On December 8, 2014, PDC Energy (ticker: PDCE) announced its 2015 capital budget after a profitable Q3’14.

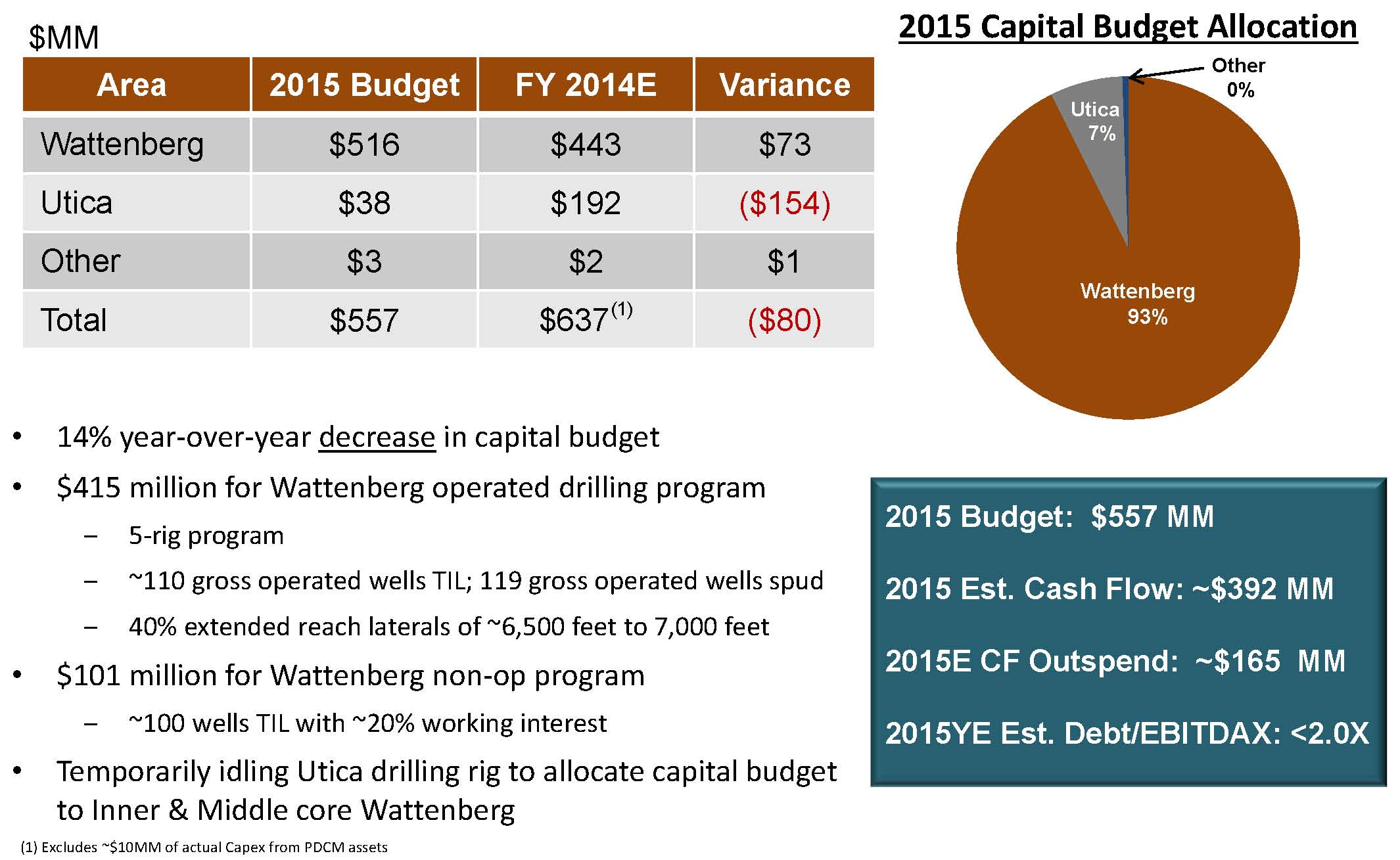

For 2015, PDC’s capital budget is approximately $557 million, a decrease of 14% compared to its 2014 expenditures. The company’s budget includes $526 million of development capital and $31 million for lease maintenance, exploration and other expenditures.

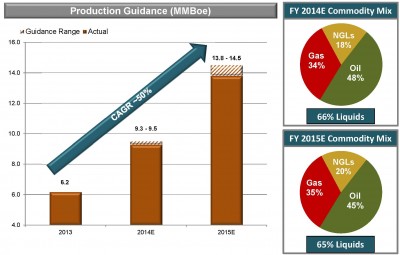

The company estimates net production volumes for 2015 will be 13.8 to 14.5 MMBOE. At its midpoint, 2015 guidance represents an increase of 50% compared to 2014’s forecasted range of 9.3 to 9.5 MMBOE. PDC anticipates a commodity mix of approximately 45% crude oil, 20% natural gas liquids and 35% natural gas.

In 2015, PDC expects to realize additional capital efficiencies through drilling extended laterals and tighter frac spacing. The company plans to enhance its completion design, decreasing the spacing between frac stages to 200 feet from 250 feet. With the modified completion design of more frac stages, the company’s gross drilling and completion costs per well for a standard and extended length laterals is $4.3 and $5.5 million, respectively. PDC expects improved reserves as a result of tighter frac spacing and extended laterals.

PDC’s 2015 hedging program has approximately 80% of expected crude production at a weighted average floor of approximately NYMEX $89/barrel and approximately 75% of expected natural gas production at a weighted average floor of approximately NYMEX $4/Mcf. Factoring in its existing 2015 hedges, the company projects it will end 2015 with a capital outspend of approximately $165 million and a debt to EBITDAX ratio of less than 2.0x.

The company says it is focused on maintaining the strength of its balance sheet, liquidity and debt metrics. As of September 30, 2014, PDC had liquidity of approximately $789 million, pro-forma for the $250 million sale of its Marcellus assets, which closed on October 14, 2014.

Entering 2015 with strong metrics

The company’s net income for Q3’14 was $54.0 million, or $1.47 per diluted share, compared to a net loss of $16.0 million, or $0.48 per diluted share, for Q3’13.

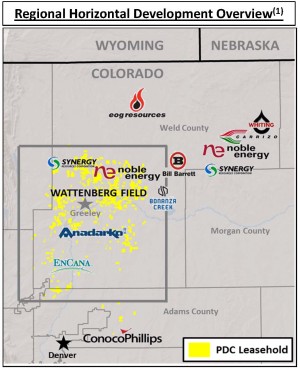

On a year over year basis, the company’s third quarter production from continuing operations increased 60% to 25,600 BOEPD compared to 16,000 BOEPD in the third quarter of 2013. Crude and NGL production increased 80% to 16,670 BOEPD from continuing operations. Crude oil, natural gas and NGLs sales revenues increased 56% to $120.5 million in the third quarter of 2014, compared to $77.4 million in the third quarter of 2013. The increase in production over third quarter 2013 was primarily due to successful horizontal drilling in the Wattenberg Field. PDC now operates exclusively in the Wattenberg and Utica following the divesture of its Marcellus position.

Production costs were $22.8 million, or $9.67 per BOE, for the third quarter of 2014, compared to $17.0 million, or $11.57 per BOE, for the third quarter of 2013, representing a 16% decrease on a per BOE basis.

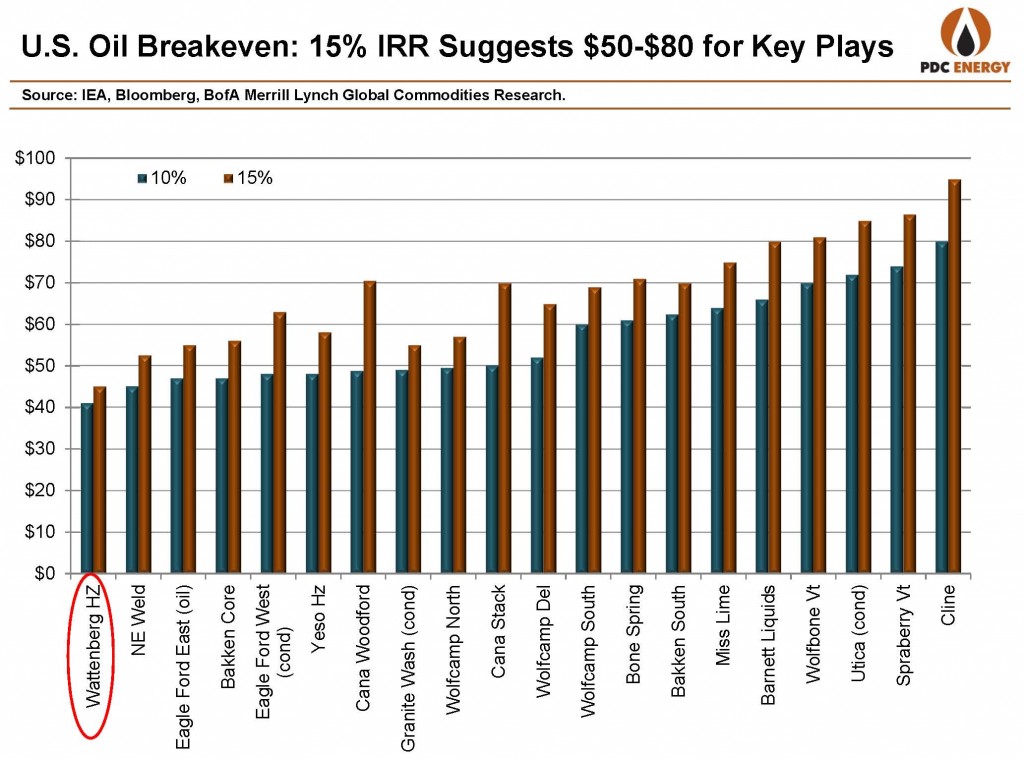

According to EnerCom’s E&P Weekly Database, PDC Energy measures up favorably to its 86 peers. Its asset intensity, described as the amount of capital required to maintain its current assets, is 36%. Therefore, the remaining 64% of cash flow can be invested in growth, paying off debt or returning to investors. The median asset intensity of its peers is 55%. PDC’s debt to market cap ratio is 62% – below the database median of 86%. Its three year finding and development costs rank 11th overall, but are the cheapest of any liquids-focused producers.

PDC in the Wattenberg

In its 2015 guidance, PDC said that it would increase its focus on allocating capital towards its highest-value drilling opportunities in the Inner and Middle core areas of the Wattenberg Field.

For 2015, the company projects it will drill approximately 90% of its wells in the Inner and Middle Core areas, up from about 67% in those areas in 2014. In a company presentation, PDC said that it would be temporarily idling drilling operations in the Utica in order to allocate capital budget towards its higher yield plays in the Wattenberg.

PDC plans to invest a total of $516 million (93% of its 2015 budget) in the Wattenberg. $415 million will be used for its operated drilling program and $101 million will be allocated to non-operated projects. The Wattenberg also received the bulk of 2014 operations, with the company dedicating $469 million (72% of its budget) to ramping up development in the play.

The company’s 2015 operated program anticipates utilizing its current five horizontal drilling rigs throughout the year. There are no plans to add any additional rigs. The Wattenberg budget for 2015 includes turning-in-line approximately 110 gross operated Niobrara and Codell wells of which 40% are expected to be extended length laterals of approximately 6,500 feet to 7,000 feet. Approximately 60% of those wells are expected to be targeting the Niobrara with the remainder targeting the Codell. The company’s non-operated program is projected to include approximately 100 horizontal wells turned-in-line at an average working interest of about 20%.

In 2014, PDC’s drilling program delivered cost efficiencies which have improved drilling economics in the core Wattenberg Field. The average drilling and completion costs for the company’s standard length lateral of approximately 4,200 feet have decreased to $4.0 million from $4.2 million per well. Additionally, PDC estimates that expected average reserves for its Inner Core wells have increased by 500 MBOE to 580 MBOE per well.

In the company’s Q3’14 report, Bart Brookman, President and COO of PDC, said: “We are particularly pleased with Wattenberg production which was up 60% this quarter over the third quarter of 2013. We expect to end the year with nearly all of our leasehold in the Wattenberg Field held by production and the vast majority under our operational control.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.