Analysts predicted draw with summer weather

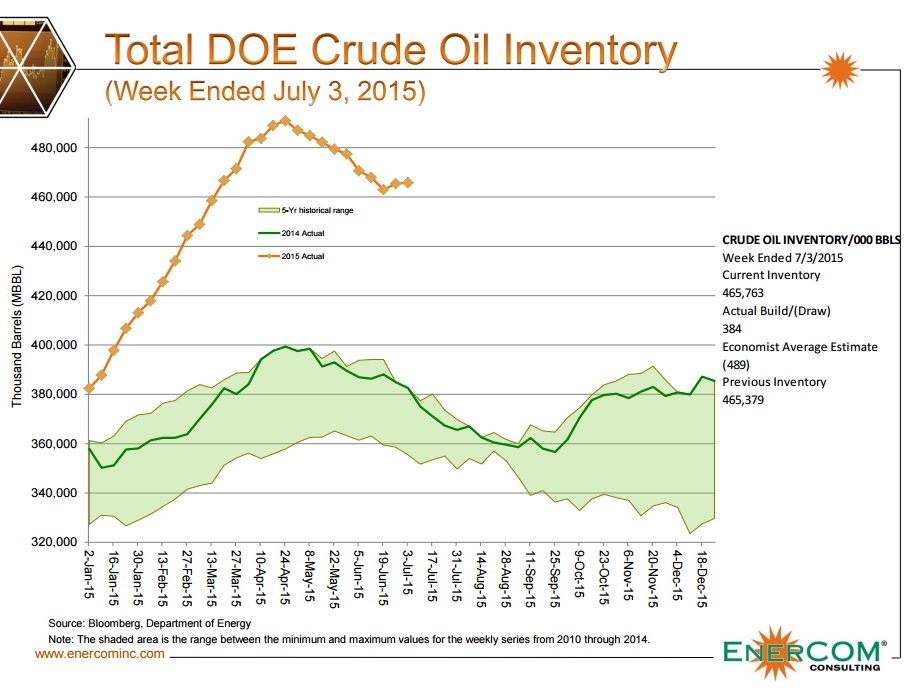

Information from the Department of Energy (DOE) showed a build of 384,000 barrels of oil for the week ended July 3, 2015, surprising analysts and sending oil prices down after a slump earlier in the week. This marks the second consecutive build, coming at a time when normally crude oil inventories were expected to come back to earth after reaching record levels in April.

Analysts polled by Reuters expected the DOE information to show a draw of 700,000 barrels, while another poll done by The Wall Street Journal predicted a 1 million barrel drop in inventories. The crude oil build brought inventory totals to 465,763,000 barrels, 26% above the five-year historic average.

The news that inventories increased for the second week in a row sent oil prices down 1.1%, leaving U.S. benchmark WTI at $51.80 per barrel just days after crude oil prices saw their largest single-day drop since February on Monday, July 6.

On Monday, WTI closed down 7.5% Monday while the international crude benchmark Brent fell 8.5% to $56.81. The steep fall in prices was due to concerns over the economic crisis in Greece and the stock-market selloff in China could potentially hurt already sluggish oil demand growth.

Ongoing talks between Iran and the P5+1 over potentially lifting sanctions and continued production growth in OPEC, along with rising U.S. rig rates for the first time this year, raising concerns that the global oil glut may worsen.