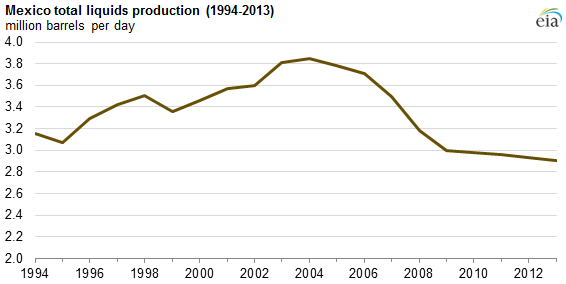

Petróleos Mexicanos, or Pemex, is Mexico’s sole producer of crude oil, natural gas and refined products. The company provides Mexico with one-third of government income and was the ninth largest oil producer in the world in 2012. The oil and gas industry in Mexico has been nationalized since 1938, but production has declined every year since 2004 (24% overall). In an effort to revitalize the deteriorating environment, the government elected to privatize its industry in December 2013 and plans on conducting its first bidding round for outside investors in 2015.

Legal Developments

Mexico may have opened its doors for private development, but the transformation is more complicated than it seems. Under the revised terms, Pemex can keep certain fields for its own development but operations must be approved by the state energy ministry. Popular opinion is Pemex will open up its deepwater opportunities for investment, which is an approach followed by Petrobras (ticker: PBR) for its offshore Libra Field properties. Pemex submitted an undisclosed list to the ministry in March 2014, containing fields it would like to retain. The ministry will decide if its state-owned company is capable, both financially and operationally, to carry out the tasks within three years. A decision on the proposal, titled Round Zero, is expected by September 2014.

Source: EIA Mexico Analysis

Mexico’s deepwater properties are believed to hold 26.6 billion BOE of reserves, and officials close to the situation say the company aims to keep as much as 29.1% (8.1 billion BOE) of the reserves. While outside investment will place a new aspect on the operations of Pemex, the company does not intend to sell down its size for the sake of immediate cash returns. Lourdes Melgar, Mexico’s deputy minister for hydrocarbons and a member of Pemex’s Board of Directors, said the country is trying to find the line for maintaining current operations without overselling its position. In an interview with Reuters, Melgar said, “A vision that aims to shrink Pemex would be very negative and is not an option.”

Pemex currently has no producing wells in the Gulf of Mexico.

Proposed Reforms

A comprehensive review of Mexico’s energy shift is detailed in a report from Control Risks Group titled “Mexico’s Second Revolution.” The report says a total of seven arms will be created to monitor the oil and gas industry, and two will be entirely new. Pemex will also decide on its potential partners and holds a right of refusal if a company asks to develop a certain field – a process underlined in Round Zero. The company will also create four contract models detailing the splits of production and revenue.

Pemex’s May 2014 presentation lays out ongoing developments in the company’s proposed future. Although the financial structure and policies may change, Pemex intends to remain the country’s leading hydrocarbons producer. Its new policies aim for it to become a state productive enterprise and anticipate the knowledge gained from potential joint ventures will enhance its production capability.

The Perdido Fold Belt is a major piece of future offshore activity. While Pemex has no offshore producing wells, it has drilled test wells that have proved huge resource potential. A well drilled to roughly 16,000 feet in 2012 revealed 350 MMBOE in estimated reserves, according to a company official. Initial flow rates from the wells were projected at 10 MBOEPD.

Addressing Difficulties

Source: Pemex May 2014 Presentation

The reforms come at a much needed time. Pemex management said production for Q1’14 was roughly 2.52 MMBOEPD. If the level continues, the company will register its 10th consecutive year of production decline. Q1’14 was approximately 2% lower than 2013 production and, if the volume remains consistent, overall production will have declined by 34% since 2004.

Mexico may be in an even more precarious position if it did not neighbor the United States, which consumes the second most energy of any country in the world. Mexico has traditionally been one of the top energy exporters to the U.S. due to its proximity and the similarities in refineries, but its export levels have simultaneously dropped with production since 2004. The United States is also in the midst of an energy renaissance, further diminishing its need for Mexico’s hydrocarbons. The EIA reports the U.S. imported only 850 MBOEPD from Mexico in 2013, which is the lowest in 20 years. The number represents a 13% decline year over and year and overall Mexican exports to the U.S. have declined 46% since 2006. In the same period, the amount of natural gas exported from the U.S. to Mexico has doubled.

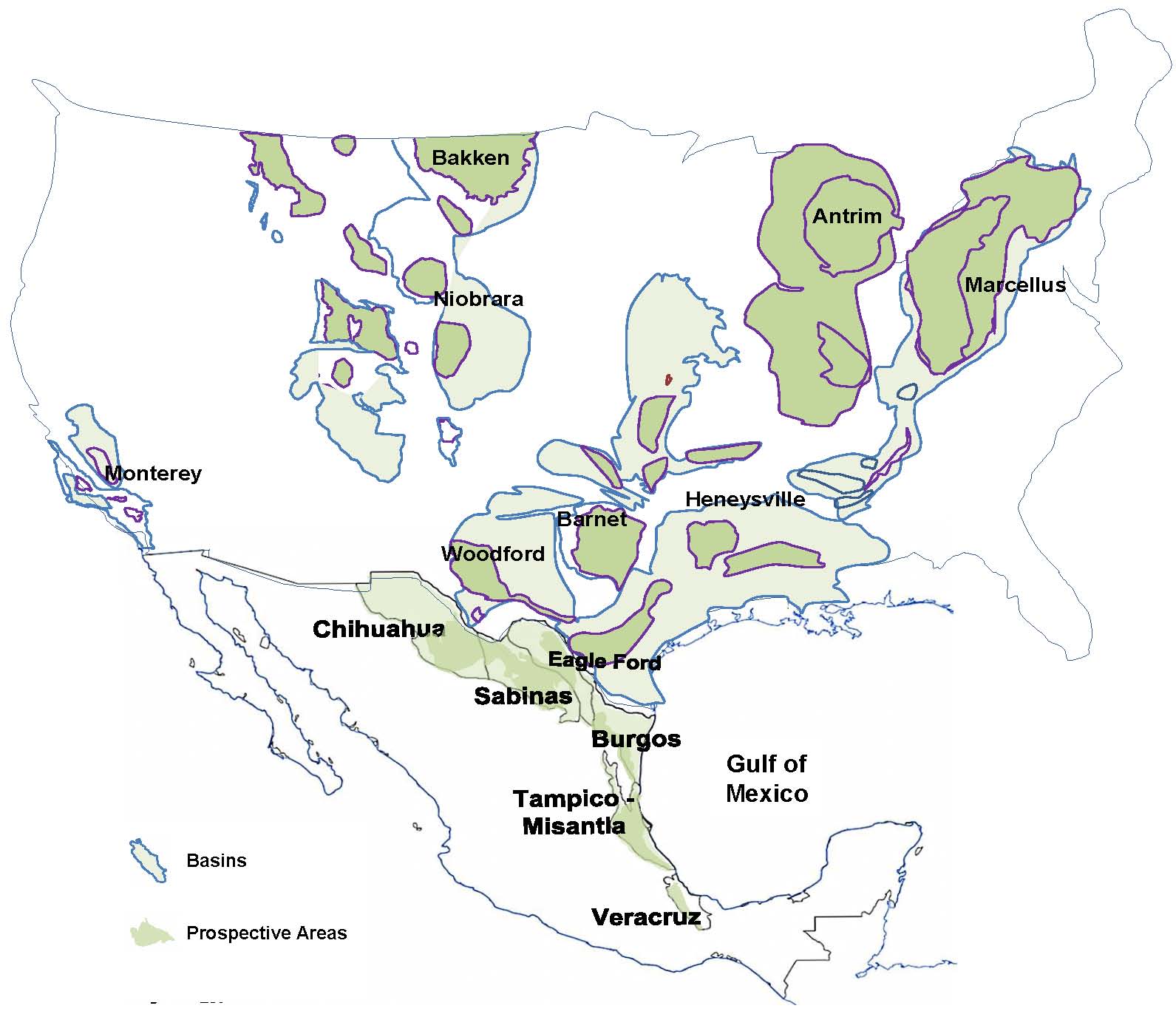

Fortunately for Pemex, the country’s geology is believed to be analogous to booming United States plays like the Eagle Ford shale. The Eagle Ford’s current production is greater than 800 MBOEPD, according to the Texas Railroad Commission. While privatization is still in the early stages, international investors are beginning to show interest. General Electric (ticker: GE) announced plans with Mexico to develop offshore infrastructure on April 8, 2014 and Canada-based ScotiaBank said it will invest $10 billion in Mexico projects through 2018. Demand in bonds, according to Pemex, was at an all-time high when it sold $4 billion worth in January 2014.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. A member of EnerCom has a long only position in Shell and Petrobras.