Oasis Petroleum Inc. (ticker: OAS) is an independent exploration and production company focused on the acquisition and development of unconventional oil and natural gas resources, primarily operating in the Williston Basin as a pure play Bakken E&P. The company holds 506,960 net acres in the Bakken along with 219 MMBOE in proved reserves having a PV-10 value of $5.2 billion. OAS believes they have 17 years of drilling inventory, and its primary operatorship of 94% allows for flexibility with the pace of the drilling program and capital spending.

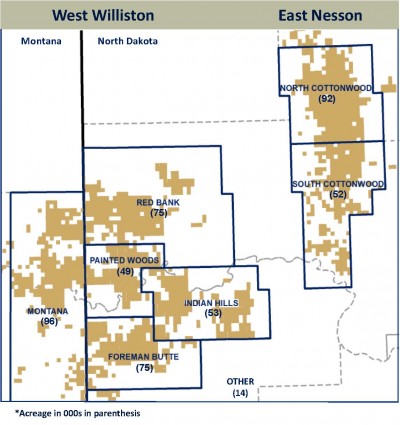

Oasis has boosted acreage by roughly 53% since September 2013, mostly from a $1.5 billion transaction that added 161,000 net acres. The company has now focused its activity on its West Williston and East Nesson areas. Oasis completed the sale of its non-operated Sanish properties for cash proceeds of $321.9 million on March 5, 2014.

Q1’14 Results

Oasis announced Q1’14 production totals of 42,856 BOEPD (89% oil) in its earnings release on May 5, 2014, which was 5% higher than the same quarter last year, net of the Sanish divesture. Production in the East Nesson alone rose by 14% and has climbed by 55% since Q1’13. Revenues also increased by 5% quarter-over-quarter to reach roughly $350 million and adjusted net income (meant to exclude proceeds from the Sanish deal) climbed 30% over the same period to reach $64.8 million ($0.65 per share).

Source: OAS May 2014 Presentation

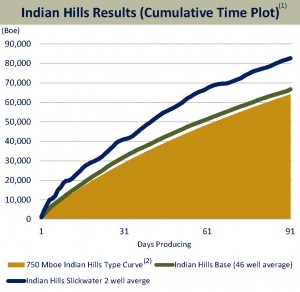

Taylor Reid, Director, President and Chief Operating Officer of Oasis Petroleum, said: “The biggest move we have made recently is with slickwater completions in the core of our West Williston position. On the wells we have completed in Indian Hills, we’ve seen an uplift of about 25% to 90 days of production, which is very impressive considering our average Indian Hills well already produces above our 750 MBOE type curve.”

The company was operating a total of 496 gross wells (385.7 net) at the time of its earnings release, with roughly 68% in the West Williston. The company also holds an interest in 260 non-operated wells (20.5 net). An additional 47 gross operated wells are waiting on completion and workover activity is up by 40%. OAS will exploit the opportunities with 15 running rigs to start Q2’14, with a 16th joining the fleet within the next quarter.

Production for Q2’14 is expected to reach 43 – 46 MBOEPD, which would be a 4% increase at its midpoint and an 8% increase if Sanish is excluded.

Williston Economics

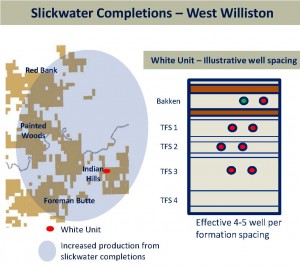

Oasis plans on completing more than 60% of its 2H’14 wells using slickwater fracs and other techniques. Average well costs are down to $7.2 million apiece from $7.6 million. OAS management credited the use of pad drilling, which takes place with roughly 80% of its wells, on stabilizing output and reducing the financial implications of a cold winter season.

The company plans on allocating 45% ($630 million) of its $1.4 billion capital budget to alternative completion techniques, downspacing and holding acreage. The remaining 55% ($770 million) will be dedicated to drilling and completion as Oasis moves towards full drilling space unit (DSU) development. OAS management said the first DSU recently spud and production will commence by Q4’14.

Source: OAS May 2014 Presentation

The recently acquired acreage has not begun development due to a lack of infrastructure in the region, but OAS management said development drilling and infrastructure buildout will likely begin in 2H’14.

Slickwater Completion Boosting Rates

Oasis’ slickwater frac completion method, consisting of only water and ceramics, has provided uplift of 30% in the Foreman Butte and East Red Bank areas and uplift of 25% in Indian Hills over a 12 month period.

“In general, what we are seeing across the areas that we’ve looked at is outperformance through the life,” said Tommy Nusz, Director and Chief Executive Officer, of Oasis Petroleum. “But keep in mind the amount of data on these slickwater jobs is pretty short at this point.”

OAS plans on completing 20% of its wells with slickwater fracs (32 total) in 2H’14 and believes the method is applicable on 20% of its acreage (100,000 net acres). Roughly half of its slickwater wells will be completed in Indian Hills and East Red Bank. Future tests are planned for the Three Forks formation including a White Unit well that will test three separate benches. A similar test is planned for the South Cottonwood in Montana late in 2014.

Source: OAS May 2014 Presentation

“There’s no reason why, that we see, why you shouldn’t get a similar uplift by doing that stimulation in the Three Forks versus the Bakken,” said Nusz.

Slickwater’s Future

Oasis has implemented coil tubing fracs for slickwater in certain regions, including North Cottonwood, and is awaiting results. Management said original 2014 guidance of 46 to 50 MBOEPD, along with EUR estimates, did not include the utilization of its new completion techniques, so upward movement is possible. Since most of the new completions are occurring later in 2014, the company believes the impact on production rates will be seen in 2015. The technique is more costly, but management believes it will be worthwhile.

Reid said: “The cost difference in a slickwater job versus our base design is on the order of $1.5 million to $2 million more… While that might place a little upward pressure on cost, we think we can offset that and at least keep our cost per well on average where they were for the first quarter for the remainder of the year.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. A member of EnerCom has a long-only position in OAS.