Weaker dollar helps oil prices find $46

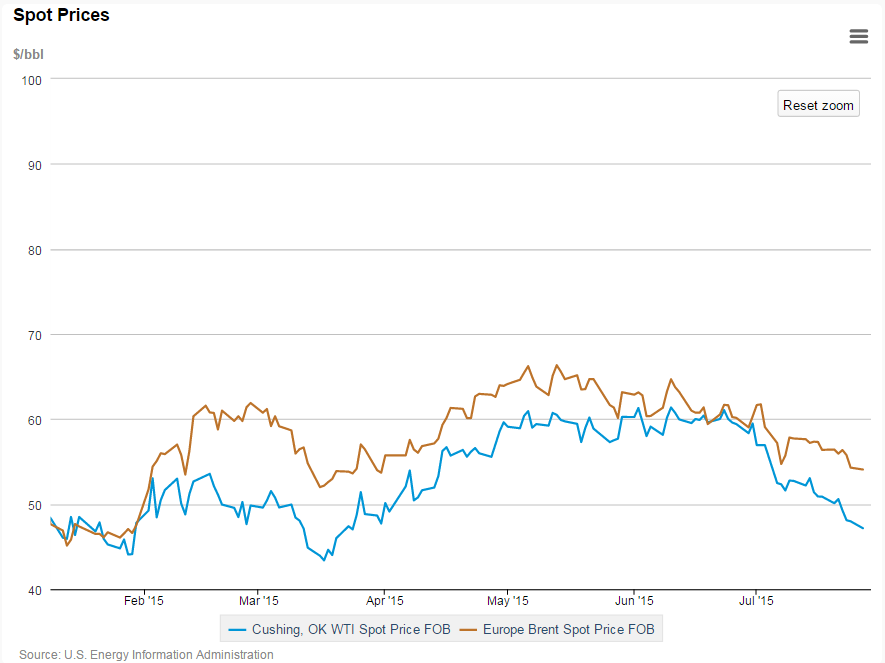

West Texas Intermediate prices gained 2.2%, or $1, Tuesday after loses Monday, rising to $46.17 per barrel on the New York Mercantile Exchange. The recovery was boosted by a weaker dollar, making oil more affordable to holders of other currencies. Brent crude prices rose 1.5%, or $0.73, to $50.25 per barrel on the ICE Futures Europe as well.

While oil prices made a recovery in early trading today, some analysts remain pessimistic about the future of oil prices. “Prices may be recovering slightly this morning, but given the 1.5 to 2.0 million barrels per day oversupply…the recovery will probably be short-lived,” a Commerzbank analyst told The Wall Street Journal.

Carlyle Group’s Rubenstein calls energy “one of the best investments in the world”

David Rubenstein, co-founder and co-CEO of The Carlyle Group, said he is still bullish on carbon-based energy investment. “The consumption of energy in something that we need to do to make the world go forward,” Rubenstein said during an interview with CNBC. “In time, (oi) prices will come back, in time demand will catch up with supply, and in time I do believe that carbon-based energy will turn out to be one of the best investments in the world.”

$10-$12 billion of dry powder for energy sector

The Carlyle Group manages $193 billion of assets, and currently has $10-$12 billion of “dry powder” to spend on the energy sector, according to CNBC.

While oil companies have taken a major hit from prolonged oil prices, Rubenstein said this will present an opportunity for investors. “I don’t want to predict any wide-scale declines in the value of all these (oil) companies, but I do think there will be opportunities to buy things at lower prices.”