Oil prices expected to stay at or below $50 for the next six months

Lower for longer is starting to truly set in with the oil and gas industry as buyside investors and the industry see a more muted outlook for oil and gas prices on the horizon. A survey that polled primarily buyside investors and members of the oil and gas industry conducted by Baird Equity Research saw little hope of a full recovery in the next six months.

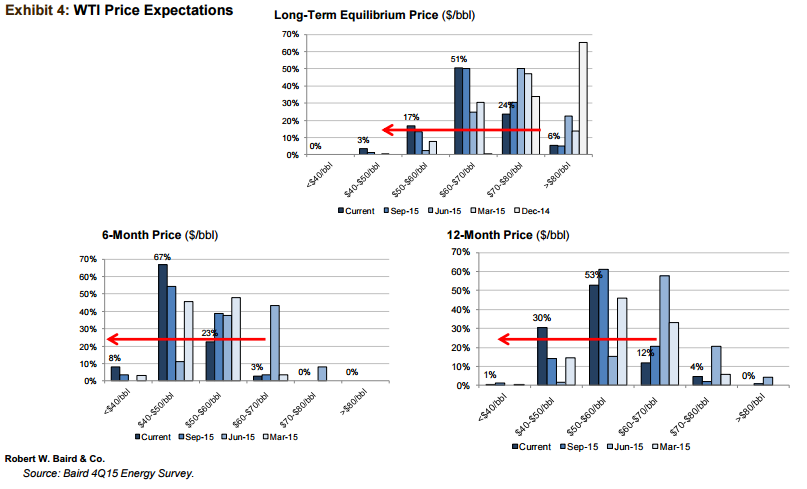

The results of the survey showed that about 75% of the respondents see pricing staying sub-$50 per barrel for the first half of 2016. The respondents expected some modest increases in price following the first six months of the year, with 53% of those polled saying that expect oil prices to reach $50-$60 per barrel over the next year. Their long-term outlook was bleaker however, with an increasing number of respondents saying that long-term equilibrium for oil prices would end up below $80 per barrel.

Lower crude prices are expected to impact the capital budgets of E&P companies further, with respondents expecting 20%-30% cuts in capital spending. Large cuts in spending will also push U.S. production down further than previously expected. Respondents believe that 2016 U.S. output will contract by close to 10%, but from the mid-single-digits when the poll was last conducted.

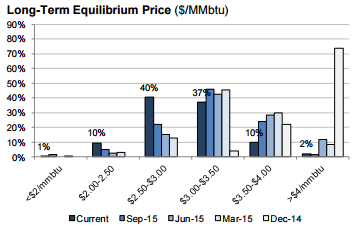

On the natural gas side, those asked about pricing said that $4 per MMBtu seemed increasingly unlikely for a long-term price. Short-term concerns over high inventories and expanding production in the Appalachian, along with growing prospects for Utica development, have pushed expectations for natural gas lower.

Despite the lower expectations for natural gas pricing, Baird believes that efficiencies could push breakevens in the Marcellus below $2 per Mcf, with further downside in breakevens in the Haynesville possible as well.

The cream of the crop rises to the top

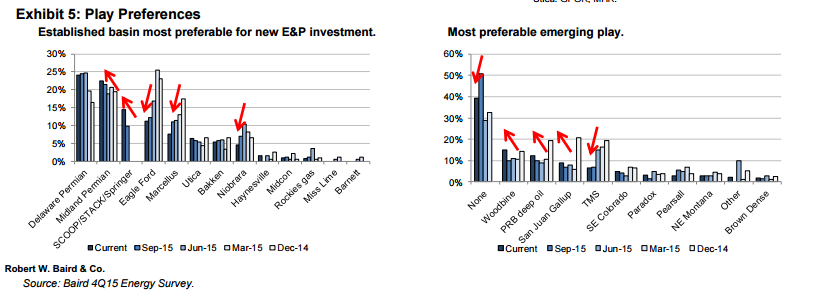

As companies continue to feel pressure from lower oil prices, those with the best positions are beginning to shine. Permian and SCOOP/STACK/Springer plays were listed as the preferred areas of operation for those included in the survey, beating out plays like the Eagle Ford, Marcellus and the Niobrara.

While the outlook from those polled in the survey was more pessimistic than during the past, Baird believes the market is overly bearish.

“The extremely oversold technical status of the energy sector suggests increased potential for major snap-back rallies,” said the company. “With sentiment so one-sided, we suspect some major eventual buying opportunity lies ahead though we suspect prudence still pays out over the near term.”

Politics remains a wildcard as well, with Iran’s return to global export markets expected to add to the pressure major exporting countries in OPEC are feeling. Less affluent members of OPEC are increasingly unhappy with the low price of oil as their export-dependent economies suffer.

Opportunities exist for strong balance sheets during recovery

Companies with strong balance sheets will be well positioned to take advantage of opportunities as they become available says Baird.