Uncertainties: U.S. Production, OPEC Compliance

UBS has revised its global supply and demand balances and forecasts to reflect recent OPEC and non-OPEC output agreements and signs of accelerating investment in the U.S. onshore from the 3Q16 U.S. reporting season.

The bank expects modest inventory draws starting in mid-2017 accelerating into 2018 and 2019. The tipping point into under supply is expected to occur in 2Q17. Draws are expected to become more dramatic between 2018 and 2020 as the market suffers from the 2014-16 collapse in conventional upstream investment.

U.S. Crude Production Growth Accelerates through 2017

The bank’s 2017 and 2018 U.S. crude production forecasts have increased significantly, up 1% and 6% respectively year over year. These assume limited service cost inflation, continued focus on production growth over returns from equity markets, and the carry-over of productivity gains achieved during the downturn.

While some upstream cost reductions are expected to be cyclical, the bank cites “growing evidence that operators are implementing overdue structural change which could be more persistent.”

Production catalysts include faster-than-expected rig count increases, 33-35% year over year increases in rig productivity in the “Big Four” oil plays, and the offsetting of 5-10% expected oilfield service cost inflation by continued efficiencies.

The bank also noted that upside price risk due to over tightening could occur if U.S. supply is less responsive than presumed.

The Permian is expected to lead the way in terms of expected production growth and efficiency gains. While Midland-Cushing pipeline differentials are expected to widen due to pipeline constraints, operators are expected to continue producing even with sub-$50 realized prices.

Compliance Issues Factored In

The base case forecast scenario assumes limited compliance with OPEC quotas outside the Gulf Cooperation Council, the GCC (consisting of Saudi Arabia, Kuwait, the United Arab Emirates, Oman, Qatar and Bahrain), along with Russia providing the only material output reductions. Iraq was cited as a prime candidate for overproduction due to its current financial situation, output growth potential, and the resistance to cutting output it expressed during the Vienna negotiations.

UBS notes that “despite OPEC’s questionable record of quota discipline, even limited compliance would support inventory draw downs through 2Q 2017.” The bank assumes 85% compliance with cuts, which will deteriorate through the rest of the year outside of the Gulf States.

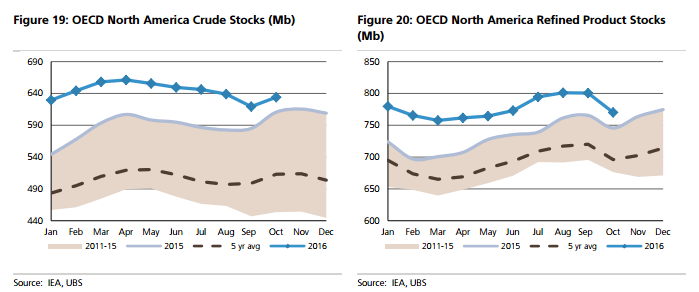

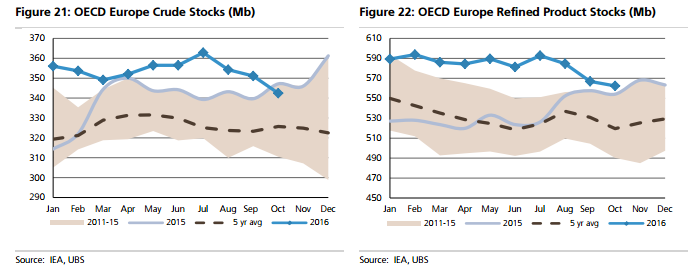

North American, European, and Asia Pacific crude oil and product inventory charts are shown below.

Traditional over producers Algeria and Venezuela are expected to be in compliance due to natural output declines resulting from the upstream investment collapse in 2014.

Downside Risks

OPEC’s weak record of quota discipline and the potential for cash-strapped producers to challenge the deal by trying to get around restrictions present further downside risk, especially when combined with the observed ramping of U.S. production.

“Factoring in a crude price recovery since September, U.S. independents have begun locking in forward prices and ramping up their capex. If the OPEC deal collapses the market is likely to continue to be oversupplied through 2017 and likely test $45.”

Weaker GDP demand growth would also contribute to downside. The bank noted that the “demand side continues to hold up well: 2015 saw the best year for growth since 2010 and 2016 looks set to come in at a +1.2 MMBOPD with surprisingly robust OECD demand and a strong India compensating for deceleration in China. Barring global economic slowdown, we envisage a similar figure in 2017, slowing to less than 1.0 MMBOPD by 2020.”