OPEC production reaches highest level since Indonesia left in 2009

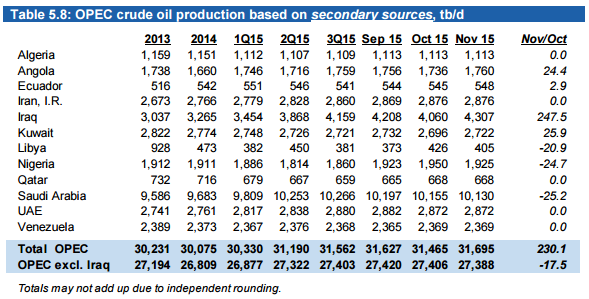

In the group’s monthly release out today, OPEC reported that the group produced 31.695 MMBOPD, the most it has produced since 2009 reports The Wall Street Journal. The higher levels of production came mostly from Iraq, which added 247.5 MBOPD in November for a total of 4.3 MMBOPD. OPEC’s November Oil Market Report did not give specific reasons for the increased production in Iraq.

Interestingly, if Iraq’s production is excluded from the rest of OPEC’s, the group’s production declined slightly in the month of November, led by production declines in Saudi Arabia. The group’s largest producer pumped 25.2 MBOPD less last month than in October, according to secondary sources cited in the OPEC report.

OPEC forecasts its strategy working, but the IEA says it will come at a cost

The report is the first to come out following the group’s decision to completely remove its production quota, much to the dismay of some of the group’s smaller members. In its 2016 predictions this month, OPEC forecasted non-OPEC supply to contract 0.38 MMBOPD, a downward revision of 0.25 MMBOPD from its last monthly report.

With non-OPEC production shrinking year-over-year, OPEC expects that demand for its crude will grow along with global demand. OPEC sees global oil demand growing by 1.53 MMBOPD this year to an average of around 92.88 MMBOPD, 30 MBOPD more than in its previous report. For 2016, OPEC forecasts global oil demand growth at 1.25 MMBOPD, unchanged from its last report.

The International Energy Agency (IEA) addressed OPEC’s strategy in its annual World Energy Outlook, agreeing that it would create more room for OPEC oil, but the strategy held the seeds of its own demise as well. OPEC’s continued higher production would keep prices depressed, an outcome the IEA called its Low Oil Price Scenario.

The International Energy Agency (IEA) addressed OPEC’s strategy in its annual World Energy Outlook, agreeing that it would create more room for OPEC oil, but the strategy held the seeds of its own demise as well. OPEC’s continued higher production would keep prices depressed, an outcome the IEA called its Low Oil Price Scenario.

“All of the OPEC countries lose more from lower prices than they gain from higher volumes over the longer term,” the IEA wrote in its report. “This is one of the main reasons why a Low Oil Price Scenario looks less likely the further it is extended into the future: it relies on the active consent of the countries that are worst affected by the outcome. The assumed OPEC strategy of pursuing market share is effective, but ultimately also costly to the producers themselves.”

OPEC left its demand forecast for its crude unchanged in this month’s report, calling for 30.8 MMBOPD of demand, a 1.5 MMBOPD growth from this year. The organization did increase its demand forecast for the remainder of 2015, however, saying that it expects demand to stand at 29.4 MMBOPD in 2015, a 0.4 MMBOPD increase from its October report.