OPEC’s September report calls for higher demand for OPEC oil as non-member production declines

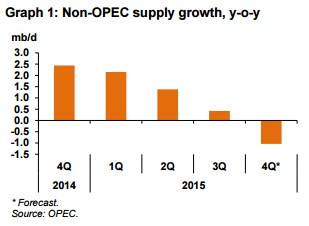

OPEC’s oil monthly report for September saw production outside the group declining as the report forecast increasing demand for its own production for the remainder of 2015 and all of 2016. Non-OPEC oil supply growth for the remainder of the year is now expected to reach 0.72 MMBOPD, down 0.16 MMBOPD from the group’s August report, mainly due to lower production from the United States. For 2016, non-OPEC supply is expected to contract 0.13 MMBOPD, a downward revision of 0.29 MMBOPD from the previous report.

As OPEC calls for lower production from non-members, particularly the U.S., it sees demand for its own production increasing slightly through the end of 2015 with total demand expected to reach 29.6 MMBOPD, 0.3 MMBOPD higher than in its previous report, and 0.6 MMBOPD about last year’s level. Demand for 2016 is expected to grow even further, with the forecast calling for demand of 30.8 MMBOPD, an upward revision of 0.5 MMBOPD from August.

As OPEC calls for lower production from non-members, particularly the U.S., it sees demand for its own production increasing slightly through the end of 2015 with total demand expected to reach 29.6 MMBOPD, 0.3 MMBOPD higher than in its previous report, and 0.6 MMBOPD about last year’s level. Demand for 2016 is expected to grow even further, with the forecast calling for demand of 30.8 MMBOPD, an upward revision of 0.5 MMBOPD from August.

The group revised its world oil demand expectations up from August, predicting total 2015 demand to increase by 1.5 MMBOPD, an upward revision of 0.04 MMBOPD due to stronger Q3’15 data. 2016 world oil demand was revised down by 0.04 MMBOPD, but OPEC still expects total demand to increase by 1.25 MMBOPD next year.

WTI slips from $50 as OPEC reports record production

Also included in the OEPC Oil Monthly Report was the group’s production, pegged at 31.57 MMBOPD by secondary sources, a 0.12 MMBOPD increase from August. The production level represents a three-year high for the group, which has a self-imposed quota set at 30.0 MMBOPD.

The news of OPEC’s increased production sent oil prices down after steady gains over the course of last week. U.S. crude bench mark WTI fell below $50 per barrel this morning on the news of the increased output from OPEC nations.

WTI rose above $50 per barrel for the first since July on October 8, but failed to settle above that mark on continued concerns of oversupply. “Traders are sizing on the monthly OPEC report today,” John Kilduff, a partner at Again Capital, said to Bloomberg. “OPEC pumping at the highest level in three years is a very bearish element.”

Baker Hughes (ticker: BHI) reported Friday that the number of active rigs in the United States continued a six-week decline last week, putting them under 800 rigs for the first time since 2002. The number of rigs drilling for oil fell to 605, while those searching for gas declined to 189 last week. Lower rig counts have some hopeful that U.S. production is also coming down, meaning less of an overhang in the market, but “the decline in U.S. production is a drop in the bucket compared with the OPEC increase,” explains Kilduff.

Brent for November settlement dropped 21 cents, or 0.4 percent, to $52.44 a barrel on the London-based ICE Futures Europe exchange. The European benchmark crude was at a $3.04 premium to WTI.

OPEC sees a balanced market in 2016

OPEC Secretary General Abdalla Salem el-Badri said the group expects production from outside the group to continue declining, thus leading to a stable market in 2016. “At OPEC, we are hopeful that the industry will see a more balanced oil market in 2016. We have recently seen a contraction in production from some non-OPEC producers and an uptick in demand growth,” he said.

The gap in oil supply and demand is due to close in the third quarter of 2016, Mohammad Ghazi al-Mutairi, CEO of state-run Kuwait National Petroleum Co., said at the Kuwait conference. Prices have bottomed and there are signs of a recovery in 2016, according to Qatar’s Energy Minister Mohammed al Sada.

No calls on OPEC to change policy

Kuwait Oil Minister Ali al-Omair said that there were no calls on the group to change its policy at the next meeting. “Today there are no ideas or demands from the member states to make any big change to OPEC’s decision (to maintain production),” Omair told Reuters. “There are signs that world economic growth could improve by the start of 2016 and this would also add to the improvements in oil prices.”

Venezuelan President Nicolas Maduro last month was on a campaign to convince other OPEC members to consider a policy that would maintain prices at a more profitable level. “The minimum, minimum price should be $70,” said Maduro during his weekly program broadcast on state television. “Oil at $70 a barrel guarantees investments needed for global energy and economic stability.”

With 95% of Venezuela’s export earnings and 25% of GDP coming from oil, and substantially smaller sovereign funds than Persian Gulf members like Saudi Arabia, the country has been much more susceptible to the decline in oil prices. Maduro hoped to call a summit between both OPEC and non-OPEC producers to agree on a policy that was focused on lifting prices, rather than lowering production.

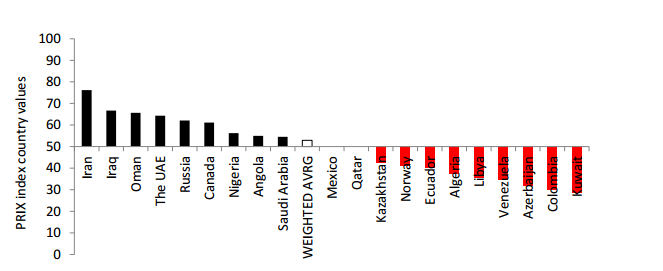

Despite his remarks that no members were looking to change OPEC policy, Omair’s country may be the first OPEC member to buckle under the pressure of lower oil prices. A survey conducted by the PRIX Index, which surveys analysts and experts in each of the top 20 oil exporting countries around the world, found that Kuwait was the most likely country of any of those surveyed to lower its production.

“The change in Kuwait’s index number is particularly interesting,” said the PRIX report. “Kuwait has consistently had a neutral index value in the past three index updates, but has now made an abrupt shift towards a very low index value of 28.57,” indicating that the country is likely to reduce its oil exports even as OPEC remains set on producing well above its self-imposed quota of 30 MMBOPD.

The next OPEC meeting to include non-members

OPEC Secretary General Badri said the next OPEC meeting due to take place in Vienna on October 21 will include seven to eight non-OEPC countries in addition to the group’s members. The additional producers to attend the meeting have not been officially identified, but it appears that Russia’s Minister of Energy Alexander Novak will be among those in attendance.

A statement from Venezuela’s Minister of Oil and Mining and President of state-run PDVSA Eulogia del Pino confirmed that Pino had spoked with his Russian counterpart about topics including “cooperation among members of the Organization of Petroleum Exporting Countries and other non-OPEC oil-producing countries,” reports NDTV.

When Russia was called on to cooperate with OPEC in November of last year, the country said that it would maintain its production as it looked to defend its market share in much the same OPEC sought to do. A statement from Novak on October 3 signaled a change for Russia, however, with the energy minister saying, “If such consultations are to happen we are ready to take part,” reports Reuters.

The combination of lower oil prices, slowing demand from China, and increasingly tense relations with the political West have left Russia’s main industry in a bind, Russian oil and gas experts Dr. James Henderson and Dr. Tatiana Mitrova told Oil & Gas 360 in an exclusive interview.

“I would even say it looks like the most catastrophic scenario we could have imagined if we had tried to draw the most pessimistic scenario five years ago,” Mitrova said from Moscow. Despite the obvious pressure the industry is feeling, she added that one of the biggest misconceptions about the Russian industry today is that it will be brought down by current market conditions.

“[Russia] is so huge and these companies are so rich that they can survive under this pressure for a decade, fifteen years, maybe twenty years. It’s a very long-term story,” she said.

Also on the agenda: Indonesia

In addition to speaking to non-OPEC members about the market, Omair said that any impact on the organization’s policy from the return of Indonesia would be examined at the meeting in October.

The country was welcomed back as the 13th member of the group on September 8th. The request to reactivate membership will be finalized during the OPEC Conference held December 4. The Asian country suspended its membership in January 2009 after becoming a net oil importer in May 2008.