Oil prices down: Iran and Saudi Arabia say no production deal in Algeria this week

Oil prices erased gains from last week on Tuesday as Iran and Saudi Arabia confirmed that there would not be a definitive agreement on OPEC production coming out of the group’s meeting in Algeria this week.

“This is a consultative meeting,” Saudi Energy Minister Khalid al-Falih told reporters.

Iranian Oil Minister Bijan Zanganeh said: “It is not the time for decision-making.” Referring to the next formal OPEC meeting in Vienna on Nov. 30, he added: “We will try to reach agreement for November.”

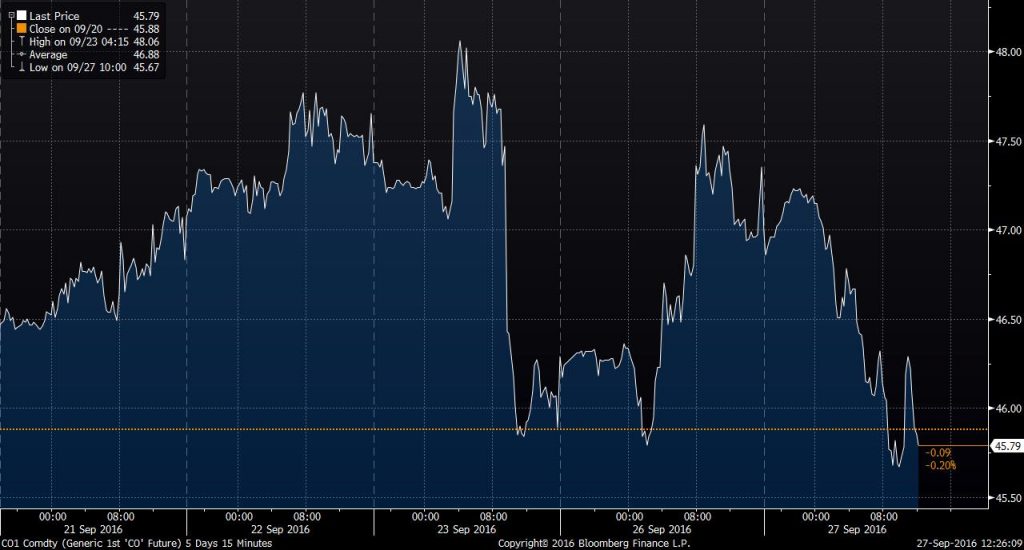

International crude oil benchmark Brent fell from more than $47 per barrel this morning to $45.79 on the news.

Previously, OPEC and non-OPEC members tried to reach an agreement on a production freeze, but the deal fell through when Iran refused to freeze production below pre-sanction levels. As OPEC and Russia continue to discuss a production deal, it appears that the rift between the kingdom and Riyadh remains too great to bridge.

Three OPEC sources said Iran, whose production has stagnated at 3.6 million barrels per day, insisted on having the right to ramp up to around 4.1-4.2 million bpd, while OPEC Gulf members wanted its output to be frozen below 4 million, reports Reuters.

“Don’t expect anything unless Iran suddenly changes its mind and agrees to a freeze. But I don’t think they will,” an OPEC source familiar with discussions said.

Sanctions have prepared Iran to outlast Saudi Arabia in the oil price downturn

Although Iran would almost certainly be in a better position with higher oil prices, it appears that the recently lifted international sanctions left the Islamic Republic with relatively less to lose from low oil prices than other members of OPEC.

Saudi Arabia, which spearheaded the decision to defend market share at the end of 2014, recently offered to freeze its production at January levels, down 500 MBOPD from seasonal highs. It appears that Tehran will hold its ground as it looks to increase production even as oil prices remain at less than half their value just two years ago.

Iranian oil sources said Tehran wanted OPEC to allow it to produce 12.7 percent of the group’s output, equal to what it was extracting before 2012, when the European Union imposed additional sanctions on the country for its nuclear activities, reports Reuters.

The lifting of sanctions has provided economic benefit for Iran even as oil prices remain low, and the much more oil-dependent economy of Saudi Arabia suffers. Saudi Arabia will suffer a fiscal deficit equal to 13.5% of gross domestic product this year, compared with one of less than 2.5% of GDP for Iran, the International Monetary Fund estimates. The IMF says the Saudis need oil close to $67 a barrel to square the books. For Iran, it’s lower, at $61.50.

When it comes to economic growth, Saudi Arabia is slowing sharply to 1 percent while Iran is accelerating toward 4 percent, reports Bloomberg.

Saudi Arabia faces a double-digit deficit this year; Iran’s is almost balanced following economic reforms in 2012 and 2013 to weather the impact of international sanctions over its nuclear program.

While Iranian President Hassan Rouhani faces elections next May and is under pressure over the country’s economic performance since sanctions were lifted, it’s already been through the austerity that’s only starting in Saudi Arabia, according to Amrita Sen, chief oil analyst at consultant Energy Aspects Ltd. “Iran has already been through so much pain, incrementally they aren’t really worse off,” she said.

Saudi Arabia’s offer to freeze production at levels seen earlier this year could be a calculated attempt to make Iran appear to be the hold-out on oil prices. By offering a deal the Saudis know Iran won’t accept, they can place the blame for OPEC inaction on the Islamic Republic.

Bjarne Schieldrop, chief commodities analyst at SEB Markets, said: “We cannot see how Iran could possibly accept the Saudi offer. It would be like asking a long-time prisoner who was finally released from prison to go back again.”

Saudi Arabia may be out of both sticks and carrots to motivate Iran. The kingdom may be forced to allow Iran to continue increasing production, even as the two face off in a number of proxy battles across the Middle East.