Range Resources replaces 292% of production with reserves

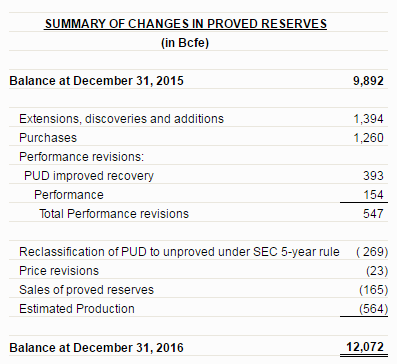

Fort Worth-based Range Resources (ticker: RRC) put out a press release Friday announcing that the company’s proved reserves as of December 31, 2016 were 12.1 Tcfe, up 22% from year-end 2015. The company’s reserve highlights are:

- Proved reserves increased 11%, excluding acquisitions and divestitures

- Proved developed reserves increased 14%, excluding acquisitions and divestitures

- Drill-bit development cost with revisions is expected to be $0.34 per Mcfe

- Future development costs for proved undeveloped reserves are estimated to be $0.42 per Mcfe; Marcellus costs are estimated to be $0.37 per Mcfe

- Unhedged recycle ratio improves to over 3x based on future development costs of $0.42 per Mcfe

Commenting on Range’s 2016 proved reserves, Jeff Ventura, Range’s CEO, said, “Range had another solid year of reserve growth, replacing 292% of production from drilling activities with drill-bit development costs of $0.34 per Mcfe when considering pricing and performance revisions.

“Positive performance revisions continued in 2016 as we extended laterals, improved targeting and drove efficiencies throughout our developed leasehold and infrastructure. The strong reserve additions from drilling activity were driven primarily by our development in the Marcellus, as our acquisition of North Louisiana assets closed in late 2016.

“Future development costs for proven undeveloped locations are estimated to be $0.42 per Mcfe, which is outstanding and should improve our top tier unhedged recycle ratio to over 3x. Importantly, Range added 1.65 Tcfe of reserves, excluding acquisitions, reflecting our large inventory of low-risk, high-return projects in the Marcellus shale and in North Louisiana.”

During 2016, Range added 1,394 Bcfe of proved reserves through the drill-bit, driven by 1,315 Bcfe from the company’s Marcellus development. The “extensions, discoveries, and additions” amount excludes 393 Bcfe of Marcellus reserves associated with undrilled locations that now have increased recovery estimates as a result of longer laterals, better lateral targeting and increased frac stages. This improved recovery estimate is included in the “revision” category. The lateral lengths for existing proved undeveloped locations increased to 7,162 feet in the 2016 report from 6,301 feet in the 2015 report, while newly added proved undeveloped locations in the Marcellus incorporate an average lateral length of approximately 7,900 feet.

During the year, Range sold 165 Bcfe of proved reserves primarily in Oklahoma and non-operated areas in Pennsylvania.

Year-end 2016 proved reserves by volume were 65% natural gas, 31% natural gas liquids and 4% crude oil and condensate. Proved developed reserves represents 56% of the company’s reserves. The company’s Appalachia reserves were audited by Wright & Company, Inc. and were within 1% of the aggregate estimates prepared by Range’s petroleum engineering staff and the company’s North Louisiana reserves were audited by Netherland, Sewell and Associates, Inc. and were within approximately 2% of Range’s estimates.

Range Resources continues to delineate its assets in Northern Louisiana

Along with the news of the company’s year-end reserves, Range Resources also gave an update on three of the company’s wells in North Louisiana. RRC completed the wells in the extension area of North Louisiana, south of Terryville. These wells were drilled north, east and west sides of the Vernon Field and encountered gas in multiple zones across the Upper and Lower Red intervals, similar to wells drilled in the Vernon Field.

The well to the west of Vernon logged pay in three Upper Red zones that have an estimated 210 Bcf per square mile in place. The same well logged pay in three zones in the Lower Red with an estimated 188 Bcf per square mile, for a combined total of almost 400 Bcf per square mile.

For reference, this total gas in place is more than 2.5 times Terryville.

The well was completed in one of the Upper Red zones and had an initial flowing pressure of 6,500 psi and a peak constrained 24-hour production rate of 12.4 MMcf/d. Based on managed cumulative production of 660 MMcf after 79 days and an effective lateral length of 5,050 feet, the well is expected to have a normalized gas EUR that is in line with Terryville Upper and Lower Red wells.

The eastern well also logged pay in three Upper Red zones and three Lower Red zones. The Upper Red zones had a total of 153 Bcf per square mile and the Lower Red totaled 263 Bcf per square mile, for a combined total of over 400 Bcf per square mile.

The well was completed in one of the Lower Red zones and had an initial flowing pressure of 6,700 psi and a peak constrained 24-hour production rate of 23.3 MMcf per day. Based on managed cumulative production of 641 MMcf after 67 days and an effective lateral length of 4,250 feet, the well also appears to have a normalized gas EUR that is in line with Terryville Upper and Lower Red wells.

The well to the north of Vernon field does not have the same amount of production history, though initial production results were below the two other tests. The well was completed in one of the Lower Red zones and had an initial flowing pressure of 5,600 psi and a peak constrained 24-hour production rate of 5 MMcf per day.

The reaction on the well results from analysts was mixed, with some saying that the 30-day IP rates from the new wells were coming in below those at Terryville, which is “a reminder that delineation of the play likely [will take] time and [will not] likely [be] a smooth path,” Wells Fargo said in a note Friday.

Others, like Wunderlich, saw the results in a more positive light.

“After weeks of suspense, RRC finally released the results from the three extension wells (see figure 1). All and all very positive, in our view, considering that these are step out wells. Two of three wells delivered excellent tests and proved that the area south of Wildhorse Resource Development’s (WRD) RCT field and the areas surrounding WRD’s Weyerhaeuser leases are productive,” Wunderlich said.

“The initial production results from outside of Terryville are encouraging,” said Ventura. “These initial three tests confirm that the Lower Cotton Valley pay section thickens as we move towards the Vernon Field, the gas in place increases and there are multiple stacked-pay targets. While remaining very focused on our core assets in the Marcellus and Terryville, we will look to expand on the initial results from the extension area by methodically testing additional targets throughout this year.”

Analyst Commentary

Wunderlich

After weeks of suspense, RRC finally released the results from the three extension wells (see figure 1). All and all

very positive, in our view, considering that these are step out wells. Two of three wells delivered excellent tests and

proved that the area south of Wildhorse Resource Development's (WRD) RCT field and the areas surrounding WRD's

Weyerhaeuser leases are productive. RRC said that these wells proved that the Lower Cotton Valley pay section

thickens as we move towards the Vernon Field, the gas in place increases and that there are multiple stacked-pay

targets.

SunTrust Robinson Humphrey

Range updated its year-end 2016 reserves and also provided an update

to its exploratory well activity that indicated some delineation success in

the extension of North LA, south of Terryville. Notably, the wells to the west

and east of the Vernon field indicated six pay zones with EURs similar to those

found in the Terryville region, though the longer-term production rates appear

sub-par when compared to Appalachian wells. Range also reported impressive

reserve growth, primarily driven by the Marcellus along with a large amount

that came along with the LA acquisition.

UBS

With its acquisition of MRD predicated on the economics of just the Terryville field, RRC identified five separate areas to test for future upside. Of the first three wells tested, the preliminary analysis and initial well results to the west and east of the Vernon Field show similar gas in place to Terryville (400 Bcf per square mile) and reserves per well in line with the Upper Red and Lower Red zones at Terryville. While the preliminary results are encouraging, we are not adding the extension areas to NAV until RRC delineates the areas to determine resource size and a development plan.

Wells Fargo

This morning RRC provided an update on its three Terryville extension wells that are contiguous to WRD's Weyerhaeuser acreage, where the company has yet to drill. Mixed results in our view with two of the three recording 24-hr peak initial production at rates lower than that of the 30-day rates on their Terryville type curves, though Range commented that two wells were tracking Estimated Ultimate Recovery (EURs) in line with the company's type curve of 17.5 Bcfe on a normalized basis and Range has permitted for additional wells in the area. While tests confirm resource, also a reminder that delineation of the play likely takes time and not likely a smooth path as extension areas are drilled. Could provide relief for those that had feared the worst given delays in receiving well results, but our take is inconclusive until we receive more production history as well as additional results.