OPEC Production Cut of 1 MMBOPD Would Raise Oil Prices About $3; Equal Demand Growth Would Add another 4$

As OPEC’s November 30 meeting in Vienna draws closer, the outlook for a production cut agreement is mixed. Sentiment has been positive today with WTI rising 5.2% to above $45 after falling 4% in previous trading sessions.

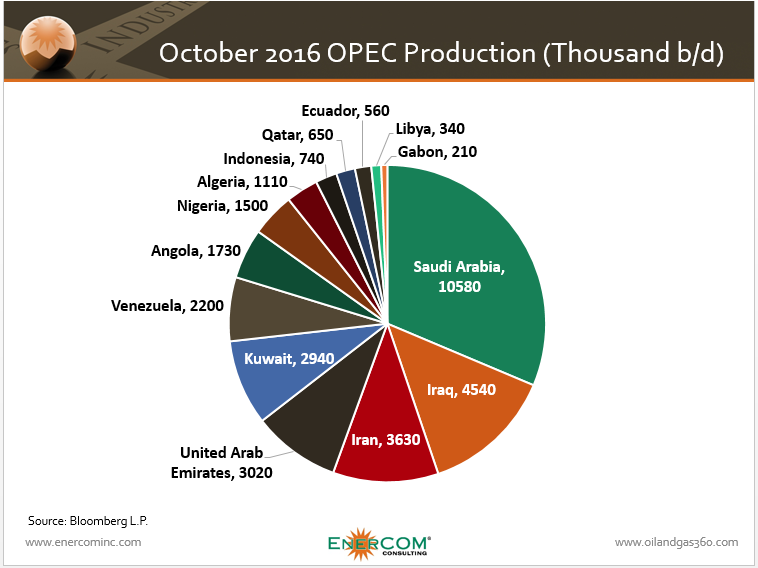

A positive report from Bloomberg yesterday triggered a wave of short covering, helped by news of an attack on the Nembe Creek Trunk Line oil pipeline in Nigeria. While Qatar, Algeria, and Venezuela are pushing a last ditch effort to finalize a deal, Saudi Arabia, Iraq, and Iran remain at loggerheads over how to share output cuts.

Reuters quoted a positive Commerzbank note saying “There is doubtless considerable pressure to take action, as the oversupply will not reduce itself.”

At the same time, BP CEO Bill Dudley told Bloomberg Television yesterday that people are generally “pessimistic about a potential agreement,” pointing to recent prices in the lower $40s. Failure to reach an agreement would cause prices to “stay around the level we’re at.”

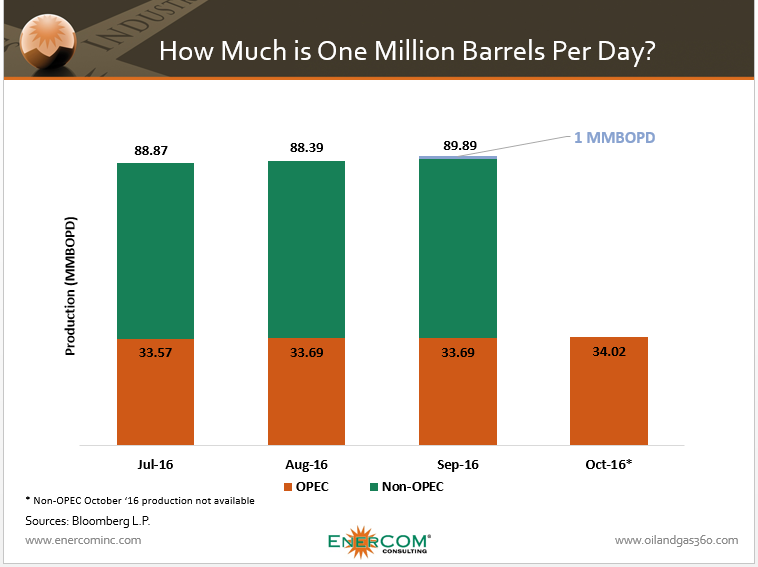

A 1 MMBOPD cut starts to look kind of small

With all this noise going on, Oil & Gas 360® looks at EnerCom’s WTI model to predict how prices would react under different scenarios.

OPEC nations produced 33.7 MMBOPD in September while non-OPEC production provided about 56.2 MMBOPD. At about 90 MMBOPD of total production, the one-million barrel cut necessary to bring current OPEC production in line with the production ceiling of 32.5 to 33 MMBOPD announced in Algiers starts to look kind of small.

The fact remains that the world is still awash in oil, and regardless of what OPEC (the Saudis) say they will do at their upcoming meeting, higher prices will require more significant cuts than one million daily barrels.

Many countries with NOCs are desperate to generate more revenue and they are not keen on lowering their production. At the same time the world’s oil producers are eager for prices to rise, at which time they will increase drilling and completion activity and grow production. In turn the higher oilfield activity will increase supply and dampen any price gains. As welcome as OPEC cuts would be, they are not likely to be of the size that will drastically alter the fundamentals.

Many countries with NOCs are desperate to generate more revenue and they are not keen on lowering their production. At the same time the world’s oil producers are eager for prices to rise, at which time they will increase drilling and completion activity and grow production. In turn the higher oilfield activity will increase supply and dampen any price gains. As welcome as OPEC cuts would be, they are not likely to be of the size that will drastically alter the fundamentals.

EnerCom’s oil model is currently predicting that a 1 MMBOPD cut in OPEC production would result in a $3 increase in oil price, all else equal. At current levels, that would push oil into the upper $40s. Of course, an agreement followed up with actual production declines would also boost market sentiment a lot.

The One-Two Punch?

Supply is only part of the picture and markets have responded much more favorably to demand increases in recent years. The ideal scenario would be a supply cut coinciding with a demand increase from developing nations such as China or India.

At current prices, a supply decrease and demand increase of 1 MMBOPD would easily push fundamentals into the mid-$50 range, all else equal.