Merged Company Will Focus on Supporting Permian Basin Production

Delek US Holdings (ticker: DK) has announced that it will buy the shares of Alon USA Energy Inc. (ticker: ALJ) that it does not already own. The move is intended to increase its exposure to low-cost crude oil produced from the Permian Basin.

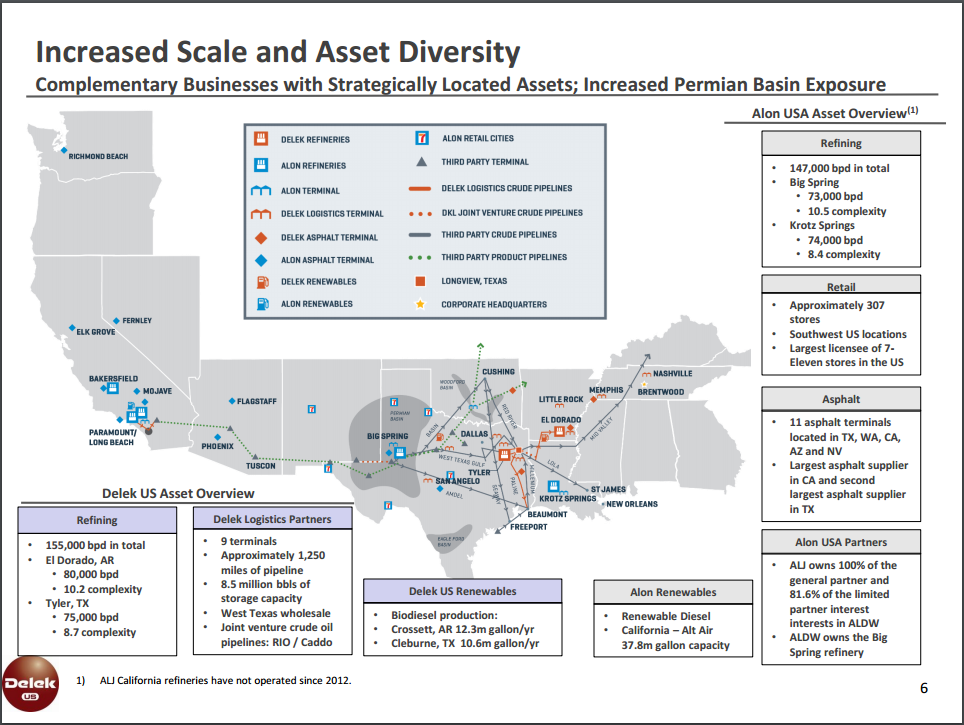

The resulting company will feature refining, logistics, retail, wholesale marketing, and asphalt operations. The company is expected to source 207,000 BOPD, or 69%, of its crude slate from the Permian. The deal is expected to be closed in the first half of 2017.

Refining, Logistics, and Marketing

The combined company’s refining system will have approximately 300,000 BOPD of crude throughput capacity consisting of four locations and 307 locations in central and west Texas and New Mexico. The larger system will also have access to crude oil pipelines, trucking, and gathering operations in the Permian as well as Delek Logistics’ RIO joint venture crude oil pipeline in West Texas.

“We expect the combined company will have the ability to unlock logistics value from Alon’s assets through future potential drop downs to Delek Logistics Partners and create a platform for future logistics projects to support a larger refining system,” said Uzi Yemin, Chairman, President, and CEO of Delek USA.

The combined marketing operations will include 600,000 barrels per month of space on the Colonial Pipeline System as well as 307 retail locations and wholesale marketing operations integrated with the Big Spring, Texas, refinery.

Asphalt and Biodiesel

The combined company’s integrated asphalt business will consist of Alon’s operations in Texas, California, and Washington and Delek US’ asphalt business in Texas, Arkansas, and Oklahoma that is approaching 1.0 million tons of sales on an annual basis. This operation is supported through production and supply/exchange volumes with 15 asphalt terminals in the operation.

The combined biodiesel/renewable diesel assets, with a total capacity of approximately 61.0 million gallons per year, include Delek US’ Cleburne, Texas and Crossett, Arkansas biodiesel plants and Alon’s renewable diesel and jet plant in California.

Analyst Commentary

From Wells Fargo:

“We expect a generally neutral reaction from the market to the announcement that DK and ALJ have agreed to merge in an all-stock transaction. The combined company will have a strong balance sheet as a result of the 100% equity exchange, but the synergies are within the range of expectations and the valuation ratio between the share prices also near our expectations.”