PDC Energy (ticker: PDCE), a Denver-based exploration and production company with operations in the Wattenberg Field and Utica Shale, reaffirmed its borrowing base at $700 million, according to a company news release on October 2, 2015. Its commitment level is unchanged at $450 million, of which $385 million was available at the time of its Q2’15 results.

PDCE also reached an agreement to extend the maturity of its credit facility to May 2020 – two years longer than the original agreement. In the release, Gysle Shellum, Chief Financial Officer of PDC Energy said the “liquidity and flexibility provides us the ability to continue operating with a clear focus on maintaining favorable debt metrics and executing on our strategic vision.”

Borrowing Base Intact

The majority of the oil and gas industry is on the edge of their seats as banks make their redeterminations on borrowing bases. A handful of companies other than PDC have seen no change to their availability, including Bill Barrett Corp. (ticker: BBG), Chesapeake Energy (ticker: CHK), Rex Energy (ticker: REXX) and VAALCO Energy (ticker: EGY).

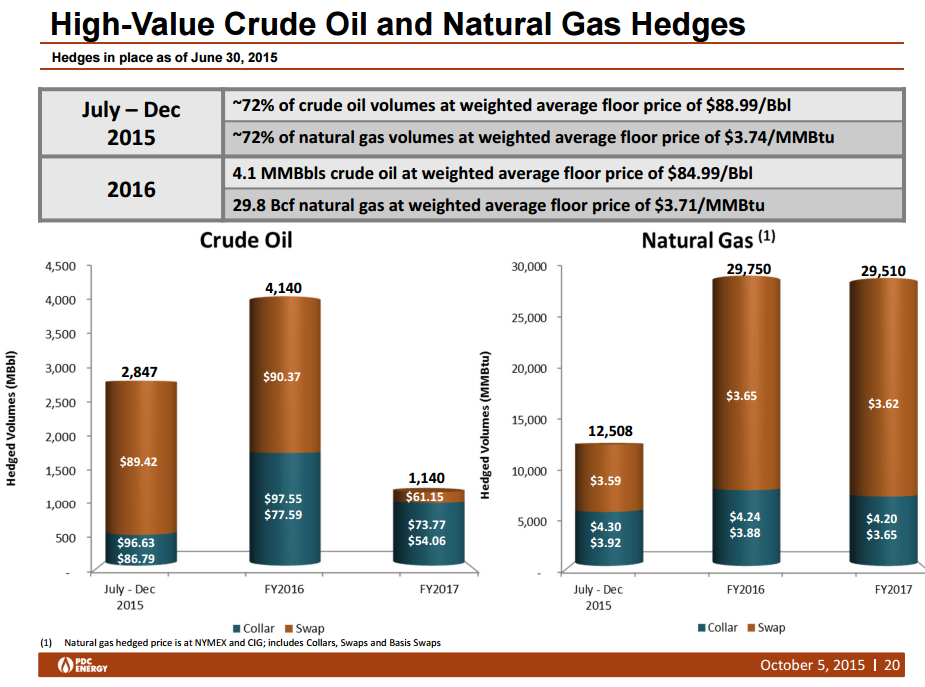

By reaffirming its borrowing base and stretching its debt maturity into the next decade, PDC’s track to 2017 is paved with rising production volumes backed by substantial hedges, along with no looming capital problems. Its debt to market cap in EnerCom’s E&P Weekly Benchmarking Report is just 31% – substantially lower than the median of 103% from 87 of its peers.

Wattenberg Providing Returns

Citing commodity prices, PDC is deferring its Utica Shale program until 2016 even though wells from two separate pads are tracking above a 680 MBOE type curve.

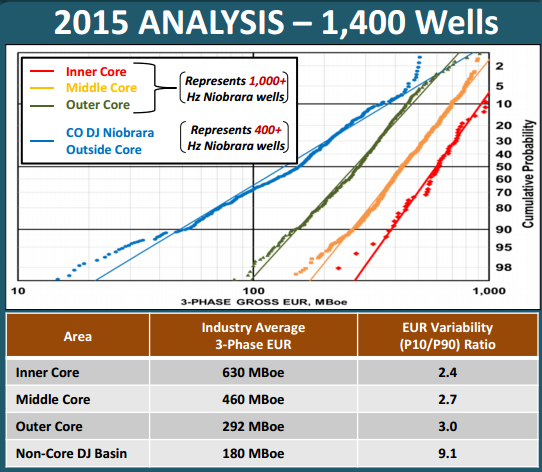

A possible factor in the deferral is the high-end returns being realized in the Wattenberg Field – particularly in the middle and inner sections, where management says rates of return are reaching anywhere from 30% to 60% in the current commodity environment. The respective prices for standard length and extended reach wells are $3.1 and $4.1 million apiece, while the estimated ultimate recovery of wells in PDC’s inner and middle acreage now exceeds 600 MBOE.

The company has plenty of space to operate in the Wattenberg: its 96,000 net acres are the third-most of any E&P in the region, and the properties are 100% held by production. Its proved reserves stand at 250 MMBOE, and the company believes 91% of said reserves are economical at $50/barrel prices.

Maintaining Growth… With Fewer Rigs

PDC’s 2015 production guidance range of 40,275 to 41,100 BOEPD represents a 60% increase compared to 2014, and the company anticipates 2016 volumes increasing by an additional 35% to places volumes at a midpoint of nearly 55,000 BOEPD.

Despite the quick rise in volumes, PDC will move to a four rig program, down from its previous count of seven. The fewer rigs aren’t necessarily a result of the new commodity environment – they’re the result of increased spud times and efficiencies. The company’s spud-to-spud time is 30% lower on a year-over-year basis and is a driving factor in estimating the 2015 spud count to reach 155, which is 36 more than originally anticipated.

Overall, PDC believes more than 1,400 drilling locations remain in the Wattenberg and the company is still in early stages of development. EnerCom’s Benchmarking Report estimates 70% of PDC’s properties are proved undeveloped, ranking in a two-way tie with Antero Resources (ticker: AR) for first place among 42 mid to large cap peers.

Three Year Program in Place

“The growth profile and clean balance sheet are two contributing factors to PDCE’s YTD performance, which is second best among our 54-company E&P coverage universe,” said a note from Capital One Securities on October 2, 2015. The performance is similar in EnerCom’s model, ranking third among its 87 peers. Despite being one of the few companies in the market with a favorable stock performance, 26 of 29 analysts covering the company have recommended a “Buy” rating. The remaining three have PDCE on “Hold.”

The rising volumes and decreased capital has PDC targeting cash flow neutrality in the second half of 2015, with the breakeven rate expected to continue into fiscal 2016. The company has $637 million in available liquidity, assuming its reaffirmed $700 million borrowing base, and management projects a year-end debt-to-EBITDA multiple of approximately 1.5x. Its drilling inventory may further increase, depending on 22 and 26-well tests in certain sections – up from its current inventory of 20 wells/section. The Capital One Securities note mentions results from the upsized well tests could me available by mid-2016, and reaching the halfpoint of the tests would increase its identified drilling locations by 20%.

PDC’s balance sheet flexibility and absence of drilling requirements will allow management to ramp up operations as necessary as the majority of its oil hedges roll off in 2017.