Denver-based PDC Energy (ticker: PDCE) is an independent oil and natural gas company that operates in Colorado’s liquid-rich Wattenberg Field and the Appalachian Basin including the emerging liquid-rich Utica Shale play in Ohio and the dry-gas Marcellus Shale in West Virginia.

Wattenberg Program

A focal point of PDC’s Analyst Day in New York on April 17, 2014 was its downspacing program in the Wattenberg Field. The region, which is now being exploited entirely through horizontal drilling, will receive an estimated $467 million (72%) of 2014’s budget. The Waste Management section was fully online in November 2013 and was the company’s first 16-wells per section Wattenberg downspacing project. The 16 wells had peak production of 7.6 MBOEPD (88% crude oil) and is exceeding the company’s estimated type curves.

The company’s Wattenberg outlook for 2015 is much more substantial than it was at the beginning of 2013: Horizontal rig count is estimated to triple to six from two and gross annual production solely from horizontals is forecast to surpass 35 MBOEPD at year-end 2015 compared to 12 MBOEPD at year-end 2013.

Source: PDCE Analyst Day Presentation

OAG360 interviewed Bart Brookman, Executive Vice President and Chief Operating Officer of PDC Energy, in an exclusive Oil & Gas 360® interview.

OAG 360: Does success from your 16-well pilot program on the Waste Management land section change what you define as your inner, mid and outer core areas?

Brookman: It changed our perspective on the outer and middle for sure. The well performance exceeded the outer curve which we’d expected, and they’re tracking with our middle type curve. We’ll be a little more cautious about applying that spacing to the inner core since we have not drilled in that area, particularly in the Codell formation.

So what we learned on the Waste Management project, using a minimum of 16 wells per section, we will apply to our drilling permits in the outer and middle areas in 2014. We will be testing even more aggressively than the 16 wells as we outlined in the investor day presentation.

But in the inner core, we only have 90 locations total in our inventory – which is both Niobrara and Codell. You will see PDC be the most cautious in the development of the Codell as the inner core was aggressively developed vertically, then refracked and tri-fracked so we have to consider the depletion risk in that formation.

OAG360: Will you target the Codell formation in your 32-well project in 2015?

Brookman: While plans aren’t finalized for this project, we expect it will include Codells. It is a 32-well equivalent, so it may involve us drilling 16 wells on half a section. However, I believe our most aggressive downspacing in the Niobrara will come from the 26 well Niobrara-only project operated by Noble Energy (ticker: NBL). They should spud this project in the first quarter of next year.

OAG360: Since so much of your Wattenberg acreage is held by production (97% of its 97,000 net acres), do you anticipate conducting any more joint ventures on your future operations?

Brookman: No, it is not part of our long-term strategic plan.

OAG360: What made you decide to downspace so aggressively?

Brookman: Data from Waste Management pad is the primary answer, but also the recovery factors, some of our micro-seismic work, as well as some of the tracer surveys we have from our tighter-spaced projects to date. So we have a variety of technical tools, but first and foremost, the aggressive downspacing is from the empirical data we gathered from the Waste Management pad.

OAG360: You upgraded type curves in the Utica, where you currently are running one rig. Is this due to your improved drilling methods? Are you finding the wells are performing beyond your initial expectations with more drilling activity?

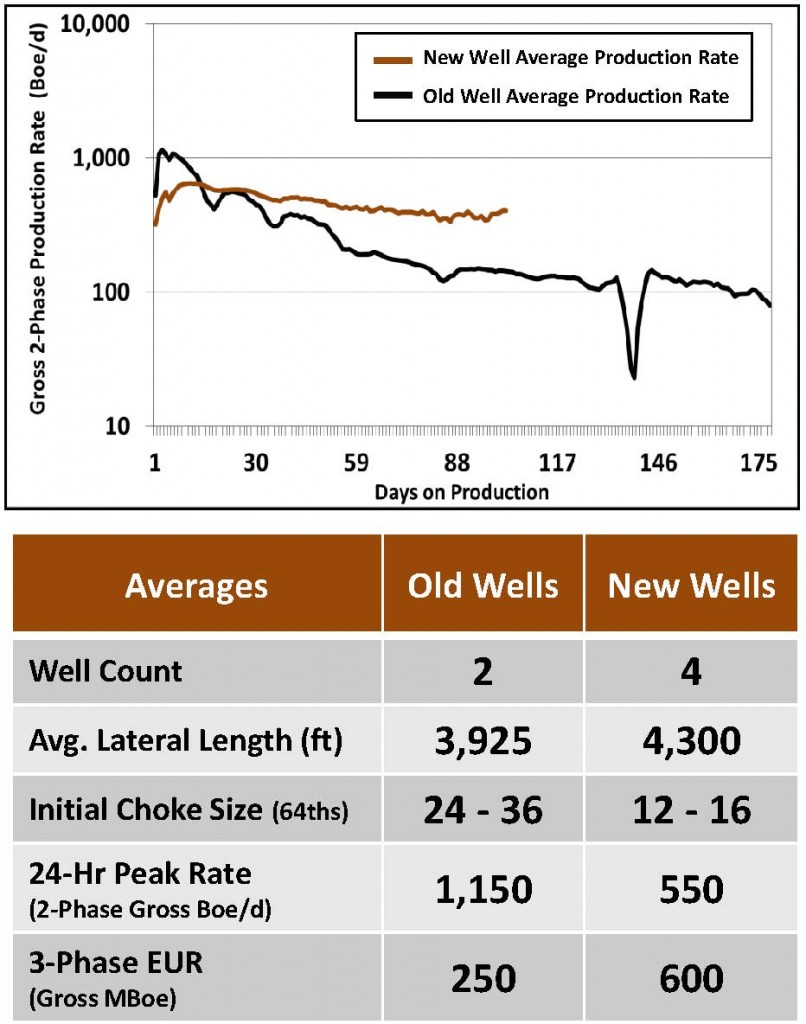

Source: PDCE Analyst Day Presentation

Brookman: It is a combination of both. Production data has come in and we have a better understanding of how to model declines. The choke management (right) on the front end has contributed to the performance of the wells, but we are also going to longer laterals, changing our completions and continually improving our frac designs, so we’ve got a variety of technical improvements coupled with better knowledge of the reservoir.

Our original type curves were based on some Eagle Ford analogies; we didn’t have our own data to build them until now.

OAG360: Do you plan on ramping up operations in the Utica/Marcellus due to rising natural gas prices?

Brookman: Our capital expenditures for the Utica are $162 million this year and we expect that to rise to approximately $200 million in 2015. We will continue to pursue acreage opportunities in the Utica. We’re planning on adding the second rig this fall and depending on results of drilling and if we acquire additional acreage, we will look at the possibility of a third rig.

We look at the Utica as a liquids play with crude and NGL pricing driving the overall economics. If we have line of sight that natural gas will be long-term $5, will we drill some of the locations that are more gassy on the eastern side? Yes, that could change our strategy as to where we drill on our acreage.

Over on the Marcellus, it’s a good question. Our decision to deploy a rig will require us to have line of sight for a stable $4.50 to $5.00 gas price. That’s when returns on drilling will compete for capital with the Utica and Wattenberg.

OAG360: Thank you for your time.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. As of the report date, neither EnerCom nor any of its employees has a financial interest in any equity or debt of any company mentioned in this report.