June 26 is renowned as one of the busiest trading days of the year, and Reuters believes as much as $40 billion in transactions will occur in its final trading hours.

The culprit is the Russell Stock Index, an operator whom adjusts its indices just once a year. The process is a transparent, straightforward formula based on market capitalization, liquidity and float. A total of 3,000 of the largest publicly traded companies in the world make the list. The top performers are slotted into the Russell 1000, but arguably the most popular is the Russell 2000, which tracks development of small-cap companies.

A preliminary release is scheduled for June 12, with follow-up lists being released in two successive weeks before the final issuance takes effect on June 26. The market values are reflective of closing on May 29.

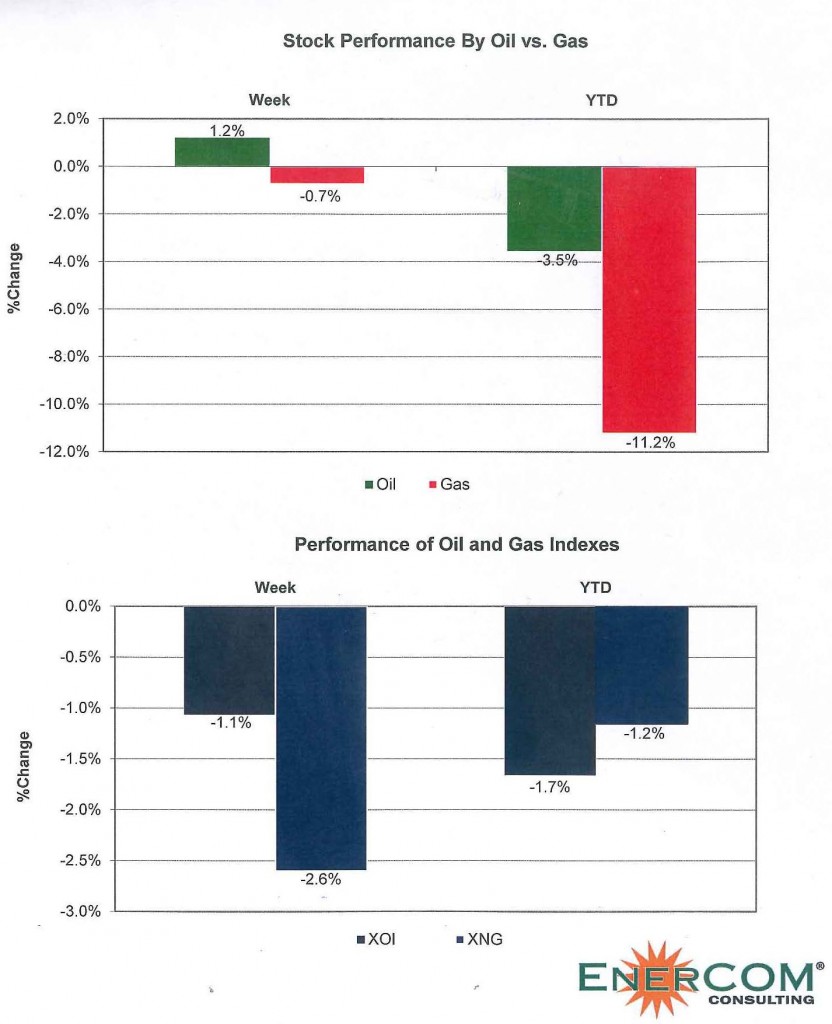

The Oil and Gas Scene

Understandably, oil and gas companies are positioned for serious slides in this year’s reorganization. On June 26, 2014, West Texas Intermediate and Henry Hub closed at $105.84 and $4.40, respectively. Those benchmarks closed at $58.14 and $2.71 on June 8, 2015 (down 45% and 39%), but have improved in recent months due to production slowdowns and steep rig count declines. Sales revenues followed suit with commodity prices, declining almost 50% in Q1’15 reports, affecting market capitalizations across the entire sphere of oil and gas companies.

The market cap swings are apparent in EnerCom’s E&P Weekly Benchmarking report. A comparison below takes into consideration the report released immediately after last year’s Russell reorganization, along with our latest figures.

Market Capitalization Averages (in millions) |

||||

|

Large-Cap |

Mid-Cap (23 companies) |

Small-Cap (21 companies) |

Micro-Cap |

|

| June 27, 2014 |

$30,467 |

$5,967 | $1,304 |

$394 |

| June 5, 2015 |

$23,689 |

$3,892 | $811 |

$166 |

| Difference |

(22%) |

(35%) | (38%) |

(58%) |

| *Note: Exact company numbers are approximate, as companies have been added and removed to reflect acquisitions, IPOs, etc. and have varied in size | ||||

Lower revenues are just one part of the story. In February and March, the majority of companies saw reductions in their borrowing bases as the PV-10 value of their reserves were reassessed by lenders, making capital less accessible. Several organizations wrote down price impairments on their Q1’15 quarterly reports.

The price shift was a game changer, and the more-levered companies acted quickly to reposition themselves for the new playing field. Private equity firms were there to answer the call for capital, investing in various groups and padding their balance sheets. Plains All American Pipeline (ticker: PAA) said in its analyst day that the private equity frenzy alone has greatly reduced the amount of anticipated mergers and acquisitions.

Others elected to issue new shares and senior notes to raise equity, and, in most cases, have received a positive reaction from the market. Petrobras (ticker: PBR) sent shockwaves last week with the rare issuance of a “century bond” of $2 billion, which is set to mature in 2115. Approximately $3.2 billion was raised by three separate companies last week, indicating the market has hardly cooled off from February, when several majors were issuing stocks and bonds by the billions.

Who Fits Where on the Russell Index

News agencies and analysts estimate a market value of about $3.3 billion to be the cut-off for inclusion in the Russell 1000 index, while companies above the $175 million threshold will make the Russell 2000 list.

If the $3.3 billion marker holds true, select mid-cap oil and gas companies may be “demoted” from the Russell 1000 to the Russell 2000, says a note from Raymond James Equity Research. The firm expects the number of energy companies in the Russell 1000 to drop to 63 from 79, but the impact of supermajors like ExxonMobil (ticker: XOM) and Chevron (ticker: CVX) will offset the losses in terms of energy’s overall weighting in the top group.

While the “demotion” to the Russell 2000 may not be an outright reflection of a company’s performance in the commodity downturn, Raymond James warns stock prices could face near-term pressure as investors sell off the names that switched indices. Last year, the firm says such equities underperformed the market by 2% to 3% in the month after the indices were released.

The Russell 2000 Conundrum

The Russell reconstitution, for the first time in arguably seven years, is occurring when the oil and gas industry is on the downside. The number of companies sliding into the Russell 2000 could increase the energy weighting of the index by as much as 1.5% once the reconstitution is complete. The shift will “force small-cap managers to prepare for higher-than current exposure to broader energy equities,” says Raymond James. The trickle-down effect won’t stop there, considering the increased number of energy companies will be benchmarked against competitors that have typically been in the more elite index. “This means that small-cap managers will need to find their favorite energy stocks now,” advises the firm.

Those watching the moves of Russell will have plenty of competition. Investors typically place bets on companies bordering the top index cutoff leading up to the final announcement, thus contributing to the hectic market activity predicted by Reuters. Investment funds that use the Russell index as its benchmark indicator have nearly $5 trillion in their war chest, while the more passive Russell investment firms account for an additional $835 million.