Big 2017 in the offing for PQ

PetroQuest Energy, Inc. (ticker: PQ) increases its fourth quarter 2016 production guidance to approximately 49-50 MMcfe/day, up from its previously issued guidance of 42-46 MMcfe/day.

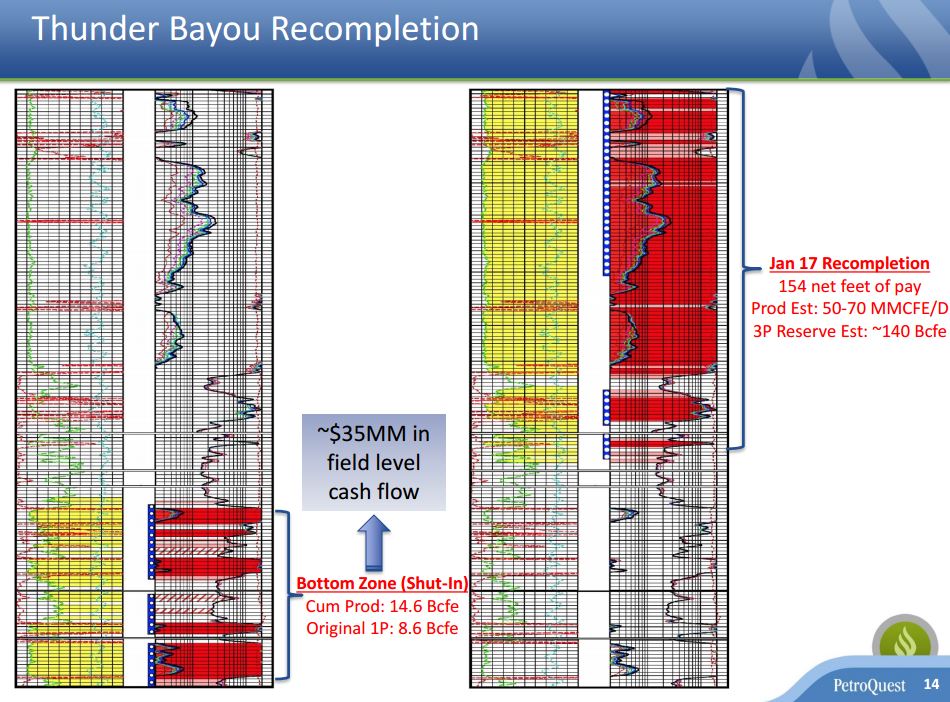

The increased production guidance is primarily due to greater than expected production from the Thunder Bayou well during December as a result of a change in the timing of the well’s recompletion operation, the company said.

Operations Update: Thunder Bayou and Cotton Valley

In South Louisiana, PetroQuest shut in the Thunder Bayou well and expects to commence completion operations in approximately one week. PetroQuest is completing the upper section of the Cris R-2 formation (154 net feet of pay).

In a press release, PetroQuest said it expects to initiate production from the upper section of the Cris R-2 formation in approximately four weeks and to increase the production rate in stages before reaching its gross production target of 50-70 MMcfe/day (NRI-37%).

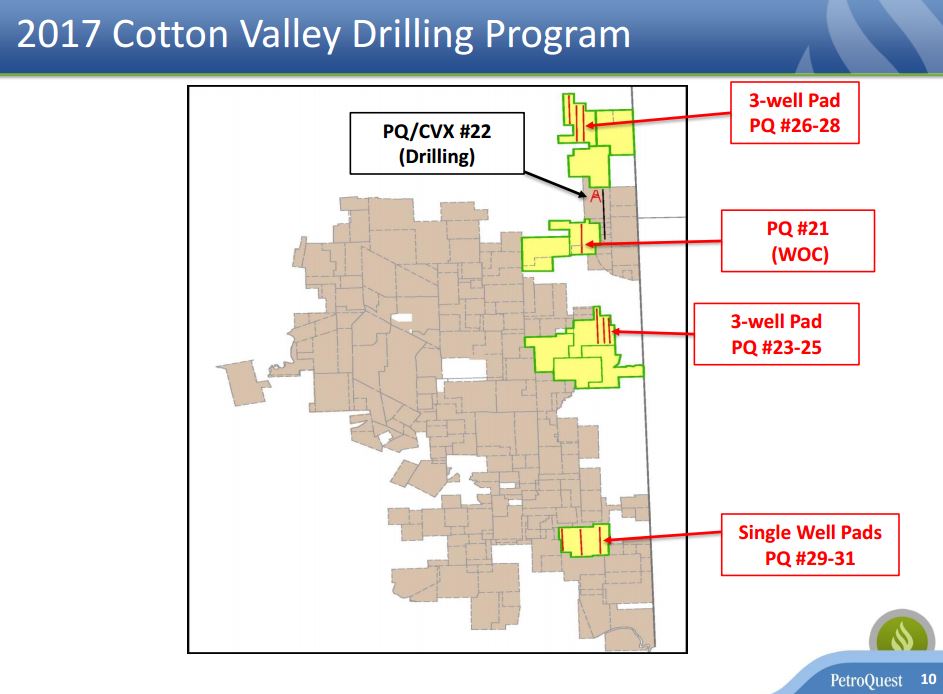

In East Texas, PetroQuest reached total depth and run production casing on its initial Cotton Valley joint venture well – PQ #21 (WI-76%). It expects to begin completion operations next week. In addition, the company is currently drilling its PQ #22 well (WI-50%), which is located on its PQ/CVX acreage position.

Following the PQ #22 well, PetroQuest plans to commence drilling operations on a three well pad (WI-76%) under its Cotton Valley joint venture program.

PetroQuest said it expects to drill and complete 8-10 gross Cotton Valley wells during 2017.

Hedging Update

PetroQuest recently entered into the following natural gas hedges:

After executing the above transactions, the Company has approximately 10 Bcf and 1.8 Bcf of gas volumes hedged for 2017 and the first quarter of 2018, respectively, with an average floor for both periods of approximately $3.21 per Mcf.

“With record level Cotton Valley drilling activity planned and our Thunder Bayou recompletion in progress, 2017 is expected to be an outstanding year,” Charles T. Goodson, PQ chairman and CEO said in a statement.

“Assuming we are successful in executing our 2017 drilling program, we are forecasting sequential quarterly production growth throughout the year, culminating with fourth quarter 2017 production volumes expected to be 100% higher than our average fourth quarter 2016 production guidance. The combination of forecasted production growth with current natural gas prices should meaningfully improve our cash flow profile and relative leverage metrics.”