The year over year drops in 2015 capital expenditures were significant, but apparently not significant enough.

Budgets for 2016 are trickling onto the newswires, and some of the largest companies in the business are pulling back on costs yet again. Heavyweights like Chevron (ticker: CVX) and ConocoPhillips (ticker: COP) are reducing capital but abiding to their dividends; other debt-laden E&Ps like Encana (ticker: ECA) are not blessed with such a luxury, cutting dividends while reducing expenditures by more than 40%.

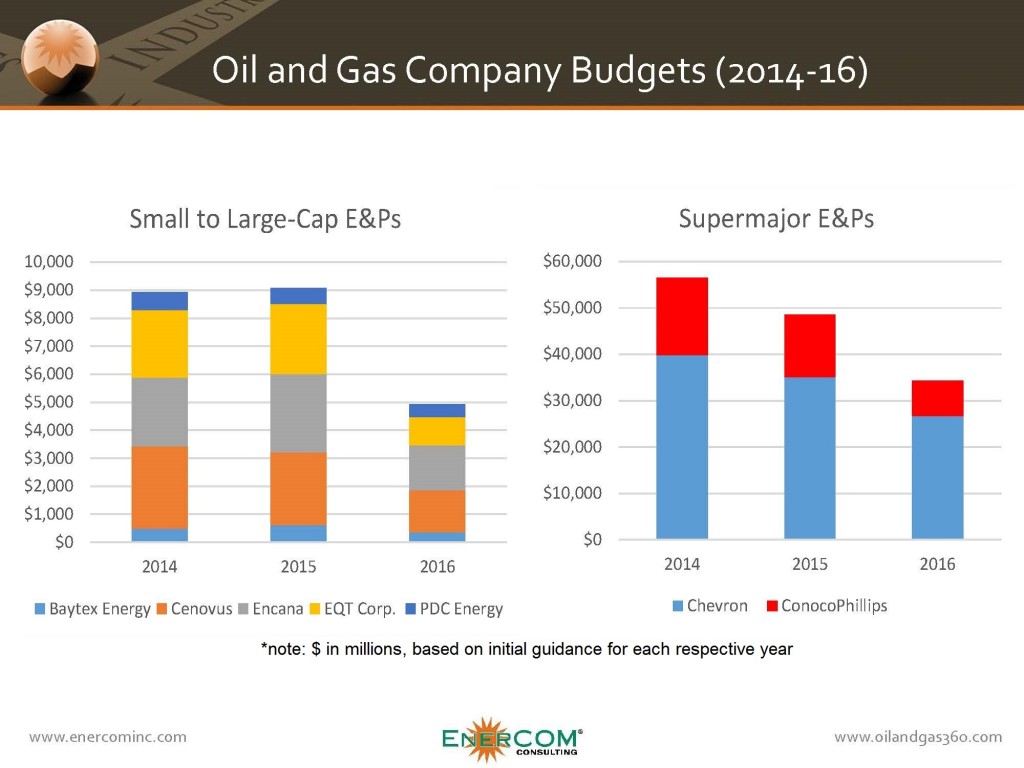

Only a fraction of the oil and gas market has released their respective 2016 budgets to date, but you can likely count on the overwhelming majority taking further action upon an average 2015 capital reduction of 35% per company. Below are a select few capital budgets, compiled by EnerCom.

2014 |

2015 |

2016 |

|

| Baytex Energy | $485 | $612 | $362 |

| Cenovus | $2,950 | $2,600 | $1,500 |

| Chevron | $39,800 | $35,000 | $26,600 |

| ConocoPhillips | $16,700 | $13,500 | $7,700 |

| Encana | $2,450 | $2,800 | $1,600 |

| EQT Corp. | $2,400 | $2,500 | $1,000 |

| PDC Energy | $647 | $557 | $475 |

| *millions | |||

| *midpoint, based on initial budgets | |||