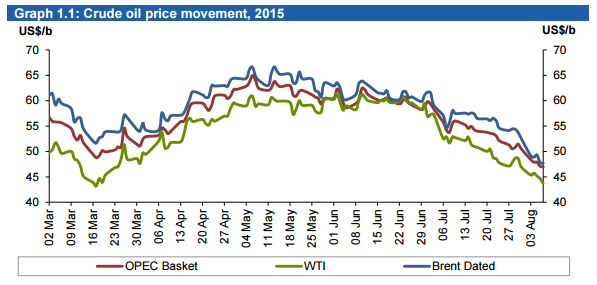

Selloff pushes OPEC crude basket lower

Even OPEC has been feeling the pressure of low oil prices brought on by the decision to maintain production in November of last year. The organization released its monthly Oil Market Report (OMR) for July today, showing that the average price for the OPEC reference basket of crude oil declined 10% from June to $54.19 per barrel.

The decline in the reference basket was caused by a selloff of oil futures contracts, according to OPEC. The selloff was triggered by concerns around the Greek financial crisis and weakness in the Chinese stock market, on top of the announcement that the global community would lift sanctions from Iran, allowing the country’s crude oil back into the market. Net-long positions in WTI declined by more than 50% in July, according to the OMR.

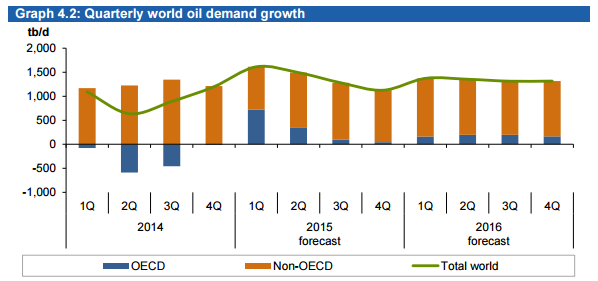

Demand expected to climb 1.38 MMBOPD in 2015

The OMR released today raised the expectations for global demand from the previous month, pegging demand growth for 2015 at 1.38 MMBOPD, about 90 MBOPD higher than OPEC projected in the OMR released last month. In 2016, OPEC expects world oil demand to grow by 1.34 MMBOPD with total world consumption hitting a record level of 94.04 MMBOPD. The bulk of the growth, 1.16 MMBOPD, is expected to come from the non-OECD.

The OECD also showed stronger than expected growth, according to OPEC. U.S. monthly demand remained positive with demand in May up 3.3% compared to the same month in 2014. June marked the first month in Mexico when oil demand requirements increased, with 2.3% more demand from the same month last year led by strong gasoline and LPG requirements. Canada showed a 6.6% decrease in year-over-year demand for May, with demand growth in 2016 expected to exceed the lower levels seen this year.

During a recent meeting between OPEC Secretary General Abdalla Salem El-Badri and Russian Energy Minister Aleksandr Novak, the OPEC head said that he does not expect oil prices to fall further.

“The balance of supply and demand must be brought into line by the market,” a joint statement from El-Badri and Novak said. “Despite continuing uncertainties, there are possible signs of achieving a more balanced situation in the oil market and to stabilize it by 2016, which is a mandatory requirement for the continuity of timely and sufficient investments.”

OPEC produced 31.51 MMBOPD in July, an increase of 101 MBOPD, it said in the OMR. The group expects demand to remain at 29.2 MMBOPD for the remainder of 2015, with an increase in demand to 30.1 MMBOPD next year. OPEC revised down its expectations for non-OPEC production growth in 2016 to 0.27 MMBOPD, 40 MBOPD lower than in the previous OMR.