PetroQuest Energy (ticker: PQ) is an independent energy company engaged in the exploration, development, acquisition and production of oil and natural gas reserves in the Arkoma Basin, East Texas, South Louisiana and the shallow Gulf of Mexico.

The company has transitioned from gas opportunities to a liquids-rich focus and expects 2014 to be its best year in company history. PQ exited 2013 with an estimated 302 Bcfe of proved reserves with a PV-10 value of $479 million – roughly 99% higher than reserves at year-end 2012. The company estimates it replaced 295% of its production during 2013. PQ expects to produce a total of 48 Bcfe (131 MMcfe/d) in 2014 – 26% greater than 2013’s totals of 38 Bcfe (104.2 MMcfe/d).

“Our decision to focus within our three core areas has resulted in significant increases in production, reserves, cash flow and earnings,” said Charles Goodson, Chairman, President and Chief Executive Officer of PetroQuest Energy, in a conference call with analysts and investors following the release. “This year’s capital program is expected to deliver record results as we work toward our goal of making 2014 a transformational year for the company,”

Q1’14 Results

PetroQuest announced production of 9,679 MMcfe (108.5 MMcfe/d) for sales of roughly $60 million in its Q1’14 earnings release on May 6, 2014. Production decreased slightly from Q4’13, but sales amounts actually rose by 13% due to increased oil production and higher realized natural gas prices. Net income was $10.0 million ($0.15 per share), compared to Q4’13’s income of $2.3 million ($0.04 per share) and 2013 full-year income of $8.9 million ($0.14 per share). Discretionary cash flow reached $34.5 million – a 24% quarter over quarter increase. By comparison, Q1’14 cash flow would account for 37% of all cash flow achieved in fiscal 2013. Liquid makeup continues to rise and accounted for 26% of Q1’14 production compared to 22% in Q1’13 and 25% in Q4’13.

Gas Prices Rise

PQ management said natural gas realizations were $4.11/Mcf ($0.80 higher than Q4’13) and were beneficial to a marketing structure that involved selling half of the gas at daily prices and the other half on first-of-the-month pricing.

Bond Clement, Chief Financial Officer of PetroQuest, said: “Over the last five months, we have not been active with our gas hedging program, as we prefer to maintain exposure to a significantly undersupplied gas market. In fact, our last 2014 gas hedge was executed in mid-January. We currently remain unhedged for 2015, as we believe there’s potential upside to the current 2015 back-rated strip price, as we get into the injection season and get a better determination on the trajectory of inventory resupply. In February, the gas daily average was closer to $6.50 versus the first-of-the-month pricing for February at $5.20, so the nice little uplift we are able to take advantage of.”

Q2’14 Guidance

The rising production is expected to carry into Q2’14, with production guidance at a midpoint of 118 MMcfe/d (8% higher) and liquids expected to consist of 30% of the stream (up from 26%). PQ management said oil production volumes are the company’s highest since 2007. Capital expenditures will remain consistent at $145 million and will be funded entirely through cash flow.

Source: PQ April 2014 Presentation

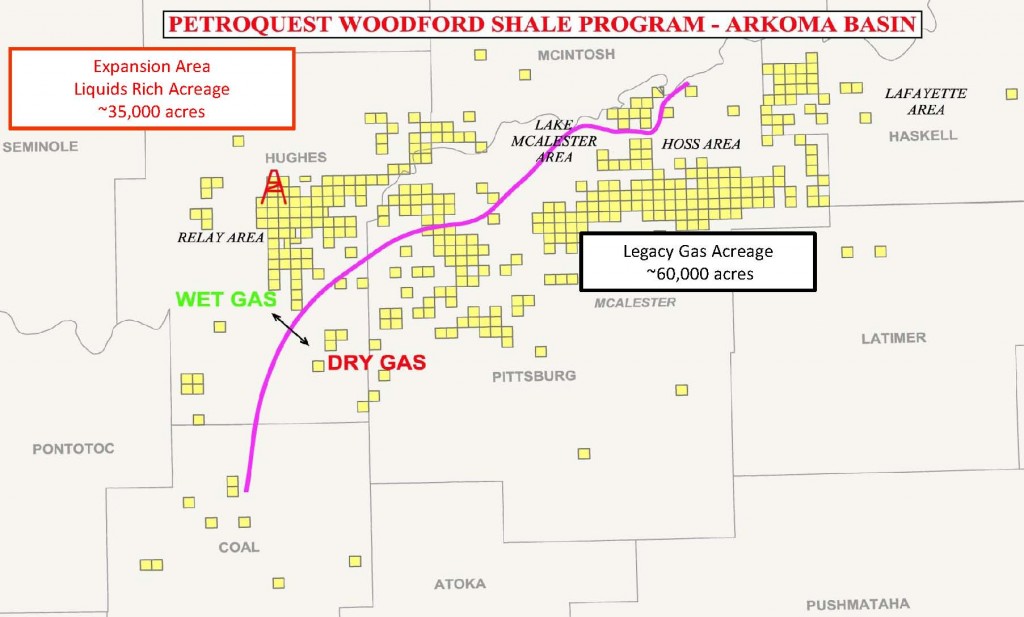

Woodford Operations

PQ’s Woodford operations (35,000 acres) will contribute to the production boost. Three recently completed wells (31% average net revenue interest) in the West Relay Field produced an average maximum 24-hour gross rate of 6,532 Mcfe/d (47% liquids) per well. Other operations in process of completion include two wells in early stages of flowback (35% NRI) and three wells in the early drilling stages (30% NRI). Production on all five wells is expected to be established by the end of May 2014 and a second rig will be added to the region in July.

Goodson said, “Our latest results in the liquids rich Woodford reinforces our belief that this recently acquired 35,000 acre position provides us with a substantial inventory of predictable and low-risk rich gas drilling locations.”

Source: PQ April 2014 Presentation

Six other Woodford wells (39% NRI) went online on April 7, 2014, and produced an average of 3,961 Mcfe/d, with one of the wells producing a maximum 24-hour rate of 4,660 Mcfe/d. At the time, Goodson said the flow rates were about 50% higher than expected and shales were roughly 150 feet thick.

Todd Zehnder, PetroQuest’s Chief Operating Officer, said: “It’s too early for us to put out a West Relay type curve, but the IP rates that we’ve seen are above and beyond what we had over in the North Relay area…We think the EURs have upside potential but until we see the decline curves and have a little bit more time, we’re not going to say what the EURs are.”

A total of 50 gross Woodford wells are expected to be drilled in 2014. Drilling times are also dropping, with recent wells averaging 10 drilling days compared to 14 days when PQ first entered the West Relay field. Costs are roughly $4 million per well.

In other operations, the company has two rigs running in East Texas and expects to have six gross wells (73% total NRI) drilled during 2014, the most PQ has ever done in the region. The company is expecting to bring four of the wells online before July. Well costs are less than $6 million apiece.

The Thunder Bayou project was successfully sold down and will spud in June. PQ will retain a 50% working interest. Drilling is also underway at its Eagle Crest prospect (50% WI) and is expected to reach total depth of 10,700 feet. PQ management said the well will cost roughly $5 million to drill and is believed to hold 600 MBOE (67% oil).

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.