In EnerCom’s Energy Industry Data and Trends for January 2015, the company examined the impact of hedges on the stock valuations of the companies that hedged versus those that did not. The research looked at companies’ performance over the eight cycles in crude oil commodity prices from January 2007, to December 2014.

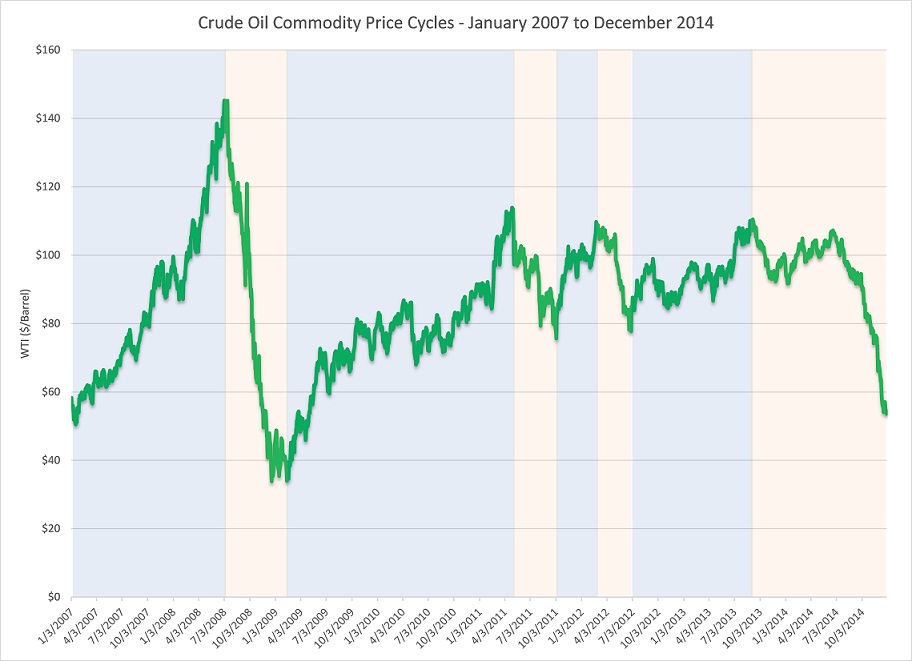

The chart below illustrates the closing near-month futures price of West Texas Intermediate crude oil from January 3, 2007 to December 29, 2014. The blue shaded sections denote periods of rising oil prices and the light orange shaded sections highlight bearish price environments.

The hypothesis driving the research was this: If a company has a high proportion of their production covered by hedges then the share price of the company would be highly insulated to commodity prices. Said another way, companies with high proportions of the their production hedged should not see their share prices rise or fall as much as those with less of their production hedged during commodity cycles.

Companies predominantly hedge for five reasons:

- Protect the annual CAPEX budget

- Protect cash flow / well economics

- Protect monthly/quarterly distributions

- Protect M&A / property acquisition returns

- Manage through risk

Companies do not put on hedges to improve stock performance.

To test the hypothesis, EnerCom identified five companies that demonstrated a high level of hedges (more than 60% of the companies’ production) and five that were relatively unhedged (35% or less of production hedged) and compared their average share price through the 8 cycles. EnerCom’s findings are summarized the in the chart below.

Interestingly, the results do not support the original hypothesis – that the performance of hedged companies would exceed that of unhedged companies in down markets and vice-versa. Not only did the unhedged companies fare the best over the course of the past seven years, but their performance in this last down cycle has been particularly telling.

During the most recent down cycle, companies in the unhedged group lost an average of 7.61% of their value, while hedged companies have declined 33.4%, or more than four times that of the unhedged companies in a down market.

Thinking about hedges and capital expenditures, the chart below shows how much a company has its 2015 production hedged and its expected CAPEX.

But the cuts are not meant to spell doom. The cuts, as we see them, come from a mismatch in costs and revenues. In a market where the producer is a price taker, not a price maker, companies won’t drill using a $100 OilService price book when they are receiving 50% less in revenue per produced unit.

Hedges do work. The most frequently cited reason for hedging is in the companies’ obligations to their lenders. The companies in the hedged group used for EnerCom’s analysis had higher levels of debt than the unhedged group. Once a company assumes debt, they are beholden to certain covenants and now represent a risk to the lender that must be managed.

Speaking of covenants, companies are in direct communication with their bankers either working on amendments to current agreements, seeking to modify covenant levels, or both. Unlike the large revolver draws that happened in late 2008 and into 2009, companies are not seeking to increase the draw on their bank revolvers. Witness the recent equity transaction completed by Bonanza Creek (ticker: BCEI) that sought to build future liquidity.

As companies increase borrowings, the bank’s exposure to loss increases proportionately. In order to mitigate that risk, many lenders mandate that borrowers mitigate the exposure by hedging. As companies take on more debt, their covenants require that they hedge more of their production in order to protect the lender from greater risk.

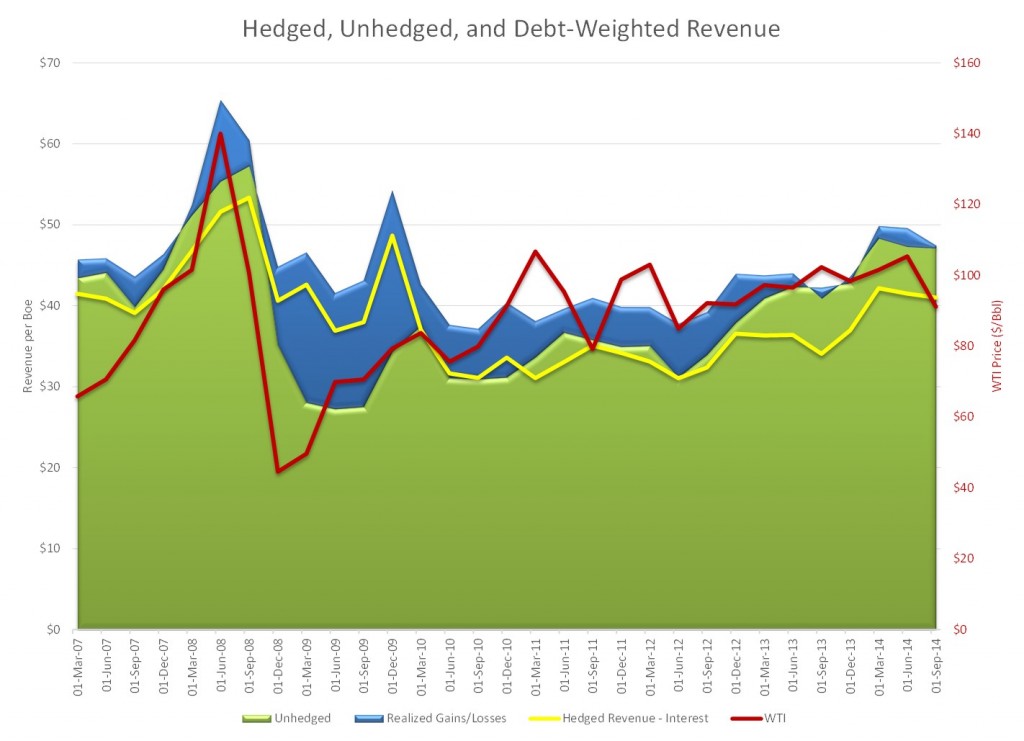

It is not just banks twisting arms that encourage companies to hedge, however. One benefit of hedging is to reduce the variability of quarterly revenue. According to the research done by EnerCom, most of the time hedges have added, or stacked-on, to unhedged revenue, which means operators are, on average, earning more than the prevailing spot price as hedged floors kick in and swaps become more valuable.

Given that the primary reason for a company to hedge is to protect their lenders from risk, it is important to factor in the cost of holding the debt and net that cost against any hedging gains. The yellow line in the chart below represents this debt-weighted revenue, or the hedged revenue less interest expenses per barrel. In most cases, interest expense has wiped out the benefits of hedging and more recently, hedging gains have not covered interest expenses.

Speaking with institutional investors as we do here at EnerCom, we thought it prudent to bring forward their top five attributes that they use in evaluating a company in a volatile market as we are in presently:

- Business position. This includes acreage, the age of the company, and future growth

- Quality of management.

- Strength of balance sheet.

- Timing – catalysts, general health of story.

- Current evaluation and cycle-tested “valuation.”

The list above is obvious and works in all markets. But, in this market will investors pay companies to grow? We believe yes they will pay up for the right companies because shrinking is not the right direction. Financial obligations are demanding, and we believe companies are cycle-tested to execute their plans and strategies in this market. In the present tense, the CAPEX cuts are required; however, companies were already taking steps with their operations to increase efficiencies, and ultimately returns by implementing procedures and processes gained from their learned experiences drilling their highly repeatable programs:

- Companies have a higher percentage of HBP acreage than they did five years ago. Capital is not required to drill to hold acreage as it was in the “land bank days.” This is an obvious CAPEX cut,

- Companies are highly efficient with their drilling. The shortening in spud to release days has generated, by our calculation, a 20%+ reduction in day rates.

- Acceptable internal rates of return on single wells are achievable in this market. For example, Sanchez Energy (ticker: SN) is spending about $5 million on a horizontal well on its Catarina acreage to realize a 35%+ IRR for a Lower Eagle Ford . Back in August 2014, the cost for Sanchez to drill the same well was 30% higher, or $6.5 million. Sanchez has pushed its spud to total depth from 15 days to 9 days.

- Just the reduced cost in diesel fuel and gasoline affords a cut in expenditures.

Common rates of decline for unconventional reservoirs are generally 60% to 70% in the first year, and 30% to 40% in the second year. A slowdown in North America drilling will have a measurable impact on whether this is a U-shaped or V-shaped recovery. We believe that as the commodity markets recover companies will start again to layer in hedges to support their future activities.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.