Oil in 2017

In WTI near month contracts, oil was trading above $55+ to start off the year, then it fell into a downward slog, dropping 4% to sub-$52 today. It feels like oil prices have been a tale of two continents as 2017 unfurls.

On one hand there have been media stories that shed positive light of late as to OPEC member (principally Saudi Arabia) and non-member countries (principally Russia) saying they plan to comply with the Saudi-led production cuts in 2017. On the other hand, half way around the globe, the U.S. shale producers have been ramping up drilling and completion activity, with more than a few announcing robust drilling plans for 2017. Last week, for the first time, rig count in the U.S. exceeded prior-year levels.

While Eastern producers have promised cuts, how will U.S. growth in production affect global oil supply and prices?

Petrie lends a hand

Tom Petrie, chairman of Petrie Partners, was interviewed on Bloomberg TV today in a discussion about oil and OPEC and the U.S. production.

Tom Petrie: The U.S. will come on but there’s going to be a bit of a lag to really turn production up. We did bottom about three months ago and we’re now seeing some upturn, but I don’t think that’s enough to offset the cuts that OPEC is talking about. Both Russia and more importantly Saudi Arabia look to want to cooperate on this. The big risk in my mind as we go through the balance of this year is how strong the dollar becomes and what does that portend for global demand growth.

I think OPEC is working hard to implement its cuts, but if global demand growth falls short that’s when we’ll get into a real period of indigestion.

Bloomberg: When you look at the various OPEC members and non-members who have promised to participate in this cut, who do you see as the most vulnerable if we start to see a demand drop, if we see that dollar strength you’re talking about?

TP: Well in terms of vulnerability, certainly the weakest members of OPEC have real issues—Venezuela falls in that category. Nigeria to a degree is also in that same category. We’ve got embedded declines that are beginning to show up in mature production across the board, both within OPEC and in non-OPEC countries. So that may be the other cushion that helps this all stay constructive, which I think it will in the course of 2017.

We have to remember however that we’re still looking for a draw on inventory to get us back into balance, and it’s going to take a fair amount of this year’s draw on inventory to get us to that point.

EDITOR’S NOTE: Tom Petrie, chairman, Petrie Partners, will make a presentation on global oil at the EnerCom Dallas conference March 1-2, 2017, at the Tower Club Downtown Dallas.

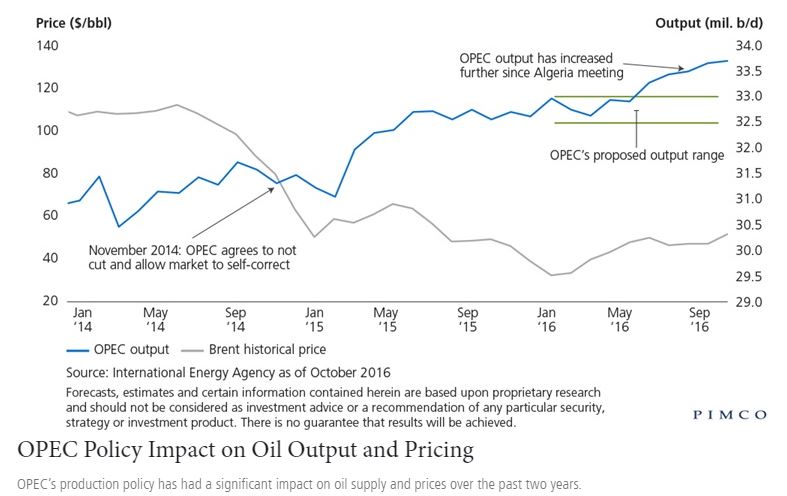

Meantime, Pimco provided an illuminating look at OPEC’s oil production compared to its proposed output range announced in the 2016 Algeria meeting.