Coming: 280,000 jobs and $195 billion in private investment

The Eastern Seaboard of the United States is back on the oil and gas map.

On July 24, 2014, President Obama opened up sections of the Atlantic Ocean to hydrocarbon development – a plan originally proposed in 2010 that was placed on indefinite suspension following the Macondo disaster in the Gulf of Mexico the same year. Sonic cannons will be used to explore the region for oil and gas and are currently used in other areas of geographic difficulty, including the Gulf of Mexico and Alaska.

Operations in the Atlantic Ocean have not existed since 1982 due to government memoratoriums, but opening the doors to expanded offshore development is a plan Obama has reiterated throughout his tenure. In 2011, the president called to cut U.S. oil imports by one-third by 2025, which would represent total import totals of roughly 2,800 MMBO in comparison to 2011’s total of 4,174 MMBO. The United States imported a total of 3,574 MMBO in 2013, which is already 14% lower than 2011 numbers. In the same time frame, imports from OPEC have fallen by 19% (1,353 MMBO from 1,662 MMBO).

Atlantic Overview

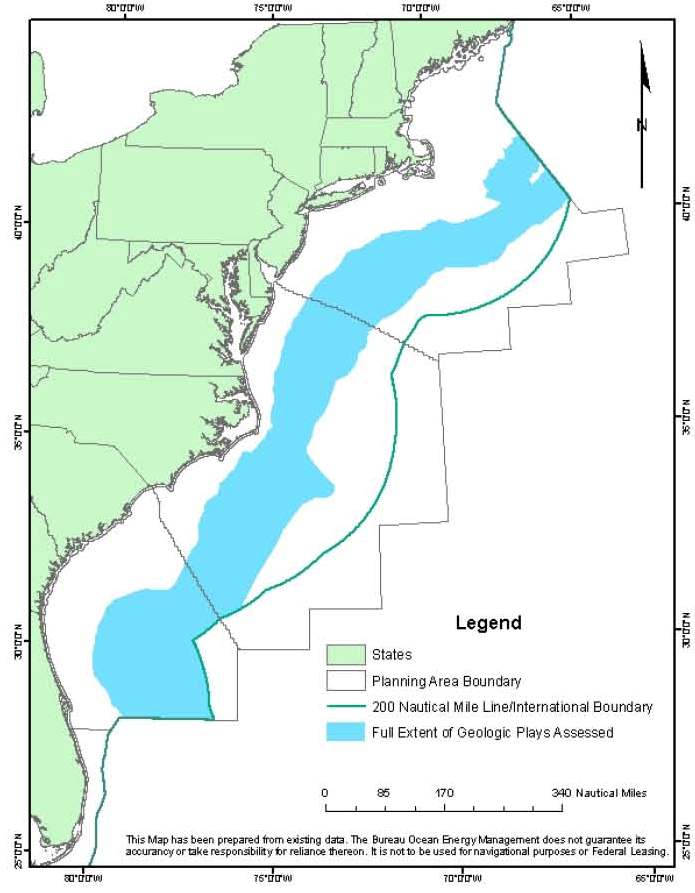

Information on Atlantic Ocean hydrocarbons is limited due to the drilling ban that has existed for more than three decades, but a 2013 estimate from the Bureau of Ocean Management (BOEM) placed 4.7 billion barrels of technically recoverable oil on the Atlantic Shelf. The focus area in the study, consisting of offshore property from Florida to Maine, is believed to hold an additional 37.5 Tcf of recoverable gas. Drilling depths range from 7,000 feet to 30,000 feet.

The move marks further government permitting easing following the Macondo spill. The BOEM released a 550 page environmental study on the potential effects from coastal drilling in 2012, just after the Obama administration enforced a five year ban on any offshore drilling in either the Atlantic or Pacific. Leasing plans may begin as soon as the ban expires in 2018. Exploration and mapping may begin immediately, and companies have already applied for permits.

Offshore United States oil accounted for 465 MMBO (or 17%) of countrywide production in 2013 – a stark difference from 2010, when offshore production of 585 MMBO consisted of 29% of all United States extraction. Doug Lamborn, Chairman of the Energy and Mineral Resource Subcommittee, said development of the Atlantic Ocean could generate 280,000 jobs and add $195 billion in private investment.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.