil price shocks, she said.