Noble Energy announces $2.3-$2.6 billion budget with a focus on liquids in the DJ, Delaware and Eagle Ford

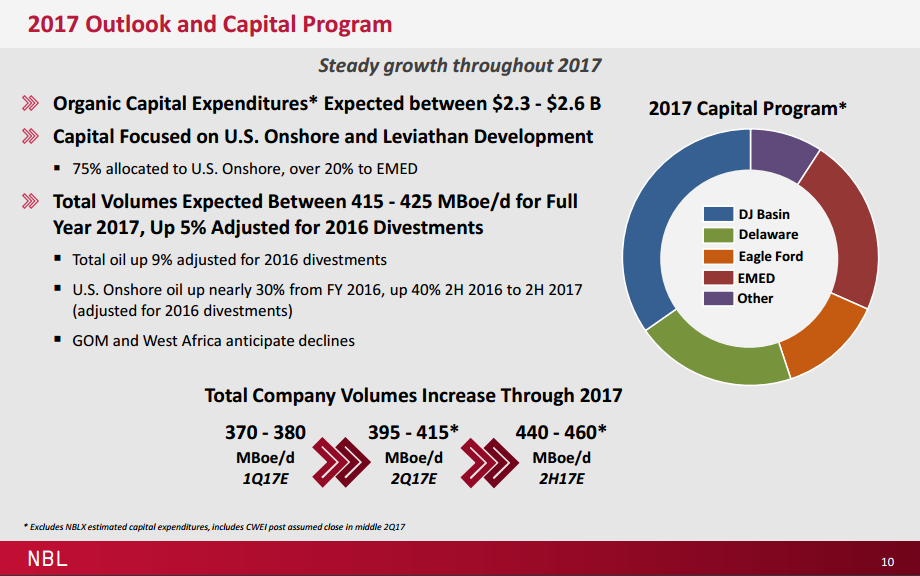

Houston-based Noble Energy (ticker: NBL) announced the company’s capital guidance for the year, stating that the company plans to increase its spending by $950 million (63%) from its 2016 capital budget. The company said it will spend between $2.3 and $2.6 billion in capex during the course of 2017 compared to $1.5 billion in its 2016 guidance.

Approximately 75% of the total capital program will be focused on U.S. onshore development, with a focus on liquids-rich assets like the DJ, Delaware and the Eagle Ford, according to the company’s press release Monday. Noble anticipates that the company’s oil volumes will increase by 9%, after adjusting for 2016 divestment impacts.

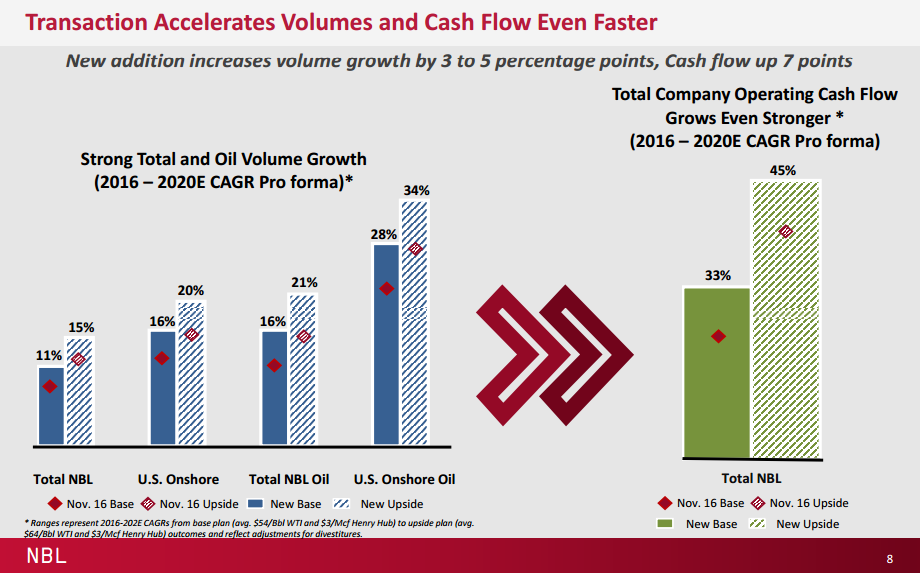

“Noble Energy is now rapidly accelerating our pace of development in 2017,” said Noble Chairman, President and CEO David Stover. “In the U.S. onshore business, we are materially increasing the capital allocation to each of our liquids-focused assets in 2017, including the DJ Basin, the Delaware Basin, and the Eagle Ford. We will continue to concentrate on long laterals and pad drilling, enhanced completions with higher proppant loadings and tighter stage and cluster spacing, as well as integrated facility design. We have leading positions in two of the top U.S. oil basins, and we materially enhanced our Delaware Basin position earlier this year through the announced acquisition of Clayton Williams Energy. Our onshore portfolio provides some of the highest return opportunities in the U.S., and our 2017 capital plan positions us for significant value-added growth, near term and for many years to come.”

U.S. onshore organic investments are up approximately 90 percent from 2016 levels and will be primarily focused on drilling and completion activities within the company’s three focus areas. Capital expenditures in the Marcellus Shale will focus on the completion of previously-drilled uncompleted wells. For the Clayton Williams Energy assets, reported capital has been included from closing (expected in the second quarter of 2017) through the end of the year.

Noble expects to exit 2017 with nine rigs

Noble Energy’s total U.S. onshore rig count is expected to average more than eight operated rigs for 2017, exiting the year with nine. A third operated rig for the DJ Basin has been accelerated and is now planned to be added in the second quarter of 2017. In the Delaware Basin, Noble Energy increased its operated rig count on its existing position to three rigs during the fourth quarter of 2016 and anticipates running three rigs during 2017. Following closing of the Clayton Williams Energy acquisition, Noble Energy anticipates adding a second operated rig to this position mid-year and a third rig by the end of 2017. Combined, total rigs running at the exit of 2017 in the Delaware Basin is anticipated to be six operated rigs. On average for 2017, a one rig program is anticipated in the Eagle Ford.

Rigs are becoming increasingly effective, with those operating in the Niobrara and Permian Basins producing approximately 3.4x more barrels of oil equivalent in December 2016 than in January 2014, according to analysis done by EnerCom Analytics.

Noble plans to drill and commence production on approximately 225 onshore wells in 2017, the company said in its press release. The average drilling length across the U.S. onshore activity for 2017 is 8,200 lateral feet, with approximately two-thirds of the wells to be drilled in the DJ Basin, nearly 25% in the Delaware and the remainder in the Eagle Ford.

In the DJ Basin, half of the anticipated wells in the 2017 program are located in Wells Ranch. The company will also be drilling wells in the East Pony and Mustang areas.

In the Delaware Basin, the vast majority of the wells are expected to be in the Wolfcamp A interval, with a few wells in other zones.

The majority of the Eagle Ford program is focused on Lower Eagle Ford wells in Gates Ranch; however, the company plans to also include multiple Upper Eagle Ford wells in its 2017 activity. Noble Energy will continue to utilize enhanced completion designs throughout its U.S. onshore well activity.

Included in the U.S. onshore capital expenditure amount is approximately $120 million related to midstream facility infrastructure buildout for central gathering facilities (CGF) and associated gathering lines, split evenly between the DJ Basin and Delaware Basin. These amounts include the buildout of the CGF in the Mustang area of the DJ Basin as well as for the company’s first two CGFs in the Delaware Basin, Noble said.

The $120 million reflects Noble Energy’s interest in the respective development companies (NBL currently owns 75% of both systems). The remaining 25% is owned by Noble Midstream Partners LP (ticker: NBLX), which is designing and operating the facilities in support of the company’s long-term upstream plans.