ONEOK expects:

– Dividend to remain flat

– No cash income taxes in 2016

– No long-term debt maturities until 2022

– Free cash flow after dividends and cash on hand totaling approximately $250 million available to support ONEOK Partners

ONEOK Partners expects:

– No public equity offerings in 2016 and well into 2017

– ONEOK Partners’ fee-based margin to increase to approximately 85 percent in 2016 from approximately 75 percent in 2015

– Distribution coverage at 1.0 times or better in 2016 under current NYMEX future strip pricing, and distributions to remain flat compared with 2015

– Capital-growth expenditures of $460 million, which is adequate to support continued infrastructure needs

– GAAP debt-to-EBITDA ratio of 4.2 times or less by late 2016

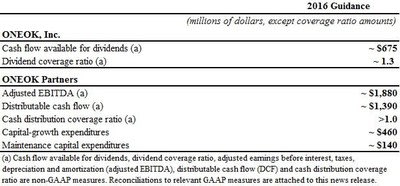

ONEOK, Inc. (OKE) and ONEOK Partners, L.P. (OKS) today announced 2016 financial and volume guidance.

ONEOK Partners’ 2016 capital-growth expenditures are expected to be approximately $460 million, and maintenance capital expenditures are expected to be approximately $140 million.

“We expect 2016 earnings to be driven by continued natural gas and natural gas liquids volume growth across our integrated pipeline system, with strong year-end performance providing us momentum into 2016. Our substantial backlog of well connects, flared gas inventory in the Williston Basin and uncompleted wells provides considerable visibility into our 2016 volumes,” said Terry K. Spencer, president and chief executive officer of ONEOK and ONEOK Partners. “Our commodity price outlook remains cautious for 2016. However, we expect the partnership’s 2016 earnings to increase compared with 2015 guidance, primarily from volume and fee-based margin increases, resulting in increased distributable cash flow.

“At ONEOK Partners, we remain committed to maintaining our investment-grade credit ratings, sustaining our current distribution and achieving distribution coverage of 1.0 times or better in 2016 at current NYMEX future strip pricing of $40 to $45 per barrel of crude. ONEOK Partners does not expect to access the public equity markets in 2016 and well into 2017,” said Spencer. “If needed, ONEOK continues to be well-positioned to provide financial support to ONEOK Partners. We have a long history of prudent financial decision-making, as demonstrated by the $750 million of equity raised at the partnership this past summer, and we will continue to make decisions that are in the best long-term interest of our investors at both ONEOK and the partnership to create value, reduce risk and protect the partnership’s investment-grade credit rating.

“The partnership has a solid balance sheet and ample liquidity, including access to our commercial paper program and $2.4 billion credit facility, to support our current capital-growth program and fund the 2016 long-term debt maturities,” Spencer said. “We continue to evaluate long-term debt financing alternatives for our 2016 debt maturities, but our strong liquidity position allows us to be opportunistic when refinancing. Additionally, ONEOK has no maturities until 2022 and an unutilized $300 million credit facility. The credit facility can be drawn to facilitate purchasing partnership equity, with the expectation to repay those borrowings with internally generated cash flow.

“ONEOK Partners is well-positioned to not only withstand the low commodity price and uncertain capital market environment but also to take advantage of opportunities,” added Spencer. “Our strong position in the Williston Basin continues to serve us well, and we continue to benefit from a large natural gas supply backlog in the basin. Our natural gas pipelines segment is well-positioned to expand its fee-based natural gas export capabilities in the future, particularly to Mexico where we have key relationships through our joint venture Roadrunner Gas Transmission pipeline. Our large and extensive natural gas liquids business maintains a growing position in the emerging Stack and SCOOP plays in Oklahoma, and we remain well-positioned in the Gulf Coast to take advantage of ethane demand growth potential over the next two years.”

“The partnership has significant ethane volume and fee-based earnings upside as natural gas processors start to recover ethane. Approximately one-third of all U.S. ethane being rejected is on our system, which presents a great opportunity for the partnership going forward,” said Spencer. “Our NGL volume growth outlook starting in 2017 reflects the potential for increased ethane recovery of up to 150,000 barrels per day, primarily in the Mid-Continent and Rockies, as demand from new world-scale petrochemical facilities comes on line.”

> View ONEOK and ONEOK Partners non-GAAP tables.

BUSINESS-SEGMENT GUIDANCE:

Natural Gas Liquids Segment

NGLs gathered are expected to average approximately 800,000 to 870,000 barrels per day (bpd) and NGLs fractionated are expected to average approximately 540,000 to 590,000 bpd in 2016.

Volume growth in 2016 is expected to be driven primarily by the recently completed Lonesome Creek plant and the completion of the partnership’s Bakken NGL pipeline expansion and Bear Creek natural gas processing plant in the third quarter 2016; five new third-party natural gas processing plant connections; and the full year volume benefit from 2015 plant connections and completed capital-growth projects.

In 2016, the segment expects to connect to five additional third-party natural gas processing plants – two in the Williston Basin, two in the Mid-Continent and one in the Permian Basin – increasing the partnership’s total third-party plant connections to more than 180.

The partnership connected seven third-party plants in 2015, including four in the Mid-Continent, two in the Williston Basin and one in the Powder River Basin.

ONEOK Partners also continues to build infrastructure connecting its NGL storage facilities at Mont Belvieu, Texas, with world-scale ethane-consuming petrochemical facilities being constructed in the Gulf Coast, which are expected to be operational beginning in 2017 and require significant ethane supply.

Natural Gas Pipelines Segment

The natural gas pipelines segment expects its earnings to remain more than 95 percent fee-based in 2016, with approximately 92 percent of its transportation capacity and 76 percent of its natural gas storage capacity expected to be contracted for the year.

The first phase of the segment’s Roadrunner Gas Transmission Pipeline is expected to be complete in the first quarter 2016. The 640 million cubic feet per day (MMcf/d) joint venture pipeline project is fully subscribed under 25-year firm fee-based (take-or-pay) commitments with expansion opportunities available depending on market demand.

Natural Gas Gathering and Processing Segment

The natural gas gathering and processing segment continues to successfully restructure commodity sensitive percent-of-proceeds contracts to largely fee-based contracts. The impact of contract restructuring is included in ONEOK Partners’ 2016 financial guidance. The natural gas gathering and processing segment, on an ongoing basis, will continue restructuring efforts in 2016 and expects its fee-based margin to increase to more than 75 percent in 2016, compared with its 2015 guidance of 45 percent.

Natural gas gathered is expected to average approximately 1,700 to 1,800 MMcf/d, or 2,200 to 2,300 billion British thermal units per day (BBtu/d), and natural gas processed is expected to average approximately 1,500 to 1,600 MMcf/d, or 1,900 to 2,000 BBtu/d, in 2016.

The partnership expects natural gas gathered volumes to increase approximately 27 percent in the Williston Basin and more than 6 percent in the Mid-Continent compared with 2015 volumes.

Volume growth in the Williston Basin is expected to be driven primarily by a large backlog of flared natural gas inventory in the basin, as well as by the continued ramp up of projects completed in 2015, including the Lonesome Creek natural gas processing plant and additional natural gas compression infrastructure. The partnership’s Bear Creek natural gas processing plant, which is expected to be complete in the third quarter 2016, also will be a significant contributor.

LINK TO NON-GAAP TABLES:

http://www.oneok.com/~/media/ONEOK/GuidanceDocs/2016/OKE_OKS_2016Guidance_JWJHV4n.ashx

NON-GAAP (GENERALLY ACCEPTED ACCOUNTING PRINCIPLES) FINANCIAL MEASURE:

ONEOK and ONEOK Partners have disclosed in this news release expected 2016 cash flow available for dividends, free cash flow, dividend coverage ratio, adjusted EBITDA, distributable cash flow and cash distribution coverage ratio, which are non-GAAP financial metrics, used to measure ONEOK’s and ONEOK Partners’ financial performance, and are defined as follows:

- Cash flow available for dividends is defined as net income less the portion attributable to non-controlling interests, adjusted for equity in earnings and distributions declared from ONEOK Partners, and ONEOK’s stand-alone depreciation and amortization, deferred income taxes, stand-alone capital expenditures and certain other items;

- Free cash flow is defined as cash flow available for dividends, computed as described above, less ONEOK’s dividends declared;

- Dividend coverage ratio is defined as cash flow available for dividends divided by the dividends declared for the period;

- Adjusted EBITDA is defined as net income adjusted for interest expense, depreciation and amortization, income taxes and allowance for equity funds used during construction and certain other items;

- Distributable cash flow is defined as adjusted EBITDA, computed as described above, less interest expense, maintenance capital expenditures and equity earnings from investments, adjusted for cash distributions received and certain other items; and

- Cash distribution coverage ratio is defined as distributable cash flow to limited partners per limited partner unit divided by the distribution declared per limited partner unit for the period.

These non-GAAP financial measures described above are useful to investors because they are used by many companies in the industry as a measurement of financial performance and are commonly employed by financial analysts and others to evaluate our financial performance and to compare our financial performance with the performance of other companies within our industry. Cash flow available for dividends, free cash flow, dividend coverage ratio, adjusted EBITDA, distributable cash flow and cash distribution coverage ratio should not be considered in isolation or as a substitute for net income or any other measure of financial performance presented in accordance with GAAP.

These non-GAAP financial measures exclude some, but not all, items that affect net income. Additionally, these calculations may not be comparable with similarly titled measures of other companies. Furthermore, these non-GAAP measures should not be viewed as indicative of the actual amount of cash that is available for dividends or distributions or that is planned to be distributed in a given period, nor do they equate to available cash as defined in the partnership agreement.

ONEOK, Inc. (pronounced ONE-OAK) (OKE) is the general partner and as of Sept. 30, 2015, owns 41.2 percent of ONEOK Partners, L.P. (OKS), one of the largest publicly traded master limited partnerships, which owns one of the nation’s premier natural gas liquids (NGL) systems, connecting NGL supply in the Mid-Continent, Permian and Rocky Mountain regions with key market centers and is a leader in the gathering, processing, storage and transportation of natural gas in the U.S. ONEOK is a FORTUNE 500 company and is included in Standard & Poor’s (S&P) 500 Stock Index.

For information about ONEOK, Inc., visit the website: www.oneok.com.

For the latest news about ONEOK, follow us on Twitter @ONEOKNews.