Increases Penn Virginia production by 30%

Penn Virginia (ticker: PVAC) today announced the purchase of Eagle Ford assets from Devon Energy (ticker: DVN) for $205 million.

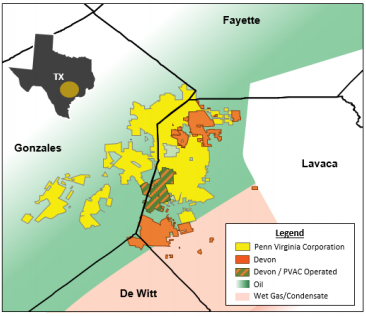

In total, Penn Virginia will purchase about 19,600 net acres in Lavaca County, Texas from Devon. The majority of the properties are contiguous with Penn Virginia’s existing acreage. According to Penn Virginia, these properties produced around 3,000 BOEPD, 64% of which was oil. The acreage has net proved developed producing reserves of 6.3 MMBOE, with a total resource potential of more than 60 MMBOE. The purchase includes the associated infield gathering and compression systems, which have no commitments or dedications.

Economics of the deal

This purchase will increase Penn Virginia’s net production by about 30%, from 10,100 BOEPD to 13,100 BOEPD. A purchase price of $205 million equates to an acreage valuation of just under $10,500/acre. After adjusting for production, valuing each flowing BOEPD at $35,000, Penn Virginia has paid about $5,100/acre for these assets. This is slightly higher than prices paid in two recent Eagle Ford acquisitions.

In May, WildHorse Resource Development (ticker: WRD) paid $5,600 per acre, $3,200 after adjusting for production, when it purchased 111,000 acres in the northern portion of the Eagle Ford. Exco Resources (ticker: XCO) received about $6,100 per acre, $2,900 after adjusting for production, from its sale of $49,300 acres in the southern portion of the Eagle Ford.

Penn Virginia will finance the purchase using $150 million in new debt and borrowings from the company’s credit facility. Penn Virginia reports that the purchase price will likely be adjusted down by $15 million to reflect net cash flows from the effective date of March 1 to the close. The purchase will likely close before the end of Q3, the companies said.

Contiguous acres

Penn Virginia Interim Principal Executive Officer and COO John A. Brooks commented, “Our operations team knows this area extremely well as the Devon acreage is contiguous to our existing acreage position. We will utilize our technical capabilities to optimize production and reduce operating and administrative costs per BOE on the acquired assets, while significantly increasing the size and scale of our company. In summary, we are acquiring high quality properties at an attractive price that will provide Penn Virginia many years of drilling inventory with enhanced economics even in today’s commodity price environment.”

Devon seeks to sell $1 billion in assets in the next year

Devon Energy announced its sale of the Lavaca County assets in conjunction with several other, more minor, asset sales. In total, Devon received $340 million for these sales, which had production of 4,000 BOEPD and reserves of less than 10 MMBOE.

These sales have put Devon well on the way to accomplishing its goal of $1 billion in divestments in the next year. Devon is currently planning to sell the Johnson County portion of its Barnett Shale properties, which represent about 20% of the company’s Barnett production and cash flow. Wells Fargo’s analysis suggests Devon’s Barnett properties could be worth about $3 billion, meaning the Johnson County portion would be worth about $600 million.

Penn Virginia will be a presenting company at the upcoming EnerCom conference in Denver, Colorado—The Oil & Gas Conference® 22.

The conference is EnerCom’s 22nd Denver-based oil and gas focused investor conference, bringing together publicly traded E&Ps and oilfield service and technology companies with institutional investors. The conference will be at the Denver Downtown Westin Hotel, August 13-17, 2017. To register for The Oil & Gas Conference® 22 please visit the conference website.

Analyst Commentary

From Johnson Rice:

Penn Virginia has announced a $205mm acquisition for 19.6k net acres and 3.0 mboe/d from DVN. The transaction increases PVAC's acreage by 35% and number of lateral drilling feet by 33% for $2.9-5.1k/ac depending on what is included in the valuation. Production guidance goes up for both '17 and '18 by 4% and 60% respectively; capex guidance goes up by $20mm and $95mm respectively. We view this as a strong acquisition due to its tuck-in nature, combined with PVAC's continued derisking of Area-2. The acquisition will be funded with debt. FY:17 production guidance was updated from 10.0-11.0 mboe/d to 10.6-11.2 mboe/d to reflect the acquisition volumes, while adding $20mm of capex. FY:18 guidance was also raised from 12.6-13.7 mboe/d and $125-145mm to 20.0-22.0 mboe/d and $220-240mm, accounting for the acquisition and increasing activity, notably on the Area-2 acreage.

From Wells Fargo:

Devon announced the sale of noncore Eagle Ford and other assets for $340MM. In total, assets represent 4,000 boe/d (60% oil) with $30MM of field level cash flow, so on the surface is an attractive price. Buyer of EF acreage (19,600 net acres in LaVaca) was Penn Virginia (PVAC $ 38.10, Not Rated) for $190MM. In addition and just as important, Devon announced it was progressing with its noncore Barnett asset sale, which is expected to represent 20% of cash flow and production (Johnson County). In total, Barnett represents $400$ 500MM of cash flow and at 6x, the total asset could be worth +/$ 3B, implying +/$ 600MM for 20%.