2017 M&A Market “Primed for Growth”

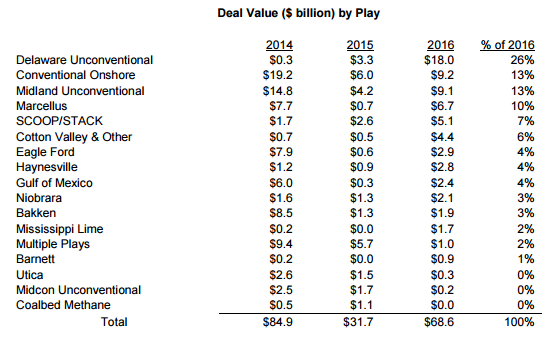

2016 merger and acquisition activity for the upstream energy sector in the United States more than doubled to $69 billion in 385 deals, according to market research firm PLS.

Deal value increased 117% over 2015, which saw $32 billion transacted in 285 deals. $85 billion was transacted in 437 deals during the much higher-priced 2014 environment. These values exclude large global deals like Shell/BG’s $83 billion deal in 2015 and Repsol/Talisman’s $13 billion deal in 2014.

Deep in the Heart of Texas

The Permian region in Texas was the most active area at $27 billion, or 84% of total U.S. activity. With Midland acreage already largely locked up by long-term players in 2014, buyers with readily available equity capital bought up acreage and setting off a new land-rush in the Delaware.

This growth was driven by the ability to buy into Tier 1 stacked pay drilling locations held by production and profitable in a $50 oil price environment.

$9 billion occurred in traditional Midland sub-basin and $18 billion in the Delaware. Based on average EURs and net revenue interest, Permian buyers secured 18,500 net drilling locations and roughly 10.3 billion net barrels in future inventory at about $1.90 per barrel.

The study described this grab as “remarkable” and that it “bodes well for the future production growth coming from the region. In addition, much of the bought acreage is held by production and allows for paced drilling that can be throttled under different oil price environments. The breakeven economics of the vast majority of this acreage is well below $40 per barrel.”

RSP Permian’s acquisition of Silver Hill was cited as a case study of the Delaware basin’s boom this year. Apache’s discovery of the virgin Alpine High resource play “further testified” to the Delaware’s potential.

Marcellus, SCOOP/STACK, and the Rest

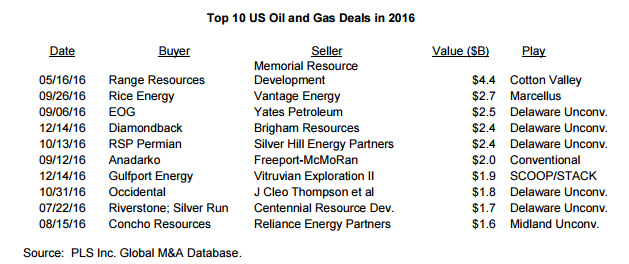

After a slow 2015, the Marcellus recovered but remained in second with $6.7 billion in deals. Oklahoma’s rapidly growing SCOOP/STACK play ranked third at $5.1 billion. Range Resources’ $4.4 billion corporate buy of Memorial Resource Development in North Louisiana’s Cotton Valley gas play was largest deal this year.

The Eagle Ford, Niobrara and Bakken plays featured $2.9 billion, $1.9 billion and $2.1 billion, respectively, but are recovering with higher pricing ahead. The Gulf of Mexico saw just $2.4 billion in deals, mostly attributed to Anadarko Petroleum’s $2.0 billion purchase of Freeport McMoRan’s Deepwater portfolio.

Source: PLS Inc. Global M&A Database

Looking to 2017

At the moment, deal markets are well supplied with inventory and capital and PLS expects 2017 to be a strong year for continued M&A activity in the U.S.

Over $100 billion in dry powder private equity capital was available going into 2016, with much of this remaining. This was supplemented by overnight secondary equity raises from Wall Street, which was eager to support the largest deals. PLS anticipates additional capital to come to market as IPO markets open up.

Stable pricing will be key to a healthy deal market, as price shocks tend to keep players on the sidelines. The industry has undergone significant deleveraging through asset sales, bankruptcies, and investment decreases.

PLS also expects longer laterals and increased proppant loadings to support EUR increases. Oil deal markets are expected to expand into the Eagle Ford and Bakken, while increasing LNG exports will push activity closer to the Gulf Coast in the Haynesville, Barnett, and Eagle Ford gas window.