$1.85 billion for drilling in 2016 with 10% production growth and no debt raises rest of year

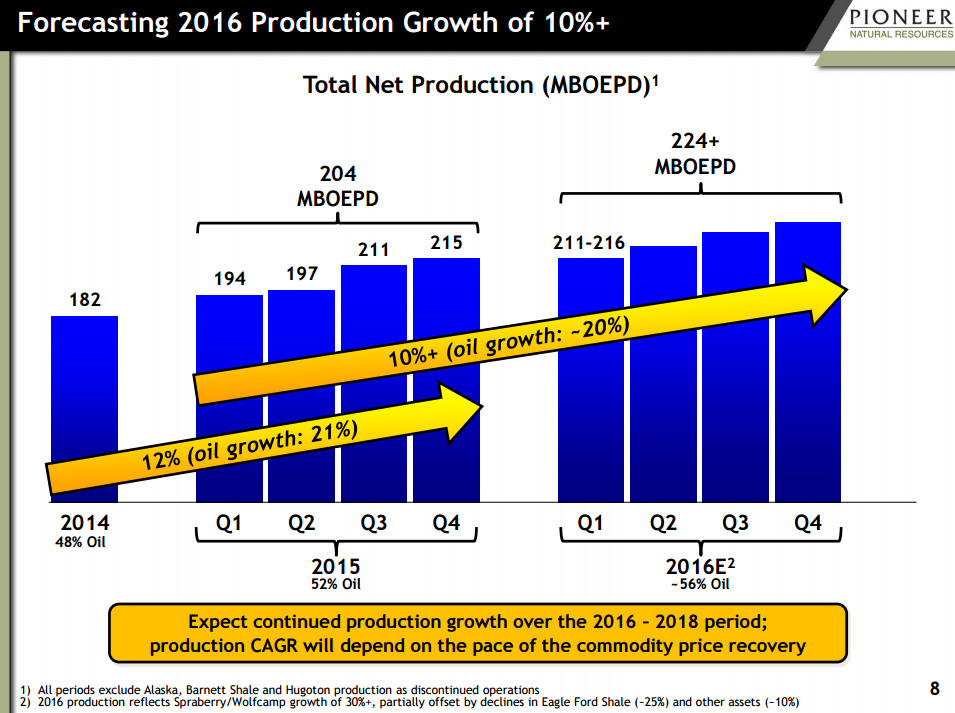

Pioneer Natural Resources (ticker: PXD, PXD.com) announced its fourth quarter results, along with its 2016 capital budget of $2.0 billion. The company lowered its 2016 capital budget expectations by $0.5 billion from earlier estimates, but still expects to grow production by about 10% as it increases the number of wells brought online to 230, up about 21% from the number of wells brought online in 2015.

PXD plans to use its budget primarily on drilling and completions, with $1.85 billion forecast to support drilling activities. The remaining $150 million will be used for vertical integration, systems upgrades and field facilities.

According to the company’s press release, Pioneer will fund its spending program through operating cash flow, cash on hand, and proceeds from recent capital raises and asset sales. The company believes that it will exit 2016 with approximately $1.7 billion in cash, which it hopes will fund half of 2017 capex. PXD said that it will not need to raise any more debt through the end of the year.

According to the company’s press release, Pioneer will fund its spending program through operating cash flow, cash on hand, and proceeds from recent capital raises and asset sales. The company believes that it will exit 2016 with approximately $1.7 billion in cash, which it hopes will fund half of 2017 capex. PXD said that it will not need to raise any more debt through the end of the year.

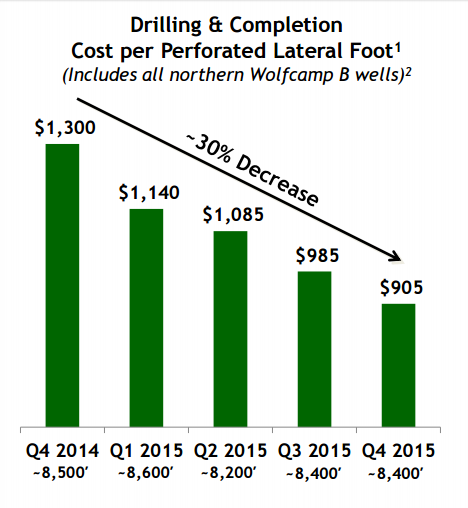

While the company does plan to bring more wells online this year than last, it will be cutting its drilling program by about 50% to 12 rigs by mid-2016. Pioneer said that it will reduce its rig count in the Eagle Ford and southern Wolfcamp to zero, while maintaining 12 rigs in the northern Spraberry/Wolfcamp. The company has said that its Northern Midland Basina acreage is capable of generating IRRs of approximately 30%+ on current strip prices.

The company’s Q4 results showed Pioneer hit the high end of its production growth guidance at 12%, producing about 215 MBOEPD (53% oil). The company’s 10% growth estimate for this year, while lower than previously forecast, also represents a 20% growth in oil production as the company continues to target more heavily oil-weighted production.

Best in class balance sheet

With Barclays predicting Pioneer’s peers will decrease their production by 7% on average this year, PXD expects to buck that trend by growing its production and simultaneously maintaining a strong balance sheet.

The company’s debt-to-market cap ratio of just 14% is less than a tenth of the group median in EnerCom’s E&P Weekly of 165%. Even when just compared to its large-cap peers, Pioneer’s debt is considerably less than the group median of 61%.

Pioneer executed a transaction on December 1, 2015, which allowed it to further shore up its balance sheet through the end of the decade. The company priced an offering of $500 million of 3.45% senior notes which will mature January 15, 2021, and another $500 million of 4.45% senior notes which will mature January 15, 2026, and used the proceeds to repurchase its senior debt due in 2016 and 2017. The company also has $1.5 billion available on its unsecured credit facility.

Pioneer’s balance sheet is further supported by strong hedges, with approximately 85% of oil production in 2016 covered and over $800 million in estimated hedge gains at current prices. “Looking at current prices, most of that coverage is three-way collars, which would get you right around $60 in today’s low price market,” said Senior Vice President of Investor Relations Frank Hopkins.

The company also has strong EBITDA/BOE metrics, with EBITDA of $32.63 per BOE, 62% higher than the group median of $20.17 on EnerCom’s E&P weekly benchmarking report, available through EnerCom Analytics.

With plans to spend inside cash flow allowing the company to fully fund its 2016 budget, and half of its 2017 estimated budget, in addition to a strong balance sheet and acreage positions, Pioneer does appear set to post healthy growth in 2016. Its strong balance sheet, in particular, will allow the company to quickly ramp up drilling activity if commodities prices improve, it said in its investor presentation.