WTI crude oil prices hold above $29 per barrel, while production remains steady

Crude oil prices shot up over 12% last Friday, moving prices up from a 12-year low last week. Comments from The UAE’s Oil Minister Suhail bin Mohammed al-Mazrouei about OPEC being ready for production cuts excited trading, with many hoping OPEC might reprise its role as a swing producer. The UAE has been a strong supporter of fellow Persian Gulf producer Saudi Arabia in maintaining production to defend market share.

“The positive thing is the current market is forcing everyone not to increase output,” said al-Mazrouei. “I’m optimistic that the balance will happen this year despite the oversupply and stocks overhang.”

Fellow OPEC member Venezuela has been campaigning for both OPEC, and non-OPEC members to cut their production in recent weeks, with the country on track for the largest sovereign debt default in history with crude oil prices remaining well below what the country needs to balance its budget.

Russia, one of the key non-OPEC players in Venezuela’s plans for coordinated production cuts, has indicated in the last few weeks that it would cooperate in talks on production cuts, with Russia’s Foreign Ministry hoping cooperation could improve relations between Iran and Saudi Arabia, reports Reuters.

Tensions between Iran and Saudi Arabia have been growing over several decades, with conflicts in Syria and Yemen only further deteriorating ties. Cooperation on oil was meant to be the cornerstone of strong relations between the two countries, but has been unsuccessful from the beginning, according to Dr. Hossein Askari, Iran Professor of International Business and International Affairs at The George Washington University. Askari believes that if tensions between the two countries escalated to actual combat between Iran and Saudi Arabia, oil prices could spike into the triple-digits.

Looking for cooperated cuts

Venezuela’s Oil Minister Eulogio Del Pino remained upbeat about the progress being made on production cuts, saying “we’re on a very, very, very good path,” reports CNN.

“The fact that the market has reacted so strongly certainly indicates that these comments are being taken seriously,” analysts at Commerzbank wrote.

When asked to clarify his statement later, al-Mazrouei said “The UAE is always open and supports any cooperation by OPEC and non-OPEC which can stabilize the market.” But he added: “We believe the current market conditions will make all producers to sustain their production and not to increase.”

During a roundtable at the World Economic Forum in January, Saudi Arabia also indicated that it still intends to continue down the path of defending market share. “We are not going to accept to withdraw our production to make space for others,” said Khalid al-Falih, chairman of Saudi Aramco.

Like the UAE, al-Falih said the state-run oil giant would remain open to cooperation, however. “If there are short-term adjustments that need to be made and if other producers are willing to collaborate, Saudi Arabia will also be willing to collaborate,” he said.

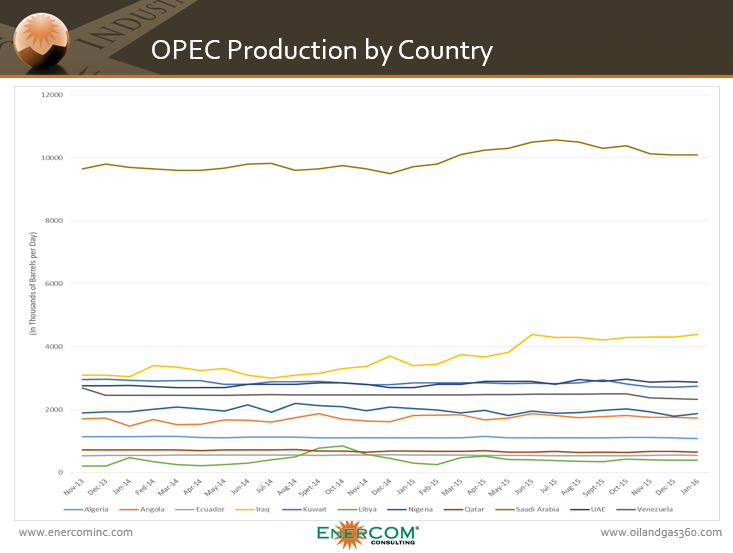

According to the International Energy Agency, OPEC’s production in January reached a record high 32.6 MMBOPD, while Russia maintained output just below 11 MMBOPD, a post-Soviet high. With the world’s major producers continuing to pump crude as fast as possible, a concrete deal remains uncertain.

Further complicating the already messy political situation surrounding the global oil cut, Iran continues to insist that it will regain its lost market share now that international sanctions have been lifted. The Islamic Republic seems unlikely to join in a coordinated attempt to keep production below current levels after just rejoining world markets, meaning it could spoil a potential deal.

Saudi Arabia and Russia set to meet in Doha

Saudi Arabian Oil Minister Ali al-Naimi plans to meet with his Russian counterpart Alexander Novak in the Qatari capital of Doha tomorrow, reports Bloomberg. The source who confirmed the previously unpublicized meeting did not say what the agenda of the meeting would be, but that it will also be attended by Venezuela.

“The back channel talks, which Qatar is brokering, had been in place for a while,” said Amrita Sen, chief oil analyst at Energy Aspects. “These are still very early days and nothing concrete has been agreed, but there is a growing sense that countries could be more flexible, although Riyadh would insist that everyone else contribute to the cut.”

A price recovery would take 18 months if it started today

If a price recover were to start today, it would still take a year-and-a-half to be complete, Continental (ticker: CLR, ContRes.com) Vice President of Crude Logistics and Hedging Kirk Kinnear told Oil & Gas 360®.

“Our studies indicate that the length of the decline is a pretty good indicator to the length of the price recovery,” said Kinnear. “Right now, we look to the summer of 2014 as the beginning of the decline, so you have at least 18 months if the price recovery started today before you see that reinvestment. It’s going to take a while.”

OPEC’s decision to pump at full capacity while drawing down on foreign reserves in order to continue supporting government programs should be “flashing lights that all is not well,” said Kinnear. “OPEC’s fields are much more mature now than they were in 1986, and their spare capacity is at an all-time low.”

Oil demand is expected to continue growing, even as concerns over China’s economy persist, potentially leaving the U.S. in a strong position. “One of the strongest positive developments of lifting the crude export ban is that the U.S. is no long an island unto itself,” said Kinnear. “The market for light-sweet oil is still pretty tight,” who expects the spread to increase between light-sweet and heavy crude grades favoring the lighter oil produced in the United States.

Production will take time to come back online when prices do recover, though, said Kinnear. “It’s not like a light switch,” he said.