Indonesia set to rejoin the Organization of the Petroleum Exporting Countries as a net importer of petroleum

The Organization of Petroleum Exporting Countries (OPEC) is set to add another member to its ranks in its coming December meeting. The organization informed Indonesia of its intent to allow the country to rejoin after a six-year hiatus. Indonesia is unique in OPEC for being the only Asian country, as well as its only net importer of petroleum products.

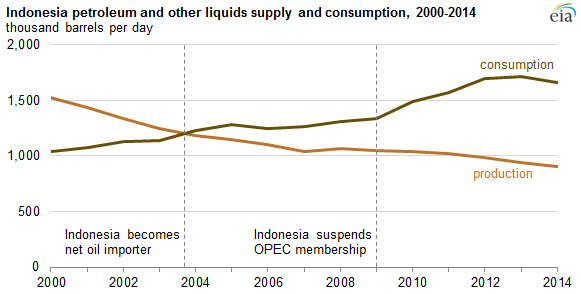

According to the Energy Information Administration (EIA), Indonesia’s petroleum consumption reached nearly 1.7 million barrels per day (MMBOPD) in 2014, while domestic refinery output supplied only 55% of domestic consumption. The remaining 765,000 barrels per day (MBOPD) was met through imports.

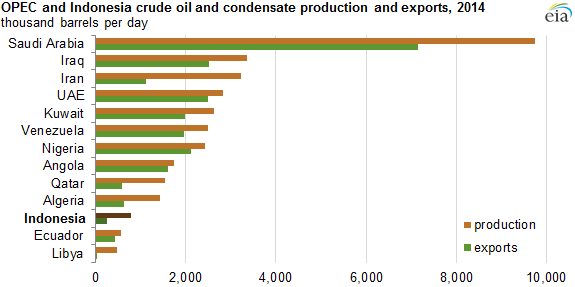

While the country does import more petroleum products than it exports, its production is still substantial. Indonesia produced 911 MBOPD of petroleum and other liquids in 2014, ranking as the 22nd-largest oil producer in the world and accounting for about 1% of total global production, according to the EIA. In 2014, oil and natural gas constituted 15% of the country’s merchandise exports, down from 23% in 2000. As of last year, PT Pertamina, the country’s state-owned integrated energy supply company, accounted for approximately 30% of domestic crude production, while international oil companies like BP (ticker: BP), Chevron (ticker: CVX), ConocoPhillips (ticker: COP), ExxonMobil (ticker: XOM) and Total (ticker: TOT) made up 40% of production.

Indonesia’s decision to suspend its OPEC membership was prompted by growing internal demand for energy, declining crude oil and condensate production in mature fields, and limited investment to increase production capacity. Indonesia had become a net importer of petroleum and other liquids by 2004 after domestic demand exceeded production, as Indonesia’s production of petroleum and other liquids has been on a general decline since the mid-1990s. Indonesia produced about 790,000 barrels per day (b/d) of crude oil and condensates in 2014, the third-lowest level among OPEC countries, reports the EIA.

According to OPEC’s statute, the organization allows as a member any country that is a substantial net crude oil exporter, has similar interests to the organization, and is accepted by three-fourths of the members. Although Indonesia is a net oil importer, the country continues to export crude oil and condensates. Because Indonesia is an archipelago, geographic distances between its domestic oil production and demand centers encourage both imports and exports. Despite its growing oil demand, Indonesia’s oil and natural gas sectors continue to be an important part of the country’s economy. Indonesia imports oil products, particularly gasoline, as a result of insufficient refining capacity to meet the growing demand for oil products.

Indonesia said that rejoining OPEC will strengthen its cooperation with oil-producing countries, provide greater access to crude oil supplies, and allow the country to be a link between energy producers and consumers. Indonesia currently buys crude oil and petroleum products through third parties or traders and wants direct access to long-term crude oil supply contracts through negotiations made between the national oil companies of OPEC members.

Indonesia anticipates more crude oil imports will be needed to meet domestic demand from refining capacity additions. Indonesia is planning a number of upgrades and expansions to existing refineries slated to become operational within the next decade. Indonesia has also proposed to build four new refineries, each having a capacity of 300,000 b/d. Because Indonesia struggles with the level of investment needed to offset oil and natural gas production declines and a lack of adequate infrastructure, it hopes to attract investment in both its upstream and downstream sectors from OPEC members. Indonesia is currently in discussions with several OPEC countries about crude oil supply deals and investments in refinery projects.