WCS/WTI Spread Lowest since 2009

Canada’s oil production for May 2015 is believed to have dropped below the 4 MMBOPD mark for the first time in nearly two years, according to an estimate from Barclays.

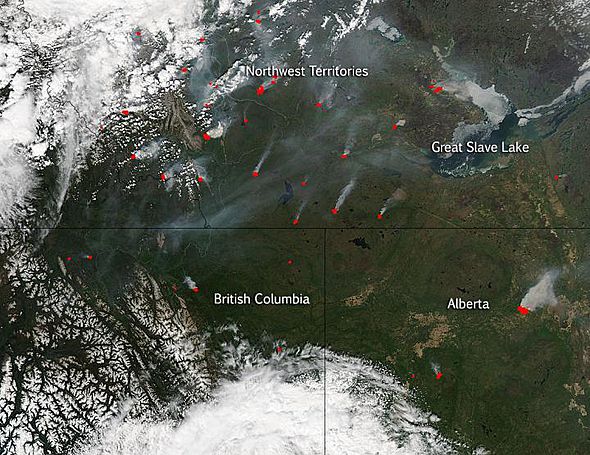

Maintenance season contributes to an expected decrease in volumes, but the unexpected element of scores of wildfires forced operators and residents to evacuate regions of northern Alberta. It is believed that nobody has been harmed in the 35 active fires throughout the region. A day of rain offered a slight break for firefighters, and the risk of new fires starting up has been downgraded to moderate.

Source: Natural Resources Canada

The latest update claimed 35 fires were still burning. As many as 66 active fires were reported in late May. BNN reported Wednesday that Cenovus (ticker: CVE) and MEG Energy (ticker: MEG) were making preparations to bring some personnel back to their operations areas.

An estimated 10% of all refineries are closed and projects run by major companies like Canadian Natural Resources (ticker: CNQ), Cenovus and Royal Dutch Shell (ticker: RDS.B) have yet to release production estimates. CNQ issued a press release commending those who are battling the blaze and said it is currently evaluating a “step by step recovery plan” to assess possible damages. CVE told Reuters via email that operations are still days away from resuming.

Canada’s production for 2015 is expected to average 4.5 MMBOPD, a year-over-year increase of about 2%. Oil sands projects continue to hum along as the country’s rig counts have nosedived by more than 80% since the beginning of December.

The refinery shut-ins may have a minor impact on the overall Canadian economy, which relies on oil and gas for about 7% of its gross domestic product. Merrill Lynch said the disruptions could trim the country’s second quarter GDP growth by 0.1% to 0.3%, but the estimates are uncertain due to the lack of clarity on when operations will return to normal.