May’s uncanny price stability, Iraq production growth, OPEC’s unknowns and shale’s “Fracklog” all competing for visibility in global petroleum’s crystal ball

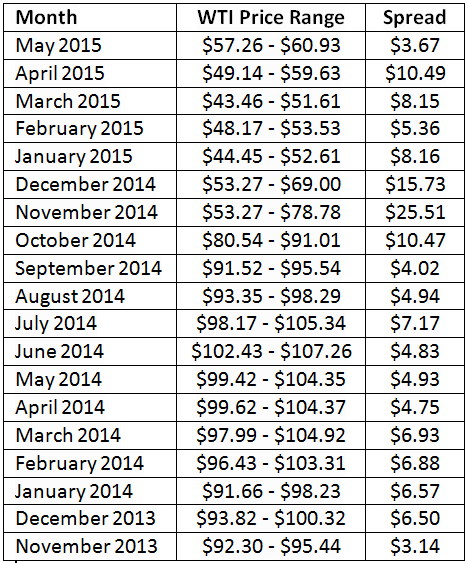

West Texas Intermediate (WTI) oil prices have ranged from $57.26 to $60.93 for the entire month of May, offering the greatest sign of stability we have seen since November 2013.

Analyst firms and oil companies are speaking with much more confidence about $60 oil for the remainder of 2015. The latest edition of the Energy Information Administration’s Short Term Energy Outlook projects WTI prices to average more than $65/barrel in 2016.

Scotiabank believes the $65/barrel marker will spur well completions that have been deferred due to the commodity downturn. “Signs point to an edging down in U.S. ‘light, tight’ oil production from the shales, given a 56.9% year-over-year plunge in U.S. oil-focused drilling activity,” says Scotiabank’s commodity price index released on May 26, 2015. “Equally important, U.S. petroleum demand (as measured by products supplied) has climbed by 3.9% year-over-year in the four weeks to May 15.”

The “Fracklog”

The “fracklog,” which it has come to be known around the media, consists of about 4,000 drilled but uncompleted wells on U.S. soil. Scotiabank says recent hedging activity suggest the wells will not be developed until WTI “consistently moves over US$65 per barrel and/or until producers can hedge forward at US$65.” The accelerated activity is already off the starting blocks in North Dakota, considering well completions more than quadrupled on a month over month basis in March.

The drastic rig count drops in the United States have also slowed. Only 20 rigs, or about 2% of the fleet, have been removed in the first three weeks of May 2015. Comparatively, an average of 53 rigs were put down on a weekly basis from the beginning of January to the end of April 2015. In a note following the rig count update, Goldman Sachs said: “We believe that should West Texas Intermediate crude oil prices remain near $60/bbl, U.S. producers will ramp up activity given improved returns with [oil service] costs down by at least 20%. Last week’s rig count is a first sign of this response and suggests that producers are increasingly comfortable at the current costs/revenue/funding mix.”

Potential Price Recovery Hurdles

Potential Price Recovery Hurdles

Goldman’s latest projection is only half of the story. Shale producers can now produce more for less.

On May 22, 2015, the firm said the market is still oversupplied and a ramp-up in activity will send WTI prices back to the $45 trough as early as October. The previously mentioned 20% oil service cost reductions, coupled with increased efficiencies, will send more oil onto a market that is already projected by the EIA to have approximately 1 million barrels of excess supply. Bloomberg Intelligence says exploitation of the fracklog could add 0.5 MMBOPD to the U.S. market by the end of 2015.

OPEC, Iraq, and Iran without Sanctions

Meantime, Persian Gulf producers continue to pump away in order to maintain market share. Saudi Arabia’s rig count is at a record high, and the OPEC leader has increased its fleet by 11% after refusing to curtail production in the last OPEC meeting in November 2014. The cartel is scheduled to meet again in early June, but the odds of any countries trimming production rates are slim to none.

That includes Iraq, the cartel’s second largest producer by volume with average production of 3.67 MMBOPD in April 2015. Bloomberg reports that the country wants to boost that number to 3.75 MMBOPD in May. If achieved, May 2015 volumes represent a climb of more than 0.7 MMBOPD of production averaged in 2013. Iran also hangs in the balance, pending a loosening of export restrictions. The EIA believes an outright end to Iran’s sanctions could add as much as 0.6 MMBOPD to the market and drop WTI prices by as much as $15 in 2016.

A Strong Dollar

Further WTI increases are strained by the continuing appreciation of the U.S. dollar, which hit a one-month high against a basket of major currencies yesterday. “The USD downward correction is complete,” Morgan Stanley said in a report. “A stronger dollar would only reinforce our near-term concerns for oil prices, especially Brent.”

Several analysts interviewed by The Wall Street Journal shared viewpoints that oil prices are being affected by outside factors, considering supply and demand have leveled off for the time being. Bob Yawger, director of the futures division at Mizuho Securities USA Inc., said, “Crude oil is at the mercy of the dollar index.”

WTI prices are down more than 4% from May 21’s closing price of $60.71.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.