Conventional E&P Uses Scale, Quick Payouts to Grow in Canada

EnerCom, Inc. arranged meetings with institutional investors for Manitok Energy (ticker: MEI) during a non-deal roadshow in Dallas and Houston on July 14 and 15, 2015.

Click here for the company’s latest presentation.

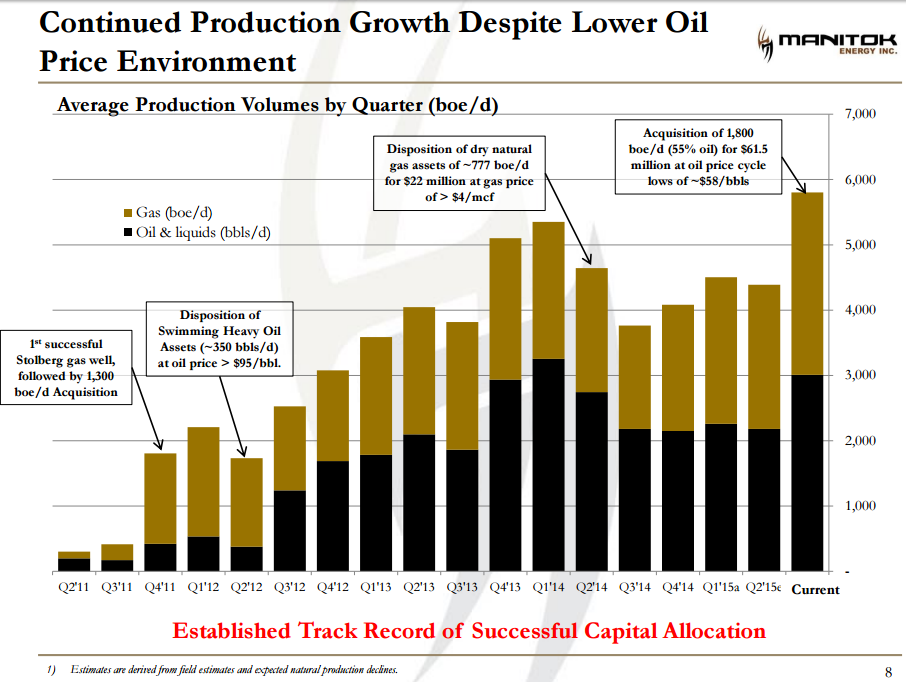

Manitok Energy is a conventional operator focused on projects in Alberta, and the company has spent the last several years amassing a considerable land position with output now approaching 6,000 BOEPD. Its footprint now extends 449,000 gross acres (93% working interest), of which 430,000 gross acres (94% working interest) have yet to be developed. In July 2015, the company closed a deal that bolstered its position with a $61.5 million acquisition of more than 67,000 gross acres with volumes of 1,800 BOEPD ($34,167 per flowing BOEPD).

The production of the Calgary-based company speaks much louder than its enterprise value, which is approximately $125 million. Manitok has managed to reach its current level while maintaining a micro-cap structure. Companies with similar production volumes include:

Manitok Comparables |

|||

| Company |

BOEPD |

Enterprise Value $MM |

EV/BOEPD |

| Abraxas Petroleum |

6,800 |

$384 |

$56,470 |

|

Callon Petroleum |

9,000 |

$809 |

$89,889 |

| Emerald Oil |

4,600 |

$284 |

$61,739 |

| Goodrich Petroleum |

8,900 |

$671 |

$75,393

|

| Marquee Energy |

5,300 |

$136 |

$25,660 |

| Rock Energy |

4,800 |

$225 |

$46,875 |

| Synergy Resources |

8,700 |

$1,104 |

$126,896 |

| Tamarack Valley |

8,000 |

$413 |

$51,625 |

| Zargon Oil & Gas |

4,700 |

$165 |

$35,106 |

| Manitok Energy |

5,800 |

$125 |

$21,552 |

Manitok History

Manitok was a private company prior to its 2010 merger with Desco Resources, a self-described “capital pool company.” The consortium raised $45 million through private placements within the year and directed its focus on oil-heavy projects in east-central Alberta. At the time, production was averaging 200 BOEPD and its annual drilling program consisted of completing six wells.

Manitok’s first breakthrough occurred in March 2011 with the successful completion of the Stolberg well, which tested at an initial production rate of 739 BOEPD. A few months later, MEI secured a 50% working interest in central Alberta properties resulting in 1,300 BOEPD of additional production. The company’s ability to grow organically is demonstrated by its climbing volumes. By October 2012, overall production reached 3,500 BOEPD and then climbed to 4,100 BOEPD in January 2013. Volumes surpassed 5,000 BOEPD near year-end 2013.

The company divested a portion of its central Alberta assets in early 2014 to reduce debt and allocate capital to its core projects. Volumes hovered in the 4,000 BOEPD range before its latest acquisition of the Wayne assets in southern Alberta, providing an additional 1,800 BOEPD and boosting volumes to 5,800 BOEPD overall. MEI management has established a goal of reaching 20,000 BOEPD within five years by capitalizing on future acquisitions and organic growth.

Manitok Today

Manitok employs conventional drilling techniques but the company operates in rather unconventional areas. Its focus areas in southeast Alberta and the Canadian foothills are less heralded than some of the supergiant fields in North America, but the under-the-radar opportunity has allowed Manitok to build out a land position, as mentioned, of 449,000 gross acres (95% undeveloped). More than 300 horizontal drilling locations have been identified through proprietary 3D seismic across the acreage position, well control from existing penetrations and successful drilling to date.

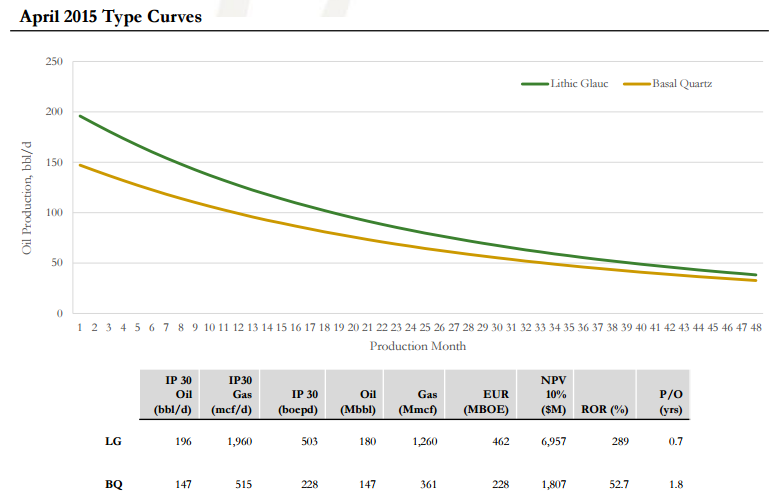

The company’s regional presence and operational experience has resulted in favorable, predictable type curves, including:

- Lithic Glauc, which include a payout in less than one year at $60 per barrel oil prices. Estimates call for a $2.4 million completion cost with estimated ultimate recovery (EUR) of 408 MBOE (42% oil);

- Basal Quartz, targeting a 16 month payout with an EUR of 228 MBOE (65% oil) at costs of $2.5 million per well; and

- Stolberg, its most developed asset, with payout in approximately 15 months at costs of $4.3 million per well with 220 MBOE (80% oil) of EUR.

The recently acquired Wayne property, in addition to its existing Entice asset, is Manitok’s growth platform moving forward and is supported by existing infrastructure and midstream assets. The company expects to generate $2 million from third party volumes alone, effectively covering its operating costs. Manitok’s own production from the region is not subject to Alberta Crown royalties, but rather to a flat 17.5% freehold royalty agreement, providing a consistent fee associated with its incoming revenue.

The company holds attractive hedges in the short term, with 1,500 BOPD of oil hedged at average strike prices of C$91 to C$95. An additional 500 BOPD are at an average strike price of C$75. About 15.1 MMcf/d is hedged at strike prices ranging from C$3.73 to C$3.85, accounting for the vast majority of its natural gas production.

On the Road

Below are a series of questions management fielded from investors during the trip:

- How could the new NDP government in Alberta and their anticipated royalty review affect your company and future economics?

- What is the driver for Manitok to establish a new core base asset in the Entice/Wayne area?

- Is there more acreage to be acquired in Entice/Wayne or are you ready to move forward with what you already have?

- How does the production facility that you acquired with the Wayne acquisition help the company strategically? Will you generate third party fees from this facility?

- What do you think accounts for the valuation disconnect between your current valuation and production level?

- What efficiencies are you looking at on the drilling and completion side that could materially reduce costs in your wells long term?

- At the end of 2015, what would you like to have accomplished?

- What is you type curve based on?

- On the Stolberg asset, what is your current recovery factor and what are you anticipating the water flood will do to recoveries?

- How much of a lead time do you need before deciding to put a rig to work and it is on-site drilling?

- What are your thoughts on heading going forward and could you monetize the hedges that you have in place? What is the current mark to market value of your hedges?

- Does reinvestment of your cash flow at current prices allow you to keep production flat?

- What is the corporate decline rate?