Production up almost 4 million barrels month over month

The North Dakota Department of Mineral Resources (DMR) reported production in the state was up 3.9 million barrels in the month of March. The DMR released its preliminary March numbers last week, showing production continues to grow despite falling rig counts.

According to the DMR, March oil production reached 36.91 MMBO, or about 1.19 MMBOPD, approximately 12% higher than in February when the state produced about 32.99 MMBO, or about 1.18 MMBOPD. Gas production also rose to 47.17 MCF in March, or 1.52 MCF/d, from 41.31 MCF in February, or 1.48 MCF/d.

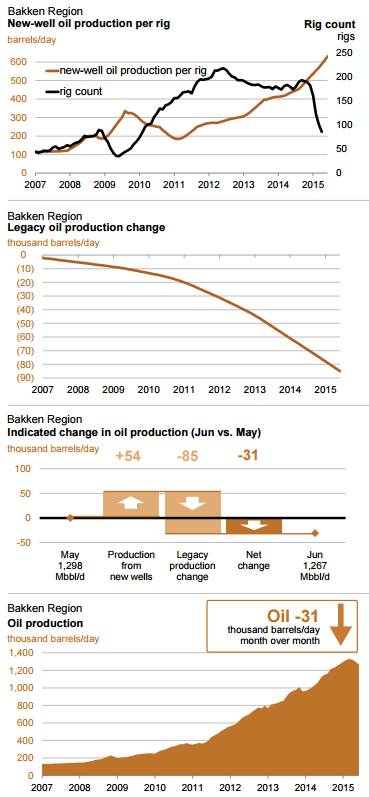

Even as production continues to increase, the rig count continues to fall. The drilling rig count dropped 25 from February to March, 17 more from March to April. The declines seen in North Dakota are part of country-wide declines that continued for a 23rd straight week, last week.

Completions spike even as rig counts falter

Well completions rose sharply despite lower rig counts in the month of March. The preliminary count on completions in March reached 189, up 350% from 42 completions in the previous month. This massive spike could be due to state-mandated time limits along with major tax incentives, according to Director of DMR Lynn Helms. In March, Helms said 125 wells had to be moved online by June to comply with time limits, although it is unclear how many of those wells were turned to sales in the latest DMR report.

Nathan Conway, CEO of Fortis Energy Services, an oil and gas service company specializing in well completions, workovers, maintenance and plugging with operations in North Dakota, agrees with Helms’ assessment.

“In the state of North Dakota, a well can only be left for 12 months after being drilled before it needs to be either completed or temporarily abandoned,” Conway told OAG360®. “Many companies are choosing to complete the wells now rather than plugging them.” Conway went on to say that he expects this trend to continue as many of his customers are planning to complete wells in the coming months.

Whiting Petroleum, the largest producer by volume in the Bakken/Three Forks trend, spent roughly 40% of its 2015 expenditure budget completing wells in Q1’15 alone. For some companies, placing the uncompleted (or frac-log) wells online has allowed production to actually climb on a quarter-over-quarter basis despite the substantial cut in operating rigs.

“The reduction in the frac log really doesn’t happen until about two months to three months, up to four months after that rig count reduction,” said Mark Williams, Senior Vice President of Exploration and Development, in a conference on Tuesday. “So, there’s a similar curve out there, beyond the rig count drop that typically happens in May and June. It’s really happening right now.”

At the end of March there were an estimated 880 wells waiting on completion services, a decrease of 20. To maintain production near 1.2 MMBOPD, 110 to 120 completions must be made per month, according to the DMR.

Drilling permit activity decreased slightly from February to March and significantly more from March to April as operators positioned themselves for low price 2015 budget scenarios.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.