Starzer’s privately held Fifth Creek is positioned to grow rapidly when oil markets turn: he’s planning to invest $1 billion in drilling over 4 years

It is difficult to overstate the importance of a good management team, particularly as the oil and gas industry slogs its way through the current downcycle. Experience at the top can help companies ride out a storm and it can also position an oil and gas company to move fast when assets come to market or when signals indicate it’s time to hit the accelerator.

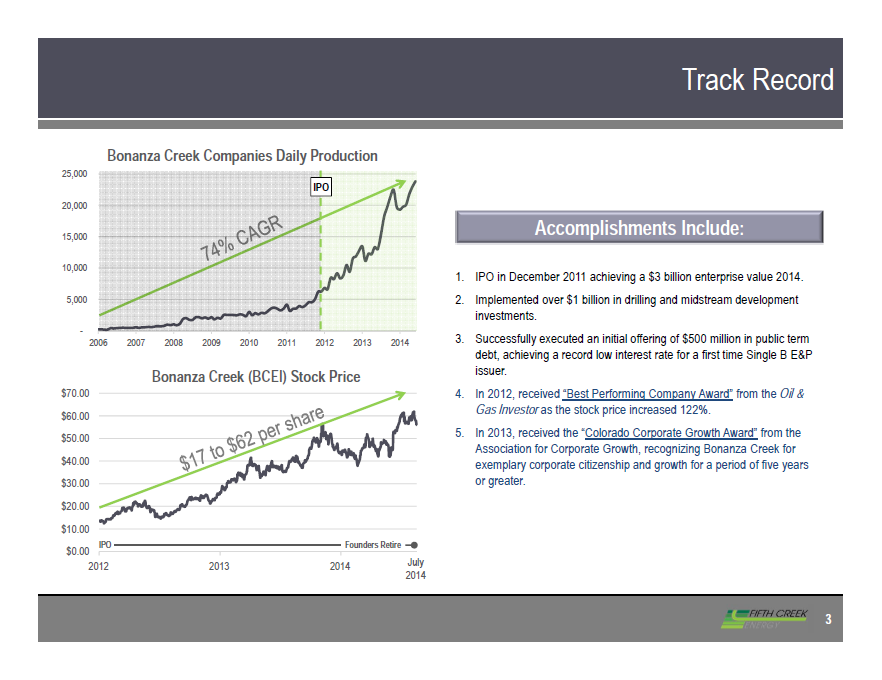

To gain a better understanding of how a successful CEO operates, Oil & Gas 360® spoke with Mike Starzer, CEO of Fifth Creek Energy, a private E&P. A total of $562 million was invested in the four Bonanza Creek companies that predated Fifth Creek, all of which maintained profitability during Starzer’s time at the helm of each. Fifth Creek, which was founded in March 2014, is focused on oily assets across North America.

Starting a new oil company amid the first price downturn since the global financial crisis might have seemed daunting to some, but Starzer and his team at Fifth Creek have a history of building value in their companies, and his most recent venture appears to be no exception.

The four Bonanza Creek companies that proceeded Fifth Creek each highlight the benefits of a skilled management team. The first Bonanza Creek grew production 15-fold in four years through the use of advanced fracture stimulation. In 2005, the company sold five of its gassy Wattenberg properties, generating a 5.9x ROI and 36% IRR for investors. Later iterations of Bonanza Creek would go on to see similar success, with Bonanza Creek Energy (ticker: BCEI) achieving a $3 billion enterprise value prior to Starzer’s retirement.

To understand how Starzer and his team at Fifth Creek are setting themselves apart in the oil and gas space, Oil & Gas 360® spoke with the company CEO about building value in today’s market ahead of Fifth Creek’s presentation at EnerCom’s The Oil & Gas Conference in Denver, Colorado on Wednesday, August 17, at 5:30 p.m. EST.

The company’s track record has attracted exceptional partners and personnel, while the company continues to build up its position in North America.

A focus on ensuring that everyone’s interests are aligned

Currently, Fifth Creek holds approximately 130,000 net acres with development potential for six-hundred 9,000 foot horizontal drilling locations. The company’s proved reserves are approximately 82 MMBOE with 2P reserves of approximately 250 MMBOE; approximately 75% crude oil.

As a point of comparison, BCEI held approximately 70 MMBOE proved reserves and 1,000 drilling locations at the end of 2013 when Starzer retired.

With the substantial acreage position the company has built up, along with Fifth Creek’s strong financial backing, Starzer is confident that the company will continue to build value. The company’s partnership with NGP in particular offers Fifth Creek a serious advantage, Starzer said.

Private equity partner a big plus

“They are the gold standard in the E&P private equity field,” said Starzer. “When we first started looking for a partner back in 2014, a lot of folks were interested in investing, but as the market softened, we saw a lot of people new to the energy space soften their interest as well. NGP was steadfast.

“We prefer the private equity partnership (to being a public company), especially when you’re starting from scratch. We investigated forming a SPAC [special purpose acquisition company], but we went back to private equity and we could not be more pleased.

“Private equity is a relationship oriented. It’s important that there’s full alignment with everyone, from management to the private equity partners, to the employees. You don’t always have that in public companies.

“What sets us apart is our equity sponsorship and that our employees and management are really high caliber, and we incentivize them. Not only are they significant participants in our success, some of them have opened their own checkbooks and purchased equity.”

Finding opportunities, even in a down market

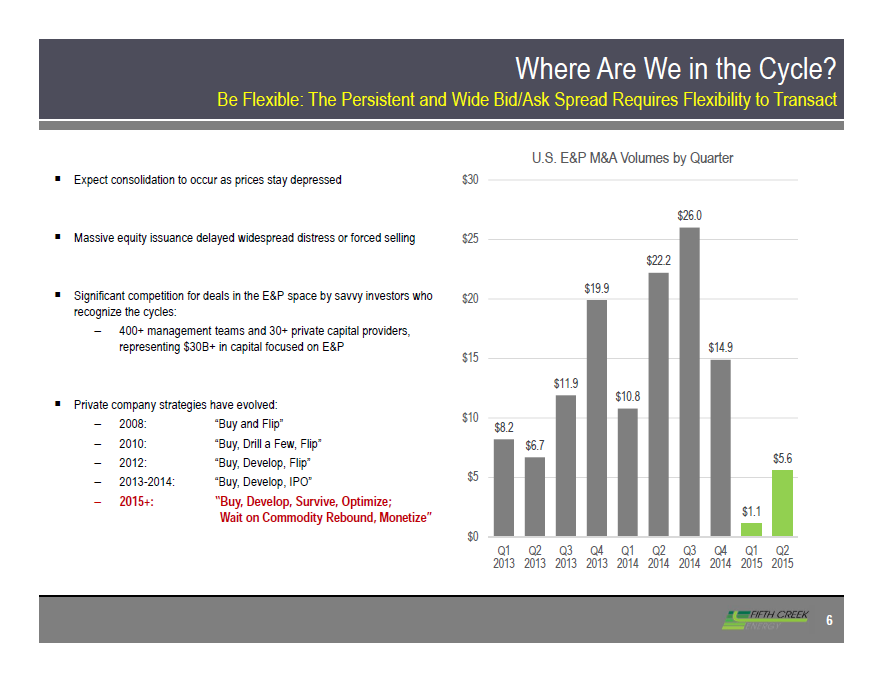

Part of the company’s stated strategy is growth through acquisitions, a challenging proposition in today’s market. The fluctuating price of oil has left the bid and ask spread too wide for the wave of M&A that was anticipated when oil prices first dropped. Even in today’s market though, Fifth Creek continues to grow and maintain a strong balance sheet.

Three priorities have guided Starzer in the four Bonanza Creek companies, and now Fifth Creek as well:

- Buy right

- Be the lowest cost – best in class operator

- Maintain an exceptional financial position at all times

“You can’t overpay—particularly in this downcycle,” explained Starzer. “Our private equity partners help us make sure we understand the market. Also, being able to walk into a potential deal and say we’re backed by NGP helps a lot when we’re talking to buyers.”

The company’s team has expertise in basins all across North America, and Starzer said Fifth Creek is looking for opportunities in the DJ Basin, the Midland and Delaware Basins, the horizontal Cotton Valley, the Utica, and assets in Canada, among others. While a specific drilling program was unavailable at the time of the interview, Starzer said Fifth Creek plans to invest over $1 billion in drilling during the course of the next four years.

More sand, longer laterals

In order to hit its second goal, Fifth Creek focuses on predictable, repeatable growth, through what Starzer referred to as “the third evolution of fracture stimulation.”

“It’s basically using higher propant concentration per foot and going to a longer lateral,” he explained. “The industry has proven that they can do that not only in the core of the core in places like the Delaware Basin, but also in plays like the Wattenberg now, too. Roll back the clock three years, and I don’t think that predictability would be there on those kinds of wells.”

Maintaining a strong balance sheet has become an increasingly salient point as oil prices struggle to maintain gains over $50 per barrel. “You must maintain an exceptional financial position at all times,” said Starzer. “We define that as a debt-to-EBITDA below 2.0x. A lot of people lost sight of the importance of that in 2014.”

At the time he retired, BCEI’s debt-to-EBITDA was 1.4x. The median debt-to-EBITDA level for the public companies in EnerCom’s E&P Weekly for the week ended July 22, 2016, was 3.6x, illustrating Starzer’s point.

Put together a team with a lot of ITT

During the Oil & Gas 360® interview, Starzer repeatedly emphasized the quality of his team.

“We have attracted the best in the business with our track record from Bonanza Creek, and by aligning our employees with the success of Fifth Creek,” said Starzer. “We offer them a piece of the action, and it attracts people with an entrepreneurial spirit.

“Our company culture is critical. Anyone who has done business with Pat Graham [Fifth Creek co-founder and COO, as well as EVP of Corporate Development at Bonanza Creek Energy before retiring shortly after Starzer] and I in the past knows what we’re all about: ITT – integrity, teamwork, and transparency.

“It needs to come from the top and run through the entire organization. It’s very important for our success,” said Starzer.

Fifth Creek and two other private E&P companies will present at this year’s The Oil & Gas Conference® 21 in Denver, Colorado, July 14-18. To learn more about who will be presenting and how to attend, click here.