Acreage Value Increase of 441% Since Initial Purchase in 2010

Goodrich Petroleum (ticker: GDP) sold its proved reserves and approximately 13,000 net acres in the Eagle Ford Shale for $118 million to an undisclosed buyer, the company said in a July 27 news release. The assets are located in LaSalle and Frio Counties of Texas and include Q1’15 production of 2,850 BOEPD (75% oil), and are expected to close by September 4, 2015. A July 2015 presentation listed total proved reserves as of December 31, 2014 of 10.5 MMBOE.

The company is scheduled to release its Q2’15 results on August 5, 2015, and will present at EnerCom’s The Oil & Gas Conference® 20 on August 17. GDP holds one of the largest positions in the Tuscaloosa Marine Shale and is expected to turn six wells online in Q3’15.

By the Numbers

Based on the $118 million sale price, the deal implies the following values:

- Dollar per acre: $9,076 per acre

- Dollar per flowing barrel of production: $41,400 per BOEPD

- Dollar per proved reserves (as of 12/31/14): $11.15 per BOE

Comparable Eagle Ford Transactions

| Mo/Yr | Buyer/Seller | Net Acreage | Price ($MM) | $/ BOEPD | $/Acre | WTI Oil Price ($/Bbl) |

| 07/15 | Undis./ Goodrich | 13,000 | $118 | $41,400 | $9,076 | $47.39 |

| 07/15 | Undis./Comstock | N/A | $115 | $41,071 | N/A | $56.96 |

| 10/14 | Carrizo/Eagle Ford Minerals | 6,820 | $250 | $93,632 | $36,656 | $84.40 |

| 05/14 | Encana/Freeport | 45,500 | $3,100 | $58,490 | $68,131 | $102.18 |

| 05/14 | Sanchez/Shell | 106,000 | $639 | $32,000 | $6,028 | $102.18 |

| 02/14 | Baytex/Aurora | 22,200 | $2,600 | $105,356 | $117,117 | $100.82 |

| 11/13 | Devon/GeoSouthern | 82,000 | $6,000 | $113,207 | $73,170 | $93.86 |

| 04/13 | Penn Virginia/ Magnum Hunter | 19,000 | $400 | $125,000 | $21,052 | $92.02 |

| 05/12 | Marathon/ Paloma Partners | 17,000 | $750 | $107,142 | $44,117 | $94.66 |

| 04/10 | Goodrich/Undis. | 35,000 | $58 | N/A | $1,675 | $84.29 |

Eagle Ford Appreciation

Goodrich was one of the early movers in the Eagle Ford Shale, jumping into the play in April 2010. GDP paid $15 million in cash up front for 35,000 net acres in the LaSalle and Frio Counties, which included certain “drill to earn” obligations. Based on GDP’s corporate presentation, the company was able to establish its position at an average cost of $1,675 per net acre.

Based on Its recent sale ($9,076 per net acre) the acreage value increase of 441% compared to the company’s entry cost. It is important to note that GDP retained 17,000 net acres of undeveloped leasehold in the play to develop when returns support it or sell to further fund expanded operations in its TMS asset base.

Maintaining an Eagle Ford Stake

The divested acreage represents about 42% of GDP’s Eagle Ford acreage. Pro forma, Goodrich retains about 17,000 net acres in the play and 226 net unrisked drilling locations, based on a July 2015 presentation.

The company had previously disclosed its intention to sell at least part of the Eagle Ford, including in an operations update in June. Other East Texas assets in Panola and Rusk counties were sold in Q4’14 for $61 million.

GDP’s Use of Proceeds

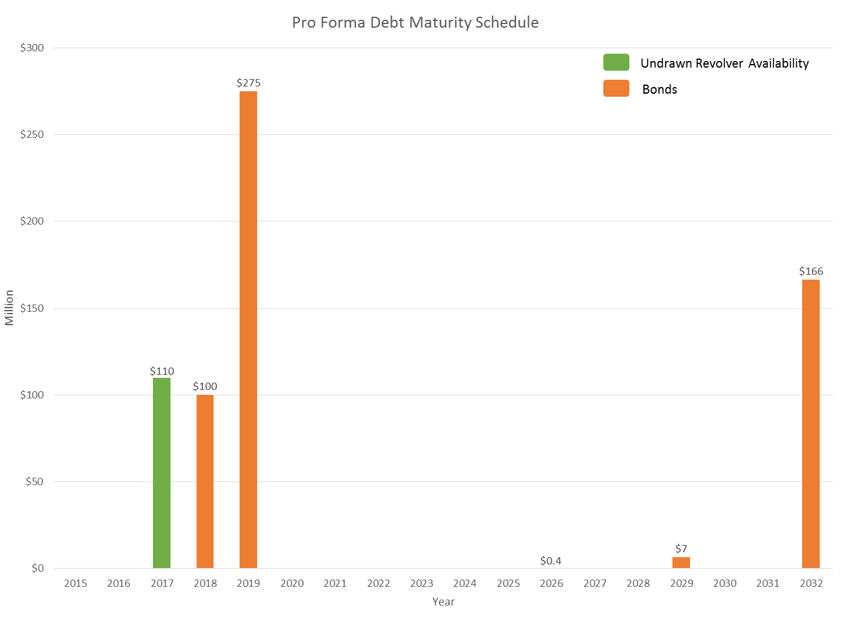

Goodrich expects a gain of $50 to $60 million after factoring in closing adjustments and will use the proceeds to pay off the $52 million withdrawn on its $150 million bank revolver as of Q1’15. The company reiterated its front-loaded $100 million capital expenditure program for 2015. A total of $48.4 million was spent in Q1’15 alone focused primarily on delineating the core and development of its 300,000 net acre TMS asset base.

“Acreage retention was an important aspect of this transaction for us as it allows for additional future value creation from the asset in what we believe will be an improved oil price environment,” said Robert Turnham, president of Goodrich Petroleum, in the release.

Michael Scialla, Managing Director for Stifel, estimates the remaining Eagle Ford properties could fetch about $200 million based on its remaining net drilling locations. “A potential sale of this acreage could close a looming 2016 funding gap,” the firm says, adding that “GDP may recommence its Tuscaloosa Marine Shale program later in the year if oil prices do not improve.”

Management believes its $150 million borrowing base will likely be reduced to $110 million pro forma the sale, but Raymond James says the company likely added about $60 million in liquidity overall, accounting for the loss in cash flow. The multiple amounts to about 6.0x and expenditures for the second half of the year are expected to be minimal.