This week PDC Energy (ticker: PDCE) announced the sale of its Marcellus shale assets for approximately $250 million to its Marcellus partner Mountaineer Keystone Energy, LLC.

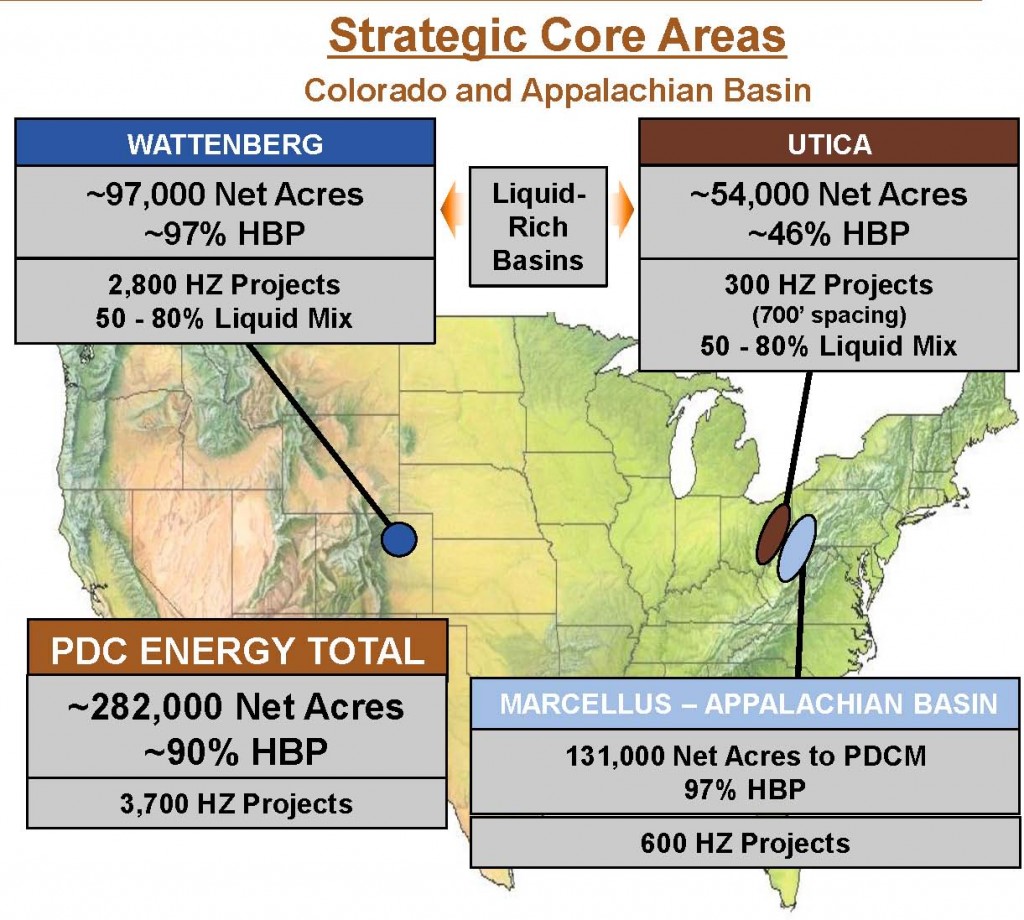

With the divesture of its approximate 131,000 net Marcellus acres, PDC’s focus now moves sharply onto two liquid rich plays—97,000 net acres in the Wattenberg Field in Colorado and 67,000 net acres in the Utica shale in Ohio.

PDC’s growth opportunities are very clear—its Colorado project inventory includes 2,800 horizontal drill sites in the Wattenberg targeting the Niobrara and Codell shale plays and 350 horizontal sites in Ohio targeting the wet gas and condensate windows of the Utica shale. The company says all of its current projects are 50% to 80% liquids. The company has five active rigs working in Colorado and two in Ohio.

Going After Liquids

PDC’s liquids mix climbs to 63% from 54% after its Marcellus exit and the recent addition of 13,000 additional Utica acres offsetting its existing acreage in Morgan County and Washington County, Ohio.

PDC says it will fund the $35 million for the additional Ohio acreage from its 2014 capital budget of approximately $647 million. The company’s 2014 CapEx budget put $467 million in the Wattenberg and $162 million in the Utica.

Value of PDC’s Divested Assets

The Marcellus assets that PDC is selling to Mountaineer Keystone Energy are approximately 99% dry gas and include an estimated 40 MMBOE (240 Bcfe) of proved reserves net to PDC, as of Dec. 31, 2013. The company reported 266 MMBOE (1,596 Bcfe) of total proved reserves as of Dec. 31, 2013. The Marcellus assets produced approximately 24 MMcfe/day net to PDC in the first quarter of 2014.

PDC converted its dry gas asset into $250 million, or approximately $1.04 per Mcfe of proved reserves. On a production basis the transaction was valued at $10,416 per Mcfe/day. The company will realize approximately $1,900 per acre after the transaction closes. After JV debt repayment and other working capital adjustments, the net pre-tax proceeds to PDC will be approximately $190 million, comprised of $150 million cash and a $40 million note.

After the sale, the company estimates total proved reserves will be 226 MMBOE (1,356 Bcfe) in its two core areas of the Utica and Wattenberg.

On a trailing twelve month basis, PDC was trading at an enterprise value per production of $17,649 per Mcfe/day.

Source: PDC July 2014 Presentation

Analysts Weigh In

PDC “plans to significantly outspend cash flow over the next two years, so the decision to sell this asset is logical, in our view. The divestiture narrow’s this year’s funding gap to $127mn from $317mn, by our estimates,” Stifel Nicolaus’s Denver office said in a note.

PDC “spent $35MM, or $2,700 per net acre — very reasonable given where per-acre values have been trending in the basin, although higher-priced transactions have typically been focused further north,” Wells Fargo Securities said in a note.

“We see the divestiture as a net positive as the lower leverage outlook offsets the loss of inventory and simplifies the story. The Utica leasehold was relatively inexpensive, though there is the argument this appropriately reflects drilling challenges experienced to date. …. The transaction looks inexpensive on reserves ($1.04/Mcfe pre-tax) and expensive on production ($10.42/Mmcfepd pre-tax),” Suntrust said in its note.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.