Range believes Terryville returns rival the Southern Marcellus

Range Resources (ticker: RRC), the legacy shale gas developer credited with discovering the Marcellus shale play, announced today that it completed the merger agreement under which RRC will acquire all of the outstanding shares of common stock of Memorial Resource Development (ticker: MRD). The all-stock transaction is valued at approximately $4.2 billion including the assumption of MRD’s net debt, Range said in a press release today.

In a press release Jeff Ventura, Range’s chief executive, summed up the transaction as combining “two high-quality unconventional producers with large de-risked, high-return projects into one portfolio.”

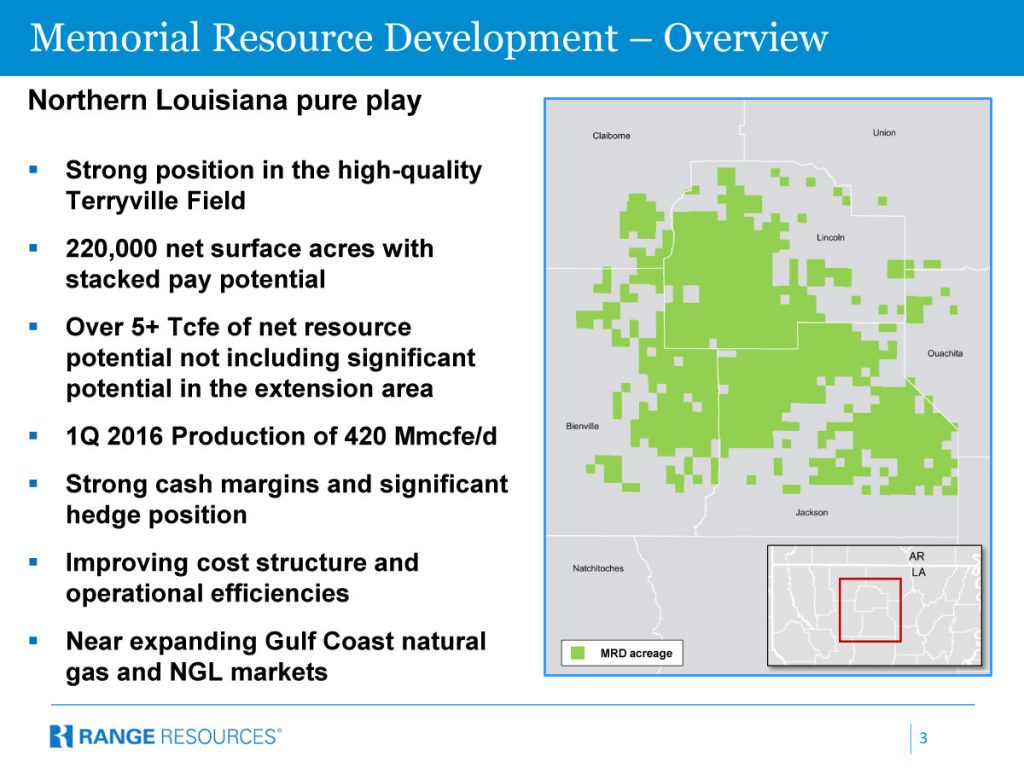

The acquisition of Memorial gives Range the long-lived northern Louisiana assets of Memorial—Terryville—an area that has been producing since 1954.

Commenting on the deal in a conference call, Ventura said, “The Terryville assets particularly the Upper Red are highly prolific well developed by a high quality technical team was evidenced by their industry leading production rates per well. Similar to the Marcellus, the Upper Red is relatively low risk, highly repeatable, high quality rock.

“Terryville is a stack pay area that provides future upside and the ability to drive operational efficiencies and improvements to our cost structures in the months and years ahead. Terryville also has the advantage of being in close proximity the growing demand and the higher prices near the Gulf Coast, boosting relative returns. When closed this transaction will be immediately accretive to cash flow per share as a result of Memorial’s high margin production.”

Ventura went on to point out that on a pro forma basis, Range will “improve its 2016 margins by approximately $0.45 per Mcfe based on analyst consensus. Memorial also has hedges in place to cover approximately 270 million per day of 2017 production at an average floor price of $3.50, securing a significant portion of the expected cash flow next year.”