Source: The Wall Street Journal

“The journey from the minor leagues to the World Series parallels the struggle to climb the ladder of American business. Many try, but only a few succeed.” – Roger Kahn, The Boys of Summer

Call it a throwback to the 1980’s, if you will.

Regardless of the outcome, the 2015 World Series will end a championship drought that has spanned roughly three decades. The American League Champion Kansas City Royals’ last World Series victory occurred in 1985. The New York Mets, the champions of the National League, won the following year in 1986. Four presidential administrations and nearly 100 Federal Reserve rate changes later, the title-starved fan bases of both respective ball clubs are just four wins away from being named World Series Champions.

For the Royals, the heartbreak of last year’s defeat fueled the young squad to their first back-to-back Series appearance in franchise history. Their 184 regular season victories in the last two years are the third-best in baseball. The Mets, on the other hand, have swooped into their first World Series appearance since 2000 on the wings of their first winning season in seven years. Interestingly, both clubs were considered relative longshots to win the title – the gambling pundits on Opening Day placed the odds at about 30 to one (amazingly, in the bottom half of the league).

A breakdown between the two respective cities/states below (note: Kauffman Stadium, the home of the Royals, is located in Missouri):

Kansas City, MO |

New York, NY |

|

| Oil Production Ranking among US* | 29 | 27 |

| Natural Gas Production Ranking among US* | 32 | 22 |

| Total Energy Production Ranking among US* | 41 | 22 |

| Energy Consumption per Capita among US^ | 26 | 50 |

| Primary Energy Source^ | Coal | Natural Gas |

| Jobs – Natural Resources & Mining | 4,000 | 5,000 |

| Hydraulic Fracturing | Allowed | Banned |

| Roster Players Alive During Last Franchise WS Win | 13 out of 25 | 10 out of 25 |

| Regular Season Batting Average (Ranking) | .269 (3rd) | .244 (28th) |

| Regular Season On Base Percentage (Ranking) | .322 (11th) | .312 (21st) |

| Regular Season Runs Scored/Game (Ranking) | 4.5 (7th) | 4.2 (17th) |

| Regular Season Earned Run Average (Ranking) | 3.73 (10th) | 3.43 (4th) |

| Regular Season Quality Pitching Starts (Ranking) | 71 (24th) | 101 (2nd) |

| Regular Season Strikeouts/Walks Ratio | 2.37 (23rd) | 3.49 (4th) |

| *2014 ^2013 |

Plenty has happened since these two teams raised championship banners in the mid-80s. Some factoids are listed below:

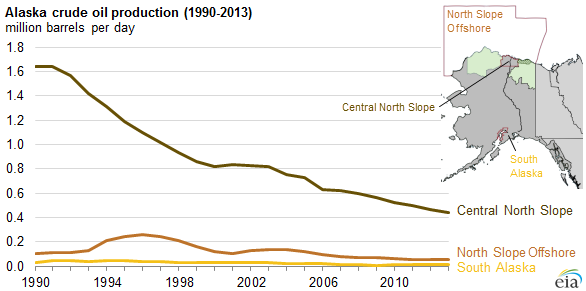

- Alaska’s 2014 oil production of 497 MBOPD was 75% below its peak of 2,017 MBOPD in 1988, and has declined sequentially for 24 of the last 26 years. The Energy Information Administration attributes the decline to variable ice

conditions and pipeline economics, but the potential is certainly there: Alaska’s North Slope holds more technically recoverable reserves than some of the most prominent fields, including the Bakken and Eagle Ford Shales. Armstrong Oil & Gas, a private E&P based in Denver, recently forked over $800 million to up its stake in America’s northernmost state.

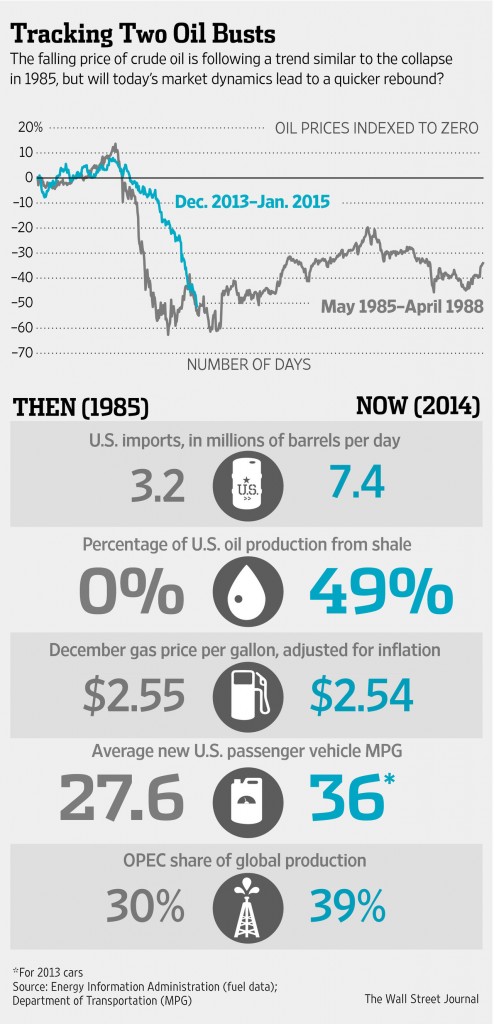

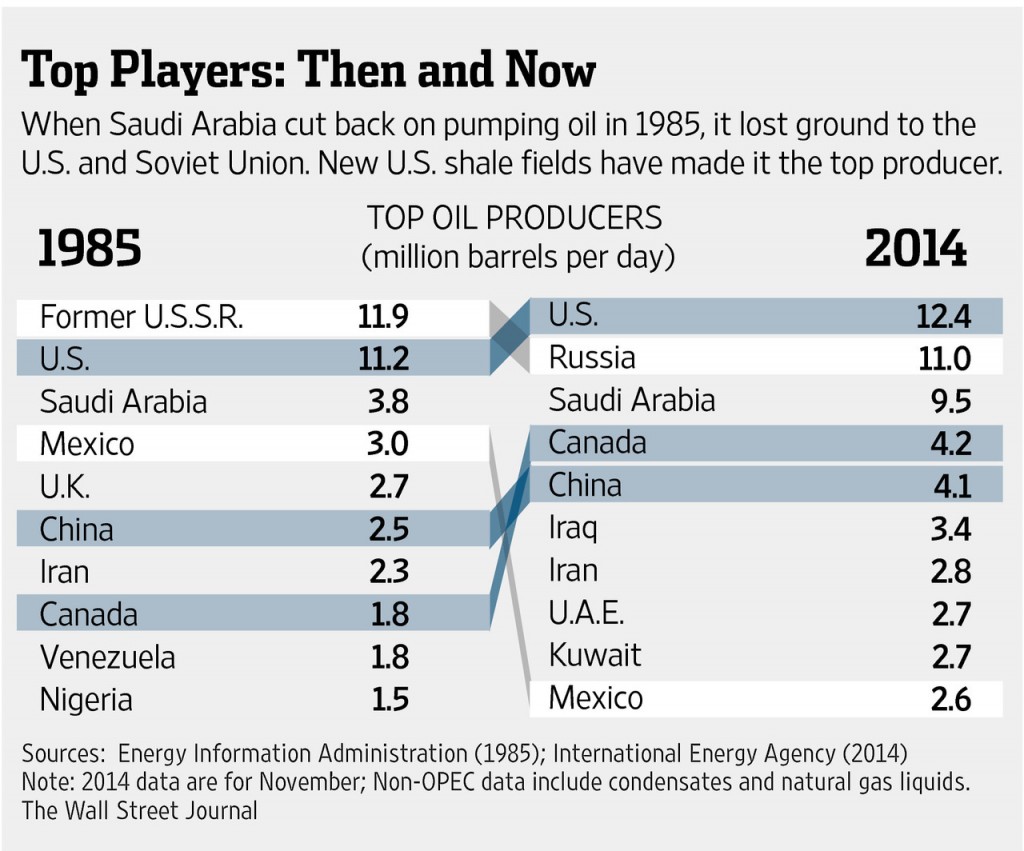

conditions and pipeline economics, but the potential is certainly there: Alaska’s North Slope holds more technically recoverable reserves than some of the most prominent fields, including the Bakken and Eagle Ford Shales. Armstrong Oil & Gas, a private E&P based in Denver, recently forked over $800 million to up its stake in America’s northernmost state. - Although Alaska crude production declined, the United States shale revolution catapulted the country to the role as the world’s top crude oil producer. Despite the increase in domestic volume, the amount 9,241 MBOPD of imported crude in 2014 is 45% below 1985’s mark of 5,067 MBOPD – the second lowest on record. Only 1,830 MBOPD was imported from OPEC that year, an all-time low. Canada, in the meantime, has more than quadrupled its exports to the U.S. (3,388 MBOPD from 770 MBOPD).

-

Source: The Wall Street Journal

In 1985, Standard Oil Co. of California merged with Gulf Oil Corporation, the nation’s fifth largest petroleum company, for $13.3 billion. The combined company was known as Chevron (ticker: CVX). Today, Chevron is still headquartered in California and reported 2014 revenues of more than $212 billion. Adjusted for inflation, the merger would amount to about $29.4 billion today. There have been two deals larger than that in the past year: Royal Dutch Shell (ticker: RDS.B) is closing on the acquisition of BG Group (ticker: BG) for $70 billion, and Halliburton (ticker: HAL) continues to work out antitrust issues to complete the $34.6 billion purchase of Baker Hughes (ticker: BHI).

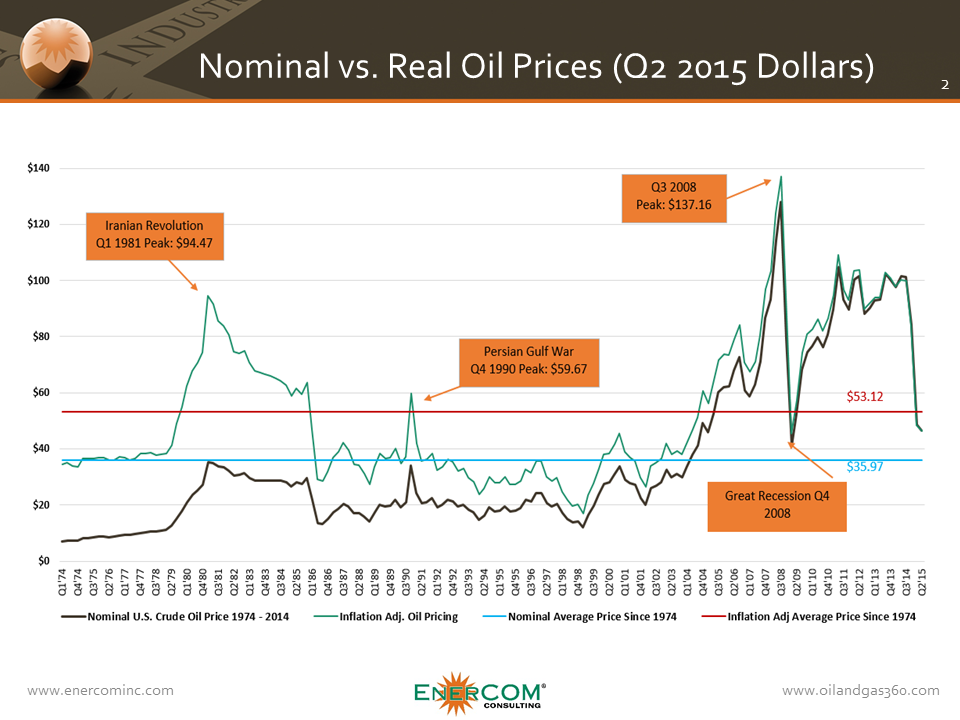

- In 1986, the nominal price of crude dropped below $15/barrel when Saudi Arabia opened the taps to an average of 5,246 MBOPD from 3,778 MBOPD in 1985. The chief member of OPEC is producing at all-time highs in the current environment, defying pleas from other cartel members to cut production. Global supply in 2014 was 93,097 MBOPD – 51% above 1986’s volume of 61,533 MBOPD.

Who Gets the Edge?

Oil prices had begun to creep south when the World Series was underway last season, but sustained West Texas Intermediate prices of below $50/barrel have placed some of the oil and gas industry’s players in a tight game. Analysts at EnerCom, Inc. expect the following challenges to be addressed in Q3’15 as part of our Bam! It’s Earnings Season quarterly update for E&Ps:

- 2016 commodity price outlook

- Potential for U.S. oil exports is building steam

- Hedge position and cost control

- Balance sheet strength and near-term debt maturities

-

Source: Morgan Stanley

Borrowing base redeterminations and bank price decks

- Midstream contracts and take-away capacity

- 2015 CapEx and activity levels – exploration vs. development

- Oilfield service costs and outlook

- Crude oil and natural gas differentials (Wattenberg, Bakken, etc.)

- Crude delivery and refining systems (rail systems, etc.)

- Potential for increasing M&A activity in E&P

- Year-end reserves vs. current reserves at $53/bbl oil

- Storage and refining capacities

- Wells drilled awaiting delayed completions

For the 2015 World Series, we believe the following matchups are critical (partial credit to Grantland and Sports Illustrated):

Mashers vs. Flamethrowers: The Royals and their deadly lineup outslugged the prolific offense of the Toronto Blue Jays the reclaim their American League crown, but the Mets’ elite rotation is averaging more than ten strikeouts per game with an earned run average of just 2.81. Of all Mets pitchers, an astonishing 65.6% of non-offspeed pitches have topped 95 miles per hour this postseason. Noah Syndergaard, a 23-year old rookie, consistently flirts with the 100 mph marker. The Royals, however, are statistically the best fastball-hitting team in the majors. Something has to give.

On the oil and gas side, increased efficiencies and drilling speed are setting new records as companies are stretching their dollar further than ever before. Baker Hughes set a company record in Q3’14 by drilling a 7,313 lateral in 24 hours, equating to more than five feet per minute. Sanchez Energy (ticker: SN) rapidly increased its knowledge of the Eagle Ford Shale and anticipates meeting drilling requirements on its Catarina asset six months ahead of schedule, despite plans to dial back its rig count.

The Bullpen Calvary: Both teams can close out games. Jeurys Familia (NYM) has emerged as a bona fide shutdown closer, allowing only two hits in eight appearances this postseason. The Royals leaned on their rock-solid bullpen to propel them to within a game of a World Series championship last year, and the reliability has not wavered. Kansas City is 157-4 when it leads after seven innings in the last two seasons, and its three-headed bullpen monster of Kelvin Herrera, Luke Hochevar and Wade Davis have allowed only one run in 21 postseason innings.

The sense of stability is apparent for companies with strong hedging programs and the ability to produce at low costs. Energen (ticker: EGN) secured 82% of 2015 oil volumes at an average price of $80.76/barrel, while Antero Resources (ticker: AR) has locked in virtually all targeted 2016 gas production at an average all-in price of $3.94/Mcf. Range Resources (ticker: RRC), another low-cost Appalachia operator, is counting on its favorable acreage position, takeaway capacity and overall economics to project double digit growth through the end of the decade,

How Much Gas is Left in the Tank? The Mets talented arms stable of Syndergaard, Matt Harvey and Jacob deGrom has already thrown more innings this year than ever before, and Sports Illustrated detailed a handful of cases in which elite pitchers suddenly hit a wall late in the season. New York’s pitching barrage has yielded only 26 runs in nine games, while its offense has scored four runs or less in six of those contests. The Mets offense will have a difficult time making up ground if the pitching staff has an off night.

In the energy industry, borrowing base redeterminations are filtering in alongside quarterly reports, revealing details on company cash flows and capex availability. Major oilservice providers believe clients have exhausted their 2015 budgets and are waiting to reload their balance sheets for 2016. However, some E&Ps must balance significant borrowing base reductions with the need to offset the high decline curves from shale production. “[E&Ps] really are in drill or die mode,” said Dave Lesar, Chief Executive Officer of Halliburton, in a Q3’15 conference call. “If you go a year without drilling a well and your production starts to turn over, you’re going to have to start drilling or you’re going to have to take your infrastructure apart that you’ve built up as a company.”

Daniel Murphy

Photo Credit: Sports Illustrated

Revenue Distribution: New York’s Daniel Murphy put on a performance for the ages in the National League circuit, homering in six straight games and driving in 11 runs. He single-handedly accounts for roughly 25% of the team’s hits and RBIs. Excluding Murphy’s brilliance from the lineup, the rest of the Mets are hitting a measly .207. Kansas City, however, has four regulars hitting .275 or above in the playoffs and hold an overall team average of .271. The Royals are especially dangerous when runners are in scoring position, boasting a batting average of .350.

The balance of power across the lineup is being realized by integrated oil and gas companies in the midst of the new commodity environment. Margins in the downstream sector are being propped up by low oil prices, somewhat offsetting the declining revenues on the upstream side. ExxonMobil’s (ticker: XOM) downstream segment doubled its earnings on a year-over-year basis in Q2’15, while Chevron’s department more than quadrupled earnings. The see-saw effect supporting the larger companies will provide some relief in what is expected to be a very difficult redetermination season. Billions have already been written off, and earnings season has just begun.

PREDICTION: Normally, defense wins championships. However, the Mets’ reliance on a young (albeit, very talented) pitching staff gives the group little room for error. Kansas City just exudes the aura of a team due for a championship, and their multiple abilities to win games makes them dangerous every night. ROYALS IN SIX.