The United States Department of Labor reported job growth of 217,000 new jobs for the month of May, marking the fourth straight month of gains greater than 200,000. The labor market has not seen such persistent job growth since the late 1990s and adds intrigue to the Federal Reserve’s ongoing discussions on when to raise interest rates. Total employment is 138.5 million, the highest since January 2008, and the unemployment rate of 6.3% is the lowest since October of 2008. The market has essentially recovered all of the jobs it lost since the Great Recession hit roughly six years ago.

While signs of improvement are apparent, there is still plenty of ground to recover. The Economic Policy Institute reports the job level is still roughly seven million positions shy of where it should be if the market had kept up with the growing labor force. The unemployment rate also does not take non-job seekers into account. In all, only 62.8% of Americans participate in the job market, which is the lowest number since 1979, lending criticism to recent improvement in the headline unemployment rate.

The Fed is scheduled to meet on June 18, 2014, to further discuss its bond buying program and the potential of raising interest rates. Chairwoman Janet Yellen has been somewhat unspecific with exact dates for when the Fed will initiate such programs, sticking with a “wait and see” approach rather than adhering to specific guidelines.

Charles Goodson, a member of the Energy Advisory Council of the New Orleans Branch of the Federal Reserve Bank of Atlanta, told OAG360 in April that he believes the Federal Reserve will likely be out of the bond buying market by October or November 2014. Then, he said, “We will probably see a quarter point rise in Fed rates probably by the second half of next year.”

Oil and Gas Employment Continues to Rise

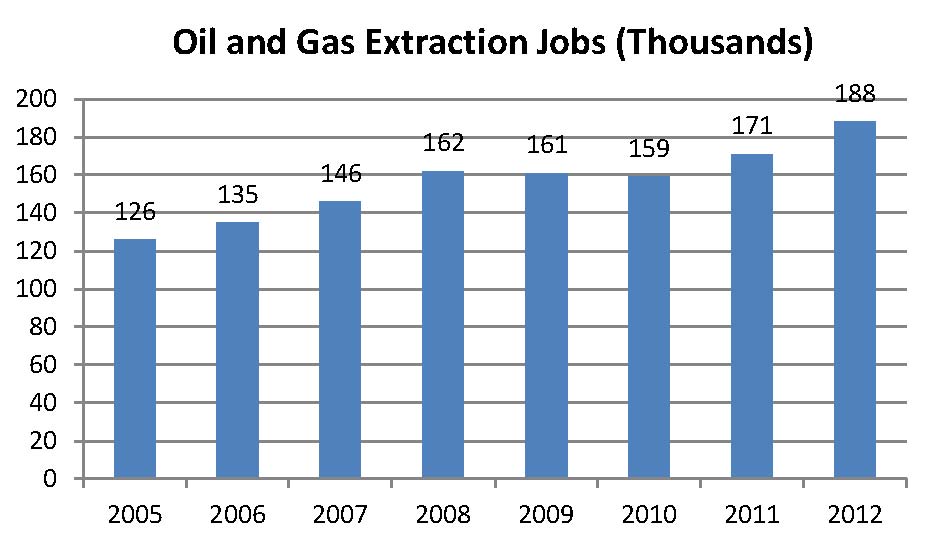

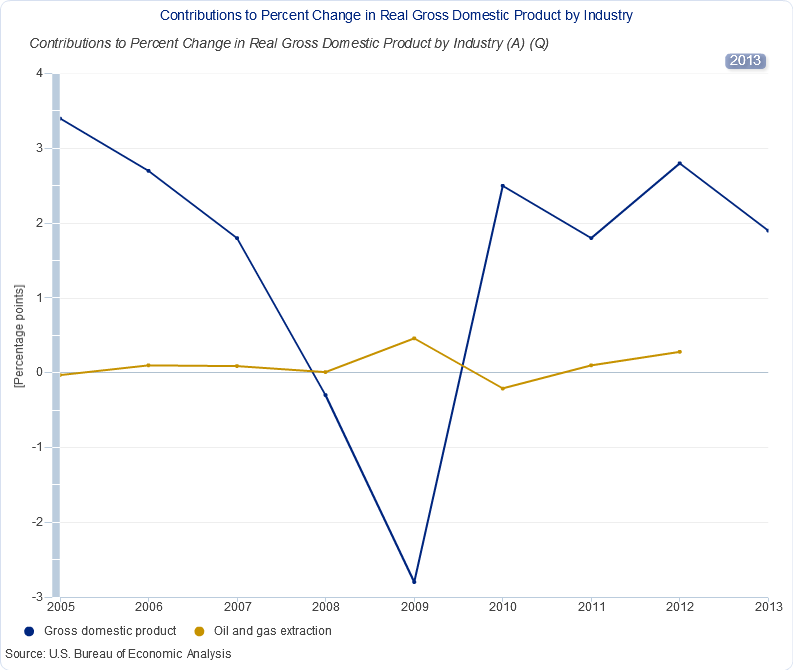

The United States Bureau of Economic Analysis (BEA) reported 188,000 jobs in the oil in gas industry at the end of 2012, which stood 49% higher than in 2005 when the sector held 126,000 jobs. Employment in the industry is also up 16% since 2008, while the rest of the economy has declined by roughly 2%. In 2012, overall gross domestic product (GDP) increased by 2.8% on a year-over-year basis. The oil and gas sector accounted for 0.28% of the change – the most of any sector. From 2008 to 2012, the overall GDP has increased by 4.3%, while the oil and gas extraction sector has jumped by 43%. In all, the oil and gas industry has single handedly accounted for 9.5% of the nation’s overall GDP growth since 2008.

More Exploration = More Jobs

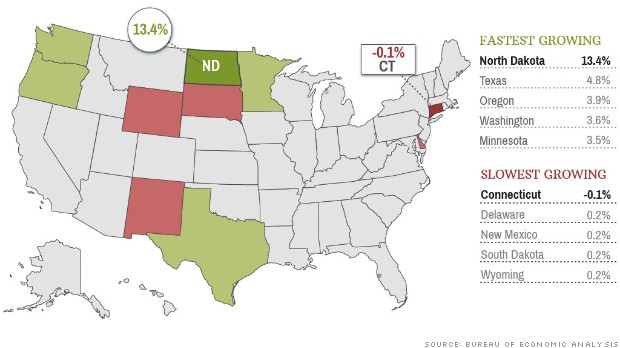

A strong job market has a direct effect on the economy. In a report by the BEA detailing state-by-state GDP in 2012, North Dakota and Texas, the two states most exploited by the oil and gas industry, topped the charts of the most rapidly growing states. North Dakota is increasing at five times the rate of the rest of the country. Future growth in Texas is expected to be driven by the Eagle Ford Shale, which has emerged into a world class oil play in just a handful of years. Oil and gas jobs in San Antonio, Texas, have more than doubled since the Shale’s boom began in 2009.

The growth is not expected to slow any time soon. In an article by the National Real Estate Investor, a direct correlation has been made with employment and rig counts. Matthew Schreck, a research analyst for Auction.com, said: “Even as rig count growth has slowed, job growth is cruising right along. The economies of both states are humming, attracting new residents in droves and bolstering the local housing markets.”

Exports, Fracking In Europe Would Increase Job Outlook

Lifting the current oil export ban would create an additional 300,000 jobs by 2020, according to a report by the American Petroleum Institute. The report also says the consumer market would save $5.8 billion annually from the decreased fuel prices.

The opportunities are even higher in Europe. The International Association of Oil & Gas Producers estimates one million jobs could be created if the continent opens its doors for shale development. The report also says the production of hydrocarbons would cut down on imports and save European nations a total of anywhere from $1.7 billion EU to $3.5 billion EU by the year 2050. Spot prices in Europe are as much as 178% higher than prices in the United States, according to the Federal Energy Regulatory Commission’s landing prices for June 2014.

Europe, however, is much less open to the idea of hydraulic fracturing than the United States. Five countries, including France, have banned the extraction method outright. However, governments are reconsidering in order to reduce reliance on gas imports from Russia. Officials in Germany have unofficially proposed to lift the country’s fracing ban in order to increase domestic supply, and governments in other countries have permitted fracing tests. However, citizens of countries like the United Kingdom, Romania and Ukraine have protested such tests and are preventing operations from commencing.

Despite the hurdles, the European oil and gas sector is quietly growing. In the United Kingdom, the site of EnerCom’s London Oil & Gas Conference™ 6, analysts are forecasting up to 39,000 new regional jobs will be created by 2016. A total of 46 out of the 100 companies surveyed said they expect to grow on an international level within that time frame, with the majority ending up in Scotland. The same report commissioned last year predicted job growth of 34,000.

The UK government is working with the industry to increase drilling activity in the country in an effort to reduce dependency on imports. The government has proposed new rules covering surface access rights in an effort to accelerate the introduction of hydraulic fracture stimulation. The proposed rules include giving oil and gas companies access to depths below 300 meters and suggests paying landowners £20,000 per well.

The European public may not be ready to embrace fracing, but many analysts and journalists, including Christopher Helman of Forbes, say its utilization is the key to breaking out of an economic slump. “What Europe needs as a balance against Putin is a fracking revolution,” says Helman in an article on May 21, 2014. “Is there really any doubt that Putin and his Russia Today propaganda machine has been supporting Europe’s anti-fracking activists precisely to keep them hooked on his gas?”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.