Rig count for the week ended July 31, 2015

The total number of rigs actively drilling for oil or natural gas in the United States declined this week to 874, down two from last week. The number of rigs drilling for oil increased again this week, while the number looking for gas slipped for a second week in a row, based on information from Baker Hughes (ticker: BHI).

The number of rigs drilling for oil rose to 664 this week, the highest they have been since May 15, 2015. Rigs drilling for natural gas sank to 209 total rigs from 216 last week. On a state-by-state basis, Kansas saw the most drastic change in rig counts, losing 4 over the course of the week. New Mexico saw the largest gains in rig count, adding three to its total.

The rig count in Canada continued to climb this week, 15 rigs added to the country’s total. The higher number of rigs in Canada reflects higher demand due to the country’s drilling season.

Prices take a tumble, but production may have already rolled over

Oil prices fell after making small gains earlier this week on the news of more oil rigs, reaching a multi-month low. More rigs have many worried that production may continue to outpace global demand amid a crude oil supply glut.

“It’s just one more thing that adds to that bearish feel to the market,” Vice President of Research and analysis at Mobius Risk Group John Saucer told The Wall Street Journal. Production “has really overwhelmed demand, even though demand is up,” he said.

News of the added rigs overshadowed signs that U.S. production may be on the decline. The Energy Information Administration (EIA) released data this afternoon showing U.S. production hit a 44-year high of nearly 9.7 MMBOPD in March, but has declined to 9.5 MMBOPD since then.

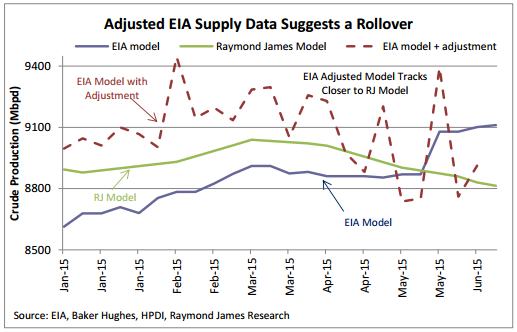

This follows estimates made by Raymond James earlier this month that predicted more accurate numbers from the EIA would show a production rollover in March. The EIA uses a plug number to balance missing production. While that number likely stems from chronic underreporting of demand, the EIA’s data in recent months suggests the administration has been overstating supply.

“Put simply,” said a note from Raymond James, this “says U.S. oil supply is already rolling over … if we add back the EIA plug number to the recently reported weekly supply data [then] U.S. oil supply probably started rolling over in March.” The note goes on to say that declines in production will likely continue for the rest of 2015.